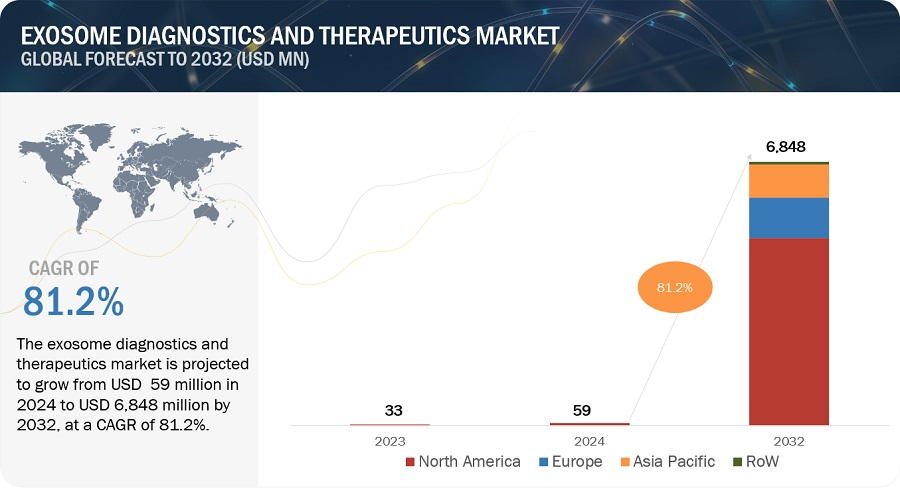

The Exosome Diagnostics and Therapeutics Market is projected to grow from USD 59 million in 2024 to USD 6,848 million by 2032 at a CAGR of 108.9%. The market is being primarily driven by the emerging potential of exosome-based liquid biopsy, which offers non-invasive options for disease diagnosis, prognosis, and treatment response monitoring across various health conditions. Additionally, significant technological advancements have led to the evolution of biopsy techniques, with liquid biopsies offering several advantages over traditional methods, such as non-invasiveness, reduced procedural costs, and easy disease monitoring.

Furthermore, exosomes, known for their stability and ability to carry genetic material such as cellular DNA, mRNA, and miRNA, have gained traction in clinical research as a novel source of biomarkers suitable for diagnostic applications. The market is segmented into exosome diagnostics and exosome therapeutics, with the former accounting for the largest share in 2023. Key contributors to market revenue include products like the ExoDx prostate cancer test, with few others in the pipeline. Additionally, the kits & reagents segment is expected to dominate the exosome diagnostics market, attributed to the growing demand for noninvasive commercial diagnostic kits.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=198025144

Browse in-depth TOC on “Exosome Diagnostics and Therapeutics Market”

335 – Tables

45 – Figures

250 – Pages

DRIVER: Increasing initiatives for product commercialization

Despite the robust product development initiatives by market players, commercialization of both exosome-based diagnostics and therapeutics is slow-paced. This has led to a spike in strategic collaborations to expedite commercial market opportunities. Companies operating in the exosome diagnostics market aim to capitalize on the growing opportunities in this dynamic industry and overcome the challenges associated with developing & commercializing exosome-based diagnostic technologies. In comparison, companies operating in therapeutics collaborate to leverage proprietary advanced exosome technologies, including exosome isolation, characterization, and analysis, to ensure the rapid launch of therapeutic candidates in the market. In March 2024, BIONET (China), a prominent player in Taiwan’s regenerative medicine sector, collaborated with UNIVERCELLS TECHNOLOGIES (Belgium) to integrate the latter’s scale-X fixed-bed bioreactor. By leveraging the scale-X hydro system, BIONET aims to optimize the production of extracellular vesicles (including exosomes) generated by MSCs for therapeutic applications. This development signifies a potential advancement in the large-scale manufacturing of standardized exosome-based therapies.

RESTRAINT: Technical complexities associated with exosome isolation

The complexities associated with isolating and characterizing exosomes, along with existing technological limitations, are significant impediments to the progress of exosome research. These challenges hinder the development of robust methodologies and impact the overall advancement of the field. The complications involved in working with exosomes, which are small extracellular vesicles, pose difficulties in their isolation and thorough characterization. Technological limitations further exacerbate these challenges, preventing achieving precise and consistent results.

OPPORTUNITY: Growing adoption of exosome biomarkers for personalized medicine

Over the years, the popularity of personalized medicine has increased due to limitations of standard diagnosis and treatment. Different fields of medicine, from cancer to psychiatry, are heading towards tailored treatments for each patient based on their biological & clinical characteristics. In 2022, the FDA approved 12 personalized medicines, representing approximately 34% of all newly approved therapeutic molecular entities. Also, five new gene or cell-based therapies were approved. Additionally, in 2022, the FDA expanded the indications for several personalized therapies, showing increased research in personalized medicines backed by increased investments, supporting the growth opportunities of the exosome research space.

CHALLENGE: Inadequate protocols for exosome development & production

The exosome field is still nascent, and no gold standards have been developed. The diversity of exosome isolation techniques, including ultracentrifugation, precipitation, and chromatography, lacks a universally agreed-upon methodology, resulting in variations in purity, yield, and contamination levels. Standardizing parameters for exosome characterization, such as size distribution, surface markers, and cargo content, is complicated by the inherent heterogeneity within exosome populations. The prevalent method, differential centrifugation, often relies on factors such as sample viscosity, resulting in inconsistent exosome capture. Alternative approaches, including size-exclusion chromatography and immunoaffinity capture, though presenting certain benefits, encounter limitations in accuracy and specificity.

EXOSOME DIAGNOSTICS AND THERAPEUTICS: INDUSTRY ECOSYSTEM

Based on the current scenario of commercializing exosomes, concerning diagnostics and therapeutics, the exosome value chain includes four integral steps. These are research & development; raw material procurement & manufacturing; regulatory compliance and quality assurance (QA); and marketing, sales, and distribution. Within this value chain, cell souring, exosome generation/development, exosome engineering, exosome cargo loading, and exosome formulation are critical steps in commercializing exosomes. The supply chain for exosome therapies spans the entire process of sourcing materials to distribute the final product to healthcare providers (hospitals, clinics/physician settings) or patients. Based on the complexity of exosome manufacturing and the need for stringent quality control, establishing a robust supply chain is essential for ensuring the safety, efficacy, and scalability of exosome therapies.

Key Players Driving Market Dynamics

Prominent players shaping the exosome diagnostics and therapeutics market landscape include Bio-Techne, NanoFCM Inc., System Biosciences, LLC., and others. Their innovative contributions and strategic initiatives are instrumental in propelling market advancement and meeting evolving healthcare demands.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=198025144

Bio-Techne (US) Leads Exosome Diagnostics Market

Bio-Techne (US) stands out as the dominant market player in the exosome diagnostics sector, expected to maintain its leading position in the foreseeable future. The firm’s stronghold is bolstered by its comprehensive product portfolio, with the ExoDx prostate cancer test emerging as a key offering.

Monopoly in a Nascent Market

The global exosome diagnostics and therapeutics market is still in its nascent stages, with commercial products approved primarily in the diagnostics segment. This limited market landscape has resulted in a monopoly, with Bio-Techne (US) currently holding the sole position in offering commercial exosome-based tests, prominently represented by the ExoDx prostate cancer test.

Strategic Acquisitions Fuel Growth

Bio-Techne’s strategic acquisition of Exosome Diagnostics Inc. in 2018 significantly expanded its foothold in the exosome market, particularly in liquid biopsy diagnostics. This acquisition paved the way for the development and commercialization of flagship products like the ExoDx Prostate (EPI) Test, a non-invasive liquid biopsy test for assessing the risk of prostate cancer.

Emerging Players and Market Dynamics

While Bio-Techne dominates the exosome diagnostics arena, other players are making strides in the market. Companies offering isolation kits, preparation kits, and liquid biopsy kits are emerging as contenders, albeit with a smaller revenue share. Among these, Capital Biosciences, Inc. (US), AMSBIO (UK), and INOVIQ (Australia) are anticipated to emerge as formidable players, leveraging their expertise and innovative product offerings.

AMSBIO (UK) and INOVIQ (Australia)

AMSBIO (UK) specializes in life science research reagents and services, particularly in genomics, proteomics, cell culture, and stem cell sciences. The company’s exosome isolation tools, including reagents, immunobeads, and immunoplates, cater to the growing demand for intact exosome isolation from biological fluids or cell media samples. On the other hand, INOVIQ (Australia) focuses on commercializing advanced precision diagnostics and exosome solutions aimed at improving cancer treatment and diagnosis. The company’s product portfolio includes EXO-NET, a pan-exosome capture tool for research applications, and the hTERT test, used as an adjunct to urine cytology testing for bladder cancer.

For more information, inquire now! Inquire Now

Content Source:

https://www.marketsandmarkets.com/PressReleases/exosome-diagnostics-therapeutics.asp