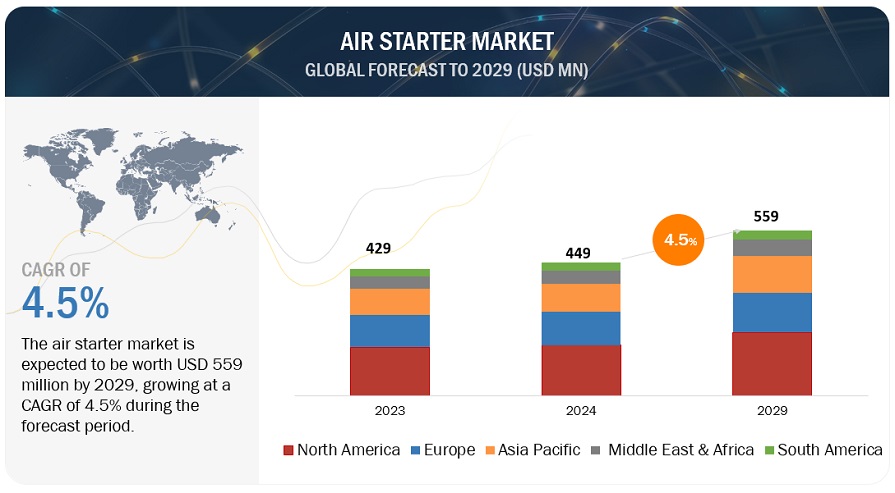

The global Air Starter Market in terms of revenue was estimated to be worth $449 million in 2024 and is poised to reach $559 million by 2029, growing at a CAGR of 4.5% from 2024 to 2029 according to a new report by MarketsandMarkets™.

The demand for air starters is on the rise globally, driven by a multitude of factors. Ongoing advancements in air starter technology, such as the use of enhanced materials and designs that improve durability and efficiency and provide increased torque capabilities are particularly being focused. Unlike electric starters, air starters can withstand extreme temperatures and dusty environments and eliminate the risk of sparks. Further, expansion in key industries such as oil & gas, marine, aviation significantly contributes to the increased adoption of air starters. These sectors largely use heavy equipment which require a reliable and robust engine starting solutions to sustain their operations, making air starters an ideal choice.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=217594045

Turbine Air Starters is expected to be the largest segment during the forecast period.

Turbine air starters are commonly used in various industries, including aviation, marine, and oil and gas, particularly for starting jet engines, large reciprocating engines, and gas turbines. Turbine air starters are smaller and lighter than electric starters, Capable of producing high torque at low speeds, from a compact, lightweight source, essential for starting large engines. These starters ensure reliable engine starts under various environmental conditions. Turbine air starters are used to start large gas turbines that drive pumps and generators on offshore drilling rigs. For example, General Electric’s LM2500 gas turbines, commonly used on rigs, are started using air turbine starters due to their ability to provide high torque in a compact form.

Oil & Gas Industry is expected to be the largest and Fastest segment during the forecast period.

In the oil & gas industry air starters are used to start large engines and turbines in various applications, including drilling rigs, production platforms, and refineries. The market is driven by increasing oil & gas exploration activities and the need for reliable starting solutions in harsh environments. North America, and Asia-Pacific are key regions driving demand for air starters in the oil & gas sector.

Air starters are preferred in the oil & gas sector due to their reliability and safety compared to electric starters. Air starters are critical in environments where traditional electric starters may be unreliable due to factors like moisture, dust, or explosive atmospheres commonly found in Oil and Gas drilling operations. Turbot win air starters are designed specifically for ultimate reliability in the harsh environments of the oil & gas industry.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=217594045

Asia Pacific is expected to be the fastest-growing region during the forecast period.

Asia Pacific is the fastest region in the Air Starter Market owing to the region experiencing significant economic development and growth in industrialization, leading to a corresponding increase in reliable engine starting systems for various end use industries. China is estimated to hold a substantial market share and is the fastest growing market throughout the forecast period due to its substantial oil & gas activities and growth in aviation, and marine sectors. Apart from China, India and rest of Asia Pacific region are also expected to be attractive markets for air starters during the forecast period.

Key Players

Some of the major players in the Air Starter Market are Ingersoll Rand (US), Caterpillar (US), Rheinmetall AG (Germany), Honeywell International Inc. (US), TLD (France), Maradyne (US), SPICO (South Korea), JetAll (US), Guinalt (France), MASCO (US), KH Equipment (Australia), TDI (US), Hilliard Corporation (US), Textron Specialized vehicles (US) among others. The major strategies adopted by these players include new product launches, joint ventures, collaborations, investments, and expansions.