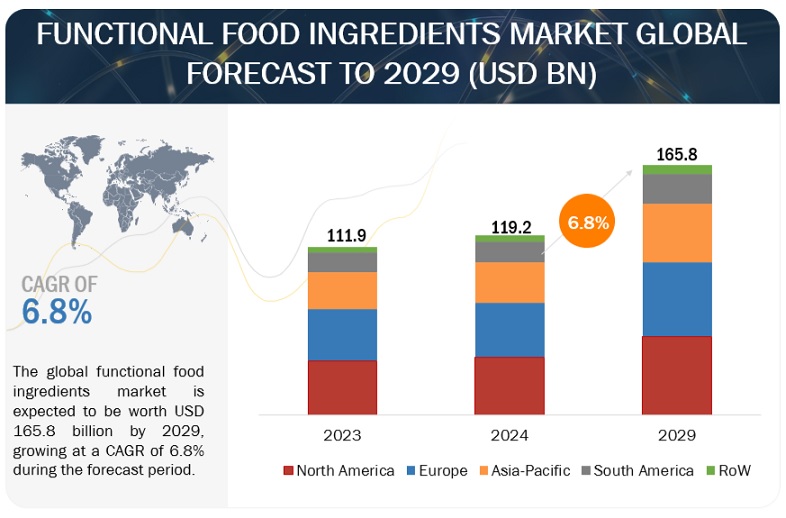

The global functional food ingredients market is valued at USD 119.2 billion in 2024 and is projected to grow at a CAGR of 6.8%, reaching USD 165.8 billion by 2029. This market is undergoing significant changes and innovations, driven by consumers’ desire for wholesome and sustainably sourced products that provide health benefits beyond basic nutrition. Functional food ingredients are essential in catering to the growing emphasis on health and wellness among consumers, offering advantages such as improved digestion, enhanced immunity, and better heart health.

As health consciousness rises and lifestyle-related diseases become more prevalent, consumers are actively pursuing products that promote their well-being. This trend has led to an increased demand for functional food ingredients. For example, a February 2022 article from the National Center for Biotechnology Information (NCBI) highlights that individuals aged 65 and older show a strong preference for various functional foods, such as yogurt with lactic acid bacteria, likely due to their heightened health concerns. As consumers continue to prioritize health and seek products with added benefits, the demand for functional food ingredients is expected to grow, further fueling market expansion.

Functional Food Ingredients Market Overview

The functional food ingredients market encompasses a wide range of ingredients added to foods to provide health benefits beyond basic nutrition. These ingredients may include probiotics, prebiotics, vitamins, minerals, fiber, and bioactive compounds. They are incorporated into various food products, including dairy, beverages, baked goods, snacks, and dietary supplements.

Key Trends:

- Health and Wellness: Consumers are increasingly looking for foods that offer health benefits, such as enhanced immune support, digestive health, and cardiovascular health.

- Natural Ingredients: There is a growing demand for natural and organic functional food ingredients, driven by a shift towards clean label products.

- Personalization: The trend towards personalized nutrition is gaining traction, with consumers seeking tailored functional foods that meet their specific health needs.

- Innovative Products: Manufacturers are investing in research and development to create innovative functional food products, such as fortified snacks and beverages.

Challenges:

Despite the growth potential, the market faces challenges such as regulatory hurdles, concerns about ingredient safety, and varying consumer perceptions of functional foods. Additionally, competition from alternative health products and dietary supplements can pose a threat to the functional food ingredients market.

Future Outlook:

The functional food ingredients market is poised for continued growth, driven by ongoing research into the health benefits of functional ingredients and increasing consumer demand for healthier food options. As manufacturers innovate and expand their product lines, the market is expected to evolve, offering more diverse and effective functional food solutions.

Food, By Application, Accounted for The Highest Market Share Among Form Segment In 2023.

With the largest market share of all the segments, the food segment emerged as the dominant segment in the market for functional food ingredients. The market for functional food ingredients is experiencing growth fuelled by a rising preference for convenient, nutritious food options and an increasing demand for fortified food and beverage products. This expansion is driven by a rapidly growing health-conscious population, especially evident in emerging markets, which seek out fortified food products incorporating functional food ingredients.

Functional foods are becoming increasingly popular among consumers who are looking for specific health benefits like better digestion, immune system support, or increased energy levels in addition to nutritional value.

To satisfy the many demands and inclinations of health-conscious consumers, food manufacturers are actively introducing functional ingredients into a broad variety of food products, from snacks and beverages to dairy products and baked goods by meeting sustainability demands. For instance, in March 2023, ADM introduced the Knwble Grwn brand of functional food ingredients, aimed at offering consumers sustainably sourced, plant-based food ingredients that prioritize wholesomeness. These products are cultivated by small or underrepresented farmers utilizing regenerative agricultural practices, contributing to environmental conservation efforts. This new brand aligns with ADM’s existing sustainability initiatives, further reinforcing the company’s commitment to environmental stewardship and responsible sourcing practices.

Functional Food Ingredients Market Regional Overview

The Functional Food Ingredients Market is experiencing significant growth, driven by increasing consumer awareness of health and wellness, advancements in food technology, and rising demand for products that offer health benefits beyond basic nutrition. Here’s a regional overview:

North America

- Market Size & Trends: North America, particularly the U.S. and Canada, holds a substantial share of the market, attributed to a well-established food and beverage industry.

- Key Drivers: Growing health consciousness, demand for clean-label products, and the prevalence of lifestyle-related diseases are pushing the demand for functional food ingredients.

- Popular Ingredients: Probiotics, prebiotics, omega-3 fatty acids, and plant extracts are particularly popular.

Europe

- Market Size & Trends: Europe is a leading market for functional food ingredients, with countries like Germany, the UK, and France at the forefront.

- Key Drivers: Stringent regulations on food safety and a strong focus on health and wellness have fueled growth.

- Popular Ingredients: Functional dairy products, fiber, and antioxidants are widely consumed.

Asia-Pacific

- Market Size & Trends: The Asia-Pacific region is the fastest-growing market, driven by rising disposable incomes and changing dietary habits.

- Key Drivers: Increasing urbanization, a growing elderly population, and greater awareness of nutrition contribute to the surge in demand.

- Popular Ingredients: Asian traditional ingredients such as turmeric, ginger, and herbal extracts are gaining traction alongside Western functional ingredients.

Latin America

- Market Size & Trends: The Latin American market is evolving, with Brazil and Mexico leading in the adoption of functional food ingredients.

- Key Drivers: A growing middle class and a shift towards healthier eating habits are driving growth.

- Popular Ingredients: Natural sweeteners, fortified foods, and plant-based ingredients are becoming more popular.

Middle East & Africa

- Market Size & Trends: This region is experiencing gradual growth, with increasing investments in the food and beverage sector.

- Key Drivers: An expanding population and rising awareness of health issues related to diet are influencing market trends.

- Popular Ingredients: Ingredients such as dates, honey, and herbal supplements are commonly used.

Top Functional Food Ingredients Companies:

The key players in this market include Cargill, Incorporated (US), BASF SE (Germany), ADM (US), International Flavors & Fragrances Inc. (US), Arla Foods amba (Denmark), Kerry Group plc (Ireland), Ajinomoto Co., Inc. (Japan), DSM (Netherlands), Ingredion (US), and Tate & Lyle (UK).

Functional Food Ingredients Industry News:

In February 2024, Cargill, Incorporated (US) and ENOUGH (UK) expanded their partnership to innovate sustainable protein options using ENOUGH’s fermented mycoprotein technology. Cargill, Incorporated’s investment, and commercial agreement will boost ABUNDA mycoprotein production, known for its meat-like texture and sustainability. This partnership allows Cargill, Incorporated to tap into the growing demand for alternative protein sources, enhancing its position in the functional food ingredients market and leveraging its global footprint to scale up production efficiently.

In September 2023, BASF SE (Germany) unveiled Product Carbon Footprints (PCFs) for selected human nutrition ingredients including Vitamin AP 1,7 TOC and Vitamin E Acetate 98%. Certified methodology reveals at least 20% lower emissions compared to the global market average. This initiative, under ISO 14067:2018, aids BASF SE in offering a competitive advantage while supporting customer emission reduction goals. By showcasing superior PCFs for functional food ingredients, this initiative not only strengthens BASF’s competitive edge but also enhances its reputation as a sustainable leader in the functional food ingredients market, fostering trust and loyalty among consumers and partners.