The global medical electronics market is expected to be valued at USD 11.1 billion in 2024 and is projected to reach USD 15.7 billion by 2029; it is expected to grow at a CAGR of 7.2% from 2024 to 2029. The increasing number of elderly people, the rising rate of chronic conditions, and more usage of health monitors and remote patient monitoring devices are the main drivers of the medical electronics market. Combining AI and IoT in healthcare systems offers great potential for better diagnosis and treatment. Besides, advanced healthcare technologies increase the demand for biomedical devices, electronic equipment used in the medical sector, and medical sensors.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=104528355

Batteries dominate the medical electronics market primarily because of their criticality in powering a variety of medical devices, thus making them portable, dependable, and functional. In this modern healthcare world, portable and implantable devices, such as pacemakers, defibrillators, insulin pumps, and continuous glucose monitors, are increasingly becoming more important as they require highly reliable power sources with extended life spans. Lithium-ion batteries, in particular, are preferred for their high energy density, long cycle life, and lightweight properties, making them suitable for wearable and implantable medical devices. Alongside this is the need to accommodate the increasing inclination towards home healthcare and remote patient monitoring. This has also resulted in the adoption of battery-powered medical equipment, bolstering market shares for batteries within the medical electronics industry.

Surgical robotic systems are expected to account for the highest CAGR in the medical electronics market during the forecast period. Several factors that are majorly the reasons behind their use in hospitals and surgical centers, such as improved imaging, sensor integration, AI-driven functionalities, etc., have therefore resulted in more efficient and versatile robotic systems that can be employed in a wide range of surgical operations among others: improved imaging, sensor integration, AI-driven functionalities. These key points make them more efficient and versatile, with a broad range of applications across various surgical procedures. Hence, this part looks at how robotic assistance helps these surgeries be less invasive together with an increase in healthcare investments besides a growing need for highly high-quality surgical results, which have led to higher demand for surgical robots. Rapid expansion and adoption rates are also facilitated by the research coupled with favorable regulatory approvals for these advanced surgical technologies.

The largest share of the medical electronics market is held by non-invasive procedures since they outweigh invasive techniques by a significant margin. They are also simple and faster; thus, patients heal more quickly. The diffusion of medical technology has produced elaborate noninvasive gadgets, like imaging systems (MRI, CT scans, and ultrasounds), wearable health monitors, and blood glucose monitors that have become preferable for doctors and their clients. These devices help continuously monitor diseases without necessarily engaging in surgical operations. This demand is fuelled by increasing awareness of preventive health care and the rising chronic illnesses requiring constant monitoring. On another note, new technologies are being developed that increase investment in research, leading to accurate results and enhancing the effectiveness of these procedures, making them dominant in this market niche.

These factors make North America the region with the largest share of the medical electronics market; a highly evolved healthcare infrastructure and fast-paced adoption of superior medical technologies are crucial among them. Robust research and development (R&D) is one of the reasons why this region remains a hotbed for innovations in medical electronics powered by huge state and corporate investments. This is further increased by many aged persons, creating an augmented need for devices or tools to manage chronic diseases and elder care. Its regulatory environment, such as through the FDA, has ensured high quality for medical devices, hence creating trust and quickening its approval process. The area also has a strong economy and higher per capita health care spending, making it possible for patients to access modern medicine, contributing to its dominance within this sector.

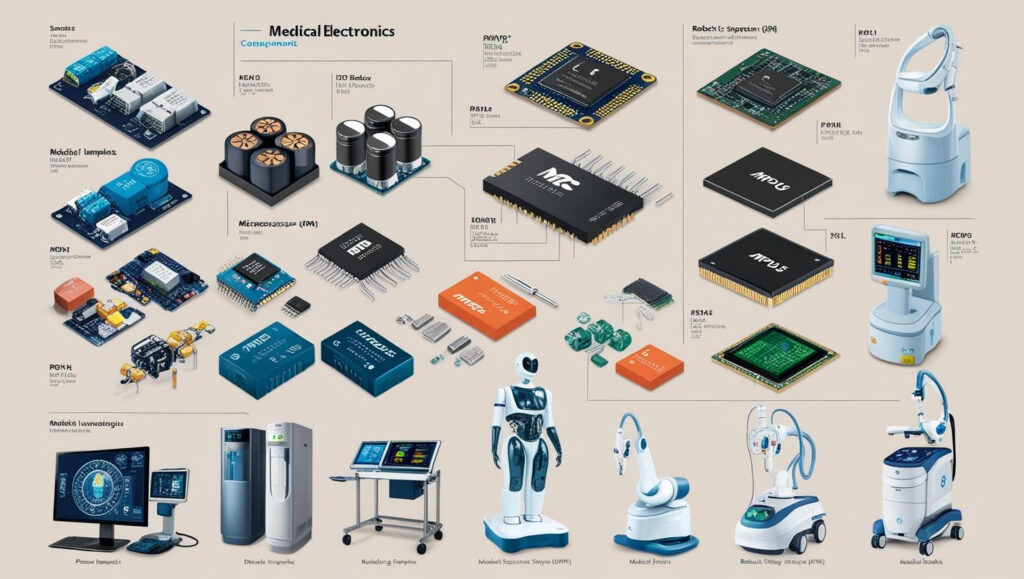

Major players operating in the medical electronics market are Analog Devices, Inc. (US), TE Connectivity (Switzerland), Texas Instruments Incorporated (US), STMicroelectronics (Switzerland), NXP Semiconductors (Netherlands), Infineon Technologies AG (US), SAMSUNG (South Korea), Semiconductor Components Industries, LLC (US), Renesas Electronics Corporation (Japan), LG DISPLAY CO., LTD. (South Korea), AUO Corporation (Taiwan), Panasonic Holdings Corporation (Japan), Ultralife Corporation (US), Amphenol Corporation (US), BOE Technology Group Co., Ltd. (China), GE HealthCare (US), Stryker (US), Microchip Technology Inc. (US), Honeywell International Inc. (US), Tekscan, Inc. (US), Sensirion AG (Switzerland), Endress+Hauser Group Services AG (Switzerland), Merit Medical Systems (US), ams-OSRAM AG (Austria), and Broadcom (US) among others. These companies have reliable manufacturing facilities and strong distribution networks across critical regions, such as North America, Europe, Asia Pacific, and the Rest of the world (RoW). They have an established portfolio of reputable products, a robust market presence, and strong business strategies. Furthermore, these companies have a significant market share, products with more comprehensive applications, broader geographical use cases, and a more extensive product footprint.