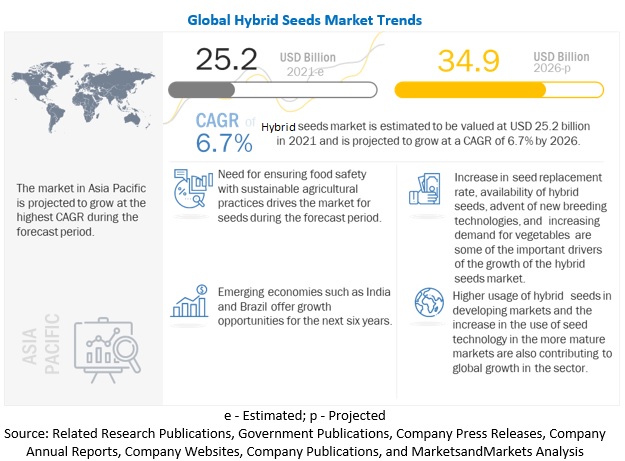

The global hybrid seeds market size is estimated to account for a value of USD 25.2 billion in 2021 and is projected to grow at a CAGR of 6.7% from 2021, to reach a value of USD 34.9 billion by 2026. The growing demand for hybrid seeds from the food, beverage, animal feed, and biofuels industry is driving the growth of the market. Demand for hybrid seeds has witnessed steady growth in countries such as China and India.

Driver: Rise in demand for fruits & vegetables across the globe

With the change in dietary practices globally, the demand for fresh and frozen vegetables has been growing. Consumers have become more conscious about what to consume to better their health and overall wellness, due to which the production of fruits & vegetables have grown. Many farmers have gradually moved toward the cultivation of industrial crops, which would result in growth in market returns.

Constraint: used hybrid seeds cannot be reproduced

The Green Revolution, which started in the 1960s, introduced the use of hybrid seeds to farmers globally. Hybrid seeds produced through cross-pollination was considered as a source for higher yield of crops with high quality. During the Green Revolution, farmers were forced to buy these hybrid seeds as a large portion of the product offerings by seed companies were hybrid seeds. These seeds grown by farmers in large acres of their farms were productive and produced tons of crop yields, even though they required more fertilizers and water. However, the seeds from these crops were unable to reproduce. Therefore, several companies disrupted the traditional method of open-pollination and self-sufficiency, which were replaced instead by hybrid seeds; farmers are also required to purchase the agricultural chemicals required to grow these seeds. This acts as a restraint as poor farmers are not able to afford these seeds and chemical fertilizers.

Opportunity: Demand for healthy and organic processed products

The increasing number of health-conscious consumers, coupled with increasing awareness about the negative effects of trans-fatty acids among the consumers, is expected to increase the demand for food products that contain low trans-fat levels during the forecast period. Manufacturers are developing food products that use healthier oils instead of trans-fatty acids. They are also developing high-stability oils, such as high oleic sunflower, linolenic canola, and low linoleic soybean, to seek emerging opportunities. There is also a considerable potential to replace trans-fats due to the growing demand for food products containing functional ingredients. The growing agricultural land, globally, for all crop types, is also creating opportunities for seeds.

Challenge: Initial breeding of hybrid seeds is expensive

The cost incurred during the initial breeding of the hybrid seeds is a major concern for most of the farmers globally. Initial breeding of hybrid seeds, that is, the F1 hybrids involves several years of preparation to create pure lines that have to be constantly maintained so that F1 seeds can be harvested each year. F1 hybrids require the utilization of chemical fertilizers for their growth which adds to the cost of breeding of these seeds. Moreover, the farmers also have to incur the cost of loss of entire seed crops owing to environmental factors such as heavy rains or droughts. These factors pose a major challenge for the breeding of hybrid seeds, especially in their initial stages.

Major players operating in the hybrid seeds market include BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), KWS SAAT SE (Germany), Land O’ Lakes (US), Sakata Seed Corporation (Japan), Groupe Limagrain (France), Corteva Agriscience (US), United Phosphorous Limited (India), DLF (Denmark), Longping Hi-tech (China), Rallis India Limited (India), Enza Zaden (The Netherlands), Takii & Co. Ltd (Japan), and Barenbrug Holding B.V (Netherlands).