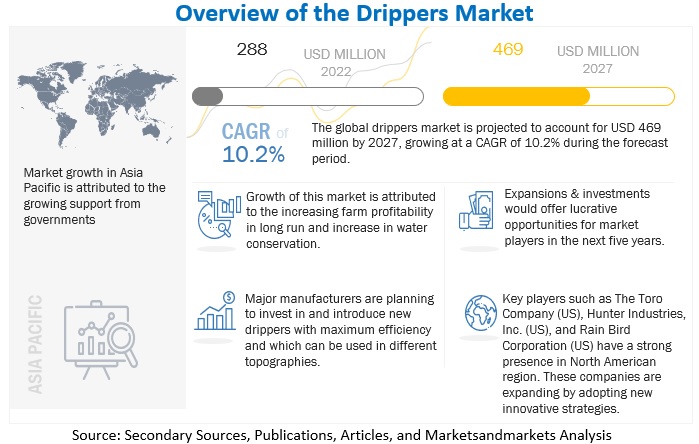

The global drippers market size is estimated to be valued at USD 288 million in 2022 and is projected to reach USD 469 million by 2027, recording a CAGR of 10.2% in terms of value. The global drippers market has realized opportunities in innovative products and patent registrations, indicating a growing demand for the latest agricultural technologies. Developing countries such as India and China are among the largest markets due to the agrarian nature of their economies and increasing levels of water scarcity that affect the regions.

Government schemes and subsidies, combined with industry participation continue to bolster prospects for drippers in the Asia Pacific region. The growth in the implementation of drip irrigation systems is supporting the growth of the drippers market globally. The global drippers market is projected to be dominated by the Asia Pacific region, which held the largest share during the forecast period.

Drippers Market Drivers: Increase in crop productivity and, thus, profitability

Farmers usually face difficulties such as rolling topography, shifting elevations, erratic weather patterns, excessive water waste, and nutrient leaching. Up to 30–40% of operating expenses can be attributed to the fertilizers used to replenish soil nutrients. Many of the issues that farmers confront seem to have practical solutions with drip irrigation. Drip irrigation systems emit small amounts of water and nutrients directly into the soil to every plant over the entire field, in contrast to systems with a saturated water flow (such as sprinklers).

Drip irrigation thus speeds up crop maturity while increasing crop production, yield, and quality. And all of this while utilizing a lot less water than conventional irrigation techniques like sprinklers, center pivot irrigation, and lateral irrigation. Drip irrigation is now a proven technique that helps in supplying a uniform quantity of water to plants, which increases farm productivity also when facing water scarcity. The total farm productivity is estimated to increase by 40%–50% with drip irrigation systems. Drip irrigation helps reduce water and fertilizer costs through proper usage and increases crop productivity by providing plants with appropriate water and fertilizer. These factors, in turn, are forecasted to support the growth of the drippers market.

By type, inline is anticipated to grow at the highest CAGR during the study period

The end users of inline emitters have substantial labor savings, as emitters are preinstalled. Inline emitters are molded into the dripline, which helps negate the costs for additional emitters. Preferably, inline drippers are installed where the plants are planted in close proximity of each other and usually have less than 3 feet of space between two crops.

Download PDF Brochure: Download PDF Brochure – Drippers Market Shares, Global Industry Size Forecast

By crop type, field crops are forecasted to grow at the highest CAGR during the research period

The use of drip irrigation in cotton cultivation is increasing, further propelling the segment’s growth. Management of soil fertility & irrigation water plays a major role in increasing cotton productivity. It is difficult to keep the cotton field’s moisture levels stable. It might encourage disease and pest outbreaks. The ideal option, in this case, is drip irrigation, which keeps moisture levels constant. In addition, problems with flowering, ball growth, and ball opening exist in cotton farming. Drip irrigation is necessary for cotton farming since these characteristics necessitate balanced nutrition, a 95% germination rate, and other requirements. As cotton plantation is done in close placing, inline drippers are preferred.

The Asia Pacific region is projected to account for a major share of the drippers market during the forecast period.

Accounting for more than 60% of the global population, the increase in technological advancement in irrigation facilities, decreasing water wastage, and government subsidies in various countries helped in exponential growth for this region. In some countries in the Asia Pacific region, the retreat of the government from irrigation is largely based on political-economic considerations. The government’s support of the irrigation sector in countries like India has been a broader pro-rural policy package that aims to support agriculture. The region has been shifting from installing basic irrigation facilities to adopting precision irrigation systems through technological upgrading. Some of the players operating in the region are Chinadrip Irrigation Equipment Co., Ltd. (China), Jain Irrigation Systems Ltd. (India), Antelco Pty Ltd. (Australia), Metro Irrigation (India), KSNM Drip (India), and Mahindra EPC (India).

Top Companies in the Drippers Market

- Jain Irrigation Systems Ltd. (India)

- The Toro Company (US)

- Rivulis Irrigation Ltd. (Israel)

- Hunter Industries, Inc. (US)

- Netafim Limited (Israel)

- Rain Bird Corporation (US)

- Chinadrip Irrigation Equipment Co., Ltd. (China)

- Elgo Irrigation Ltd. (Israel)

- Metzer (Israel)

- Azud (Spain)

- Antelco Pty Ltd. (Australia)

Jain Irrigation Systems Ltd. is majorly involved in designing, manufacturing, and selling irrigation systems, piping products, and plastic sheets. The company operates through three segments: high—tech agro-input products, plastics division, and others. The firm is leading in micro-irrigation systems in India. In June 2022, The International Irrigation Business (“IIB”) of Jain Irrigation merged with Rivulis to create a global irrigation and climate leader. This merger will help the company to focus on further improving its business in India to drive higher growth and margin in one of the fastest-growing irrigation markets in the world. Jain Irrigation operates through its production sites in 24 countries and offers its products and solutions to customers in 130 countries as of 2021.

The Toro Company is in the business of designing, manufacturing, marketing, and selling professional turf maintenance equipment and services; turf irrigation systems; landscaping equipment and lighting products; snow and ice management products; ag-irrigation systems; rental, specialty, and underground construction equipment; and residential yard and snow thrower products. In March 2022, The Toro Company announced its partnership with Sentosa Golf Club. The company would provide the Club with a complete fleet of Toro golf course maintenance equipment and irrigation products, landscaping tools, training, and on-site service and support, for the next ten years. Its global presence extends to more than 100 countries. The firm has significant manufacturing facilities and distribution centers located in the US, Australia, Belgium, China, Germany, Italy, Mexico, Romania, and the UK.

Drippers Market Segmentation:

This research report categorizes the drippers market based on type, crop type, and region.

By Type

- Inline

- Online

By Crop Type

- Field crops

- Corn

- Cotton

- Sugarcane

- Rice

- Other field crops

- Fruits & Nuts

- Grapes

- Apples

- Pear

- Walnuts

Other fruit & nuts

- Vegetable crops

- Tomato

- Capsicum

- Chili

- Cabbage

- Other vegetable crops

Schedule a call with our analysts to discuss your business needs: Speak To Analyst