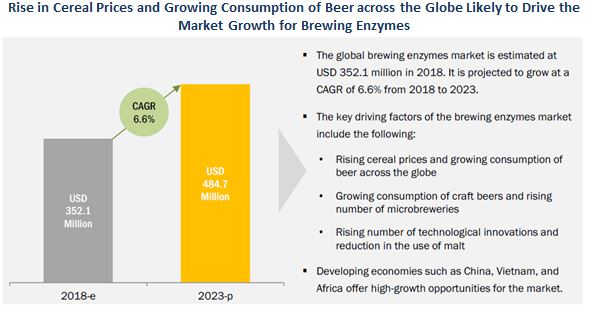

The brewing enzymes market is estimated at USD 352.1 million in 2018. It is projected to reach USD 484.7 million by 2023, at a CAGR of 6.6% from 2018, in terms of value. The use of enzymes has become increasingly important in the brewing industry, as they accelerate the chemical reaction without a change in their own structure. To enhance the brewing process, commercial exogenous enzymes are used in various steps to make the brewing faster, easier, and more consistent. The demand for brewing enzymes in the beer segment is expected to witness significant growth in the near future, due to the rising popularity of beer consumption among young consumers, rise in technological innovations, and growth in the craft beer segment and number of microbreweries.

Opportunities:

Demand for enzymes to increase beer manufacturing efficiency

Beer and wine manufacturers continue to look for advanced solutions to meet safety standards and increase productivity to meet the changes in consumer demand for beer and wine. Key beer and wine manufacturers are mostly focused on increasing the level of efficiency to grow their level of volumes for the production of beer. Brewers who seek raw material cost savings or use of local raw materials may source under-modified malts or increase the ration of adjunct. However, the limiting factor is to ensure an adequate complex of enzymatic activities for high-quality wort. Thus, with the intent of increasing efficiency and optimize raw material usage, many brewers are now focused on commercial enzymes to shorten the production time, increase capacity, and for the use of raw material alternatives to malt.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=79318910

Emerging economies with high growth potential.

The dominance of nuclear double-income families, especially in urban areas in emerging economies contributes to changes in lifestyles among consumers. Changes in consumption patterns have led to an increase in the demand for alcoholic beverages.

Challenges:

Low malt prices

Traditionally, the use of barley has been limited to 10-20% of the grist when using high-quality malts. At higher levels of barley or using under modified malts, processing becomes more difficult. In such cases, the mash needs to be supplemented with extra enzyme activity if the brewer is to benefit from the advantages of using unmalted barley while still maintaining brewing performance. Brewers can add a malt-equivalent blend of a-amylase, b-glucanase, and protease. However, traditional brewing practitioners are not inclined towards the use of industrial enzymes, produced by genetically modified microorganisms, in the brewing industry. The use of enzymes such as amylase, glucanase, and protease is hindered by these brewing traditions.

Asia Pacific is projected to be the fastest-growing regional market for brewing enzymes.

The Asia Pacific region is projected to be the fastest-growing market for brewing enzymes over the next five years, owing to an increase in overall economic growth, with diversity in income levels, technology, and demand from end consumers leading to enhanced scope for future growth. The main countries contributing significantly toward the growth of the market in this region are China, Japan, and Vietnam. The malt that is produced in China for beer production is facing a deficit in barley; hence, manufacturers are focusing on building malt production units due to the ongoing increase in domestic demand. Due to barley deficit in this region, commercial enzymes are added to improve the quality of the beer and to fulfill the domestic demand for beer, which drives the usage of enzymes in the brewing process.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=79318910

In this region, countries such as China and Japan are expected to account for a major share of the market. Vietnam is projected to be one of the fastest-growing markets for brewing enzymes in the Asia Pacific region.

This report studies the marketing and development strategies, along with the product portfolios of leading companies such as Novozymes (Denmark), DSM (Netherlands), DowDuPont (US), Amano Enzyme (Japan), Chr. Hansen (Denmark), Associated British Foods (UK), Kerry Group (Ireland), Brenntag (Germany), Enzyme Development Corporation (US), Aumgene Biosciences (India), Biocatalysts (UK), and Enzyme Innovation (US).