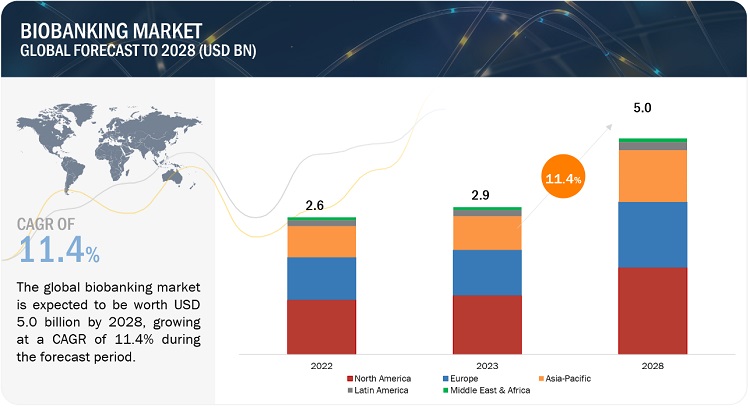

The Global Biobanking Market in terms of revenue was estimated to be worth $2.9 billion in 2023 and is poised to reach $5.0 billion by 2028, growing at a CAGR of 11.4% from 2023 to 2028.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=594

Biobanking Market Dynamics

DRIVER: Growing investments and funding for biobanks

Biobanks have gained significant recognition from governments, research organizations, and funding agencies worldwide, resulting in a rise in investments in biobanks. For example, the Biorepository and Precision Medicine Initiative (PMI) Cohort Program, funded by the US National Institutes of Health (NIH), aims to collect biological samples from one million or more individuals to create a national research resource. Similarly, the European Commission has invested in the Biobanking and Biomolecular Resources Research Infrastructure (BBMRI), a pan-European infrastructure for biobanking and biomolecular resources.

RESTRAINT: High cost of automated equipment

The high cost of automated equipment is expected to restrain the growth of the market. Automated equipment, such as advanced sample handling systems, can significantly improve the efficiency and quality of biobanking operations. However, the high cost of this equipment can be a significant barrier to the entry of smaller biobanking companies or those with limited financial resources. For instance, the cost of an automated storage system can vary depending on the size and complexity of the system. The initial investment in an automated storage system can be significant, with costs ranging from tens of thousands to hundreds of thousands of dollars. In addition to the initial investment, there are ongoing maintenance and operational costs that must be considered, such as software updates, repairs, and training.

OPPORTUNITY: Emerging countries to provide lucrative opportunities

Developing countries are expected to offer significant growth opportunities for players operating in the global market due to the low-cost manufacturing advantage offered by these countries, coupled with the availability of skilled resources at lower costs. Moreover, as compared to developed markets, such as the US, Germany, and Japan, the demand for medical products in emerging Asian markets, such as China and India, is growing at a robust rate. This has prompted medical product companies to focus on these countries for future growth.

CHALLENGE: High operational cost of biobanks

Due to the increasing utilization of biospecimens for research and the emergence of new technologies, there is a growing focus on the availability and quality of biospecimens and their effective collection. However, the long-term economic situation of biobanks is still mostly unclear, which raises questions regarding their overall sustainability. Several costs add up in the complete functioning of a biobank, including in-case collection, tissue processing, storage management, sample distribution, and infrastructure and administration costs. Additionally, high investments are required to set up the required infrastructure in biobanks. For instance, the cost of installing laboratory facility infrastructure, liquid nitrogen supplies, mechanical freezers, and software systems add to the overall operating costs. Since biobanks have to store samples over a period of time, there is a significant need to optimize operations and costs for their long-term sustainability

Request 10% Customization

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=594

The equipment segment dominated biobanking market by product & service:

The equipment segment held the largest share of the global market in 2022. This is primarily attributed to the increasing number of biobanks and biosamples, due to which the demand for equipment remains high. The biobanking equipment segment encompasses a range of specialized products essential for the processing, analysis, storage, and transport of biological samples. These specimens may include human tissues, cells, blood, DNA, and other biospecimens collected from patients, donors, or research participants. The segment covers a broad spectrum of solutions and technologies catering to the diverse needs of biobanks, research institutes, and medical facilities.

Asia Pacific region of the global biobanking market, is estimated to register the highest CAGR during the forecast period.

The market in the Asia Pacific region has experienced significant growth over the past few years. This growth can be attributed to several factors, such as the increasing prevalence of chronic diseases, rising investments in research and development activities, and the expanding healthcare infrastructure. For instance, countries like China, Japan, and South Korea have witnessed a surge in biobanks and research initiatives aimed at understanding the genetic basis of diseases and developing personalized medicine. These countries have made substantial investments in biobanking infrastructure, including the establishment of state-of-the-art biorepositories and the implementation of stringent quality control measures.

Key players in the biobanking market include Thermo Fisher Scientific, Inc. (US), PHC Holdings Corporation (Japan), Becton, Dickinson and Company (US), QIAGEN N.V. (Germany), Merck KGaA (Germany), Avantor, Inc. (US), Cryoport, Inc. (US), Tecan Trading AG (Switzerland), Azenta, Inc. (US), Greiner Holding AG (Austria), Hamilton Company (US), Micronic (Netherlands), AMSBIO (UK), Bay Biosciences LLC (US), BioKryo (Germany), SPT Labtech (UK), ASKION GmbH (Germany), Cell&Co BioServices (France), Ziath Ltd. (UK), CTIBiotech (France), Cureline (US), Firalis Group (France), Sopachem (Netherlands), ProteoGenex (US), and US Biolab Corporation, Inc. (US).

Recent Developments

- In February 2023, PHC Corporation of North America launched the PHCbi Brand VIP ECO SMART Ultra-low Temperature Freezer with industry-leading energy efficiency.

- In September 2022, Cryoport entered into a strategic partnership with BioLife Plasma Services to offer supply chain solutions and service offerings, such as bioservices and cryo-processing, for BioLife Plasma Services.

Report Link: ( Biobanking Market )

Biobanking market – Report Highlights:

- The market size is updated for the base year 2022 and forecasted from 2023 to 2028 by studying the impact of the recession on the overall biobanking industry.

- The new edition includes the impact of the recession on the biobanking market (especially the region-wise impact in the geographic analysis section) in 2022. There is a variation in the growth rate of the market due to the ongoing recession.

- Additional points such as ranges/scenarios, trends/disruptions impacting customers’ businesses, pricing analysis, value chain analysis, supply chain analysis, ecosystem analysis, patent analysis, key conferences and events (2022-2023), list of key regulatory bodies, regulatory landscape, Porter’s Five Forces analysis, key stakeholders, the influence of stakeholders on buying decisions, and buying criteria among end users have been added in the market overview chapter.

- The new edition of the report provides updated financial information till 2022 (depending on availability) for each listed company in a graphical representation. This will help in the easy analysis of the present status of profiled companies in terms of their financial strength, profitability, key revenue-generating region/country, and business segment focus in terms of the highest revenue-generating segment.

- Recent developments help us to understand market trends and the growth strategies adopted by players in the market.

- Tracking the portfolios of prominent market players helps analyze the major products in the biobanking market. The new edition of the report provides an updated product portfolio of the companies profiled in the report.

- Key market strategies/right to win, market share analysis for 2022, revenue share analysis of key market players from 2020 to 2022, and competitive leadership mapping have been added in the competitive landscape section of the report.

- The new version of the report includes competitive leadership mapping for companies operating in the market. This new section is an output of a comprehensive study of the key vendors offering biobanking products. The top 25 vendors were shortlisted from a list of 50+ vendors, and these were evaluated based on market share/ranking and product footprint, rated and positioned on a 2×2 quadrant, referred to as Company Evaluation Quadrant, categorizing them as Stars, Emerging Leaders, Pervasive Players, and Participants.

- The new version of the report includes the startup/SME evaluation quadrant for 10 companies operating in the biobanking market. This updated section is an output of a comprehensive study of the key startup vendors offering biobanking products. The top 10 vendors were shortlisted from a list of 50+ vendors, and these vendors were evaluated based on their product portfolio and business strategy, rated and positioned on a 2×2 quadrant, referred to as Competitive Leadership Quadrant, categorizing them as Progressive Companies, Starting Blocks, Responsive Companies, and Dynamic Companies.

- In the new edition of the report, the Rest of the World is segmented into Latin America and the Middle East and Africa. Country-level markets for Brazil and the Rest of Latin America in the Latin American region have been added.

- The new version of the report includes the ownership segment, which is further segmented into national/regional agencies, non-profit organizations, universities, and private organizations.

- The new version of the report includes an end-user segment, which is further segmented into pharmaceutical & biotechnology companies and CROs, academic and research institutes, and hospitals.