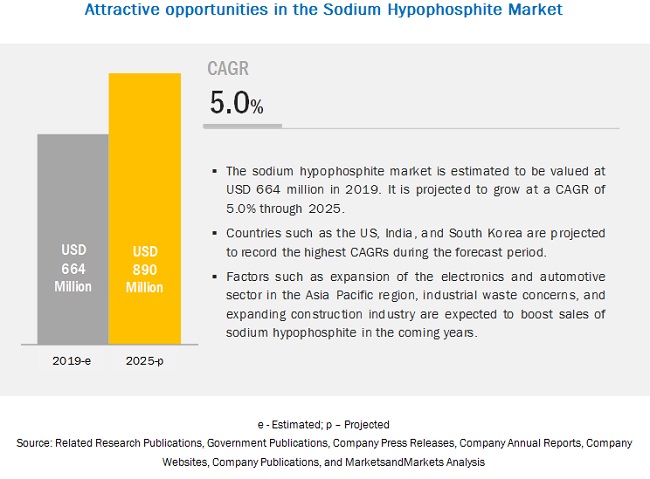

The sodium hypophosphite market is estimated to be valued at USD 664 million in 2019 and is projected to reach USD 890 million by 2025, at a CAGR of 5.0% during the forecast period.

The global sodium hypophosphite market is expected to grow owing to its increasing demand from various end-use industries such as automotive, aerospace & defense, electrical & electronics, industrial machinery, medical device, and construction. The high demand backs the current market growth for sodium hypophosphite for reducing agents and antioxidants from the Asia Pacific region.

The reducing agent segment is projected to be the fastest-growing in the sodium hypophosphite market during the forecast period.

Sodium hypophosphite acts as a reducing agent for electroless nickel plating application. Electroless nickel plating finds its usage in the electronics and automotive industry. These industries are booming in the emerging Asia Pacific, South America, and the Middle East and African regions.

The electroplating segment is projected to record the fastest growth during the forecast period.

Sodium hypophosphite finds its usage widely for electroplating application. The automotive and electronics industries utilize the electroless nickel plating application. The corrosion resistance property of electroless nickel plating makes it an ideal choice for both the industries. The Asia Pacific region, a hub of export of electronic products, boasts of high growth prospects for sodium hypophosphite manufacturers in the coming years.

The electrical grade segment is projected to record the fastest growth during the forecast period.

Sodium hypophosphite has been gaining widespread acceptance across various industrial applications owing to its multifunctional properties. Its application as a reducing agent in electroless nickel plating makes it an ideal product to be used in the automotive, electronics, and chemical industries. It holds high-growth prospects in the Asia Pacific region owing to the expansion of the industrial sector in the region.

Leading companies are Arkema (France), Solvay S.A. (Belgium), Nippon Chemical Industrial Co., Ltd. (Japan), Sigma-Aldrich (US), Hubei Xingfa Chemicals Group Co., Ltd. (China), Changshu New-Tech Chemicals Co., Ltd. (China), Jiangxi Fuerxin Medicine Chemical Co., Ltd. (China), Jiangsu Kangxiang Industrial Group Co., Ltd. (China), Hubei Lianxing Chemical Co., Ltd. (China), Jiangsu Danai Chemical Co., Ltd. (China), Hubei Sky Lake Chemical Co., Ltd. (China), and Huanggang Quanwang Chemical Co., Ltd. (China).