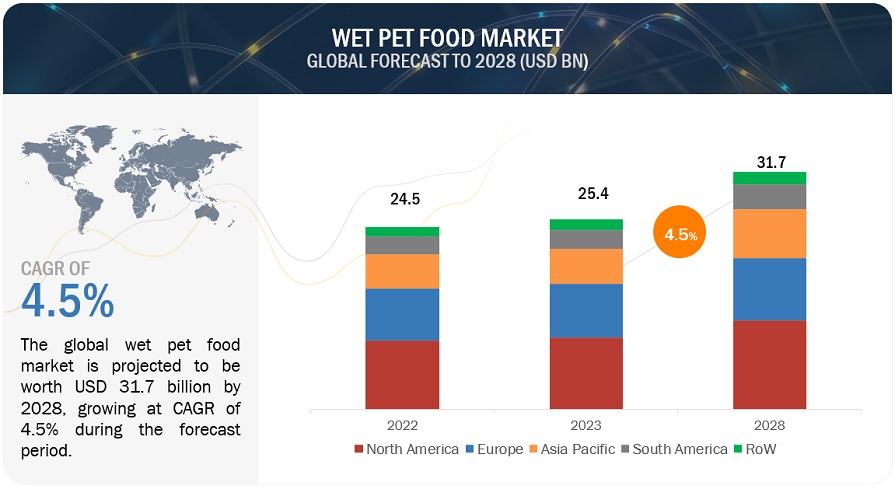

The wet pet food market size is valued at USD 25.4 billion in 2023 and is expected to grow to USD 31.7 billion by 2028, with a CAGR of 4.5% during the forecast period. In recent years, the pet industry has experienced notable expansion, offering a broad array of products ranging from specialized toys to cutting-edge grooming solutions. Among these offerings, wet pet food has gained popularity due to its high moisture content, which mirrors traditional stews and gravies. This not only enhances flavor but also supports hydration, a key factor in pet health. Additionally, wet pet food provides a rich nutritional profile, incorporating essential proteins, vitamins, and minerals, making it suitable for pets with specific dietary needs or health concerns.

As consumers increasingly prioritize health, wet pet food has emerged as a popular choice to meet evolving nutritional demands. This growth is largely fueled by rising disposable incomes, the perception of pets as family members, and a growing understanding of how nutrition impacts overall pet well-being.

Here are some key trends in the Wet Pet Food Market:

- Premiumization of Pet Food: Growing demand for high-quality ingredients and premium products is driving the wet pet food market, as pet owners seek healthier and more nutritious options for their pets.

- Grain-Free and Natural Formulations: The rise in awareness about pet health has led to an increase in demand for grain-free and natural wet pet food, which avoids artificial ingredients, additives, and preservatives.

- Humanization of Pets: Many pet owners treat pets as family members, leading to higher spending on wet pet food that mimics human food quality, including organic and gourmet options.

- Focus on Pet Digestive Health: Digestive health has become a priority, with wet pet foods offering formulations that support gut health, improve digestion, and include probiotics.

- Sustainability in Packaging: Brands are focusing on sustainable packaging solutions, such as recyclable or biodegradable packaging, to reduce their environmental footprint.

- Growing Demand for Functional Ingredients: Ingredients that provide specific health benefits, such as joint health, skin and coat care, and immune system support, are becoming popular in wet pet food formulations.

Wet Pet Food Market Insights: Dogs Expected to Hold the Largest Share

Over the past few decades, dog adoption rates have seen a notable rise. Whether adopted from shelters or breeders, more dogs are becoming cherished members of households. This increase in dog ownership is attributed to various factors, including a greater awareness of the emotional and psychological benefits dogs offer to humans. Traditionally, developed nations like the US, Australia, Germany, and the Netherlands have been key markets for dog food, driven by the growing adoption of pets and higher spending on pet food products. However, in recent years, developing countries have also emerged as important markets for dog food. Rising pet adoptions, increased awareness of dog health, and the trend of humanizing pets have fueled this growth. Countries such as India, China, and Brazil now represent attractive markets for dog food, with large populations of stray dogs being adopted. According to data from PetSecure (Australia), nations like China, Japan, the Philippines, and India have some of the largest pet dog populations. Notably, India has the fastest-growing dog population globally.

Based on the distribution channel, online mode is anticipated to have the highest growth rate in the wet pet food market.

Online platforms are fueling the growth of the wet pet food market by overcoming the challenges of traditional shopping. The ease of browsing and purchasing online eliminates the need for physical store visits, offering greater accessibility. This convenience allows pet owners to explore a wider variety of wet pet food options and make more informed choices tailored to their pets’ specific needs. The global pandemic has significantly altered consumer behavior, accelerating a shift toward online shopping. E-commerce platforms saw a dramatic increase in demand as people sought safer ways to buy products. This trend extended to pet supplies, including wet pet food, as owners turned to online shopping for high-quality products while following safety guidelines. The rise in demand underscores the growing importance of online platforms in addressing changing consumer preferences, making them a key driver in the wet pet food market’s expansion.

Nestlé (Switzerland), Mars, Incorporated (US), Colgate-Palmolive Company (US), Unicharm Corporation (Japan), Thai Union Group PCL (Thailand), Charoen Pokphand Foods PCL (Thailand), General Mills Inc. (US), The J.M. Smucker Company (US), Better Choice Company (US), Real Pet Food Co. (Australia), MONGE SPA P.IVA (Italy), Schell & Kampeter, Inc. (US), Inaba-Petfood Co., Ltd. (Japan), Sunshine Mills, Inc. (US), and Farmina Pet Foods (Italy). These players in this market are focusing on increasing their presence through expansion and collaboration. These companies have a strong presence in North America, Asia Pacific, and Europe.

Wet Pet Food Industry Development:

- In July 2023, Champion Petfoods, under Mars, Incorporated, introduced its ACANA PREMIUM PÂTÉ wet cat food line, aligning with feline natural diets focused on prey-based nutrition and hydration. The product includes 3- and 5.5-oz cans in six diverse recipes, catering to various tastes and nutritional needs, such as Omega 3 support for skin and coat health. This strategic product launch enhances its position in the wet pet food market by offering a tailored and nutritious option that satisfies the dietary preferences of cats and supports their overall health.

- In April 2023, Mars Petcare’s SHEBA brand introduced its first line of kitten nutrition products, PERFECT PORTIONS Wet Kitten Food, complementing its existing range of nutritional offerings for cats of all ages. It is designed to provide comprehensive nutrition, featuring high-quality proteins that support immune system health, bone strength, and brain development. Enriched with essential nutrients, DHA, vitamins, and minerals, the diets are available in two flavors, Savory Chicken and Delicate Salmon, in 2.64-oz trays in physical stores and online via major retailers such as Amazon, Chewy, Walmart, and PetSmart.