The Light Detection and Ranging (LiDAR) market in North America is entering a golden era of growth. Once a niche technology primarily used in geospatial mapping, LiDAR is now at the heart of some of the most transformative industries of our time—from autonomous vehicles and smart infrastructure to precision agriculture and robotics.

Driven by the convergence of next-gen sensing, artificial intelligence, and edge computing, the North American LiDAR market is becoming a high-value investment opportunity for venture capitalists, private equity firms, and strategic investors alike. LiDAR Industry worth $3.7 billion by 2029, the stage is set for remarkable returns and technological breakthroughs.

What is LiDAR and Why Is It So Valuable?

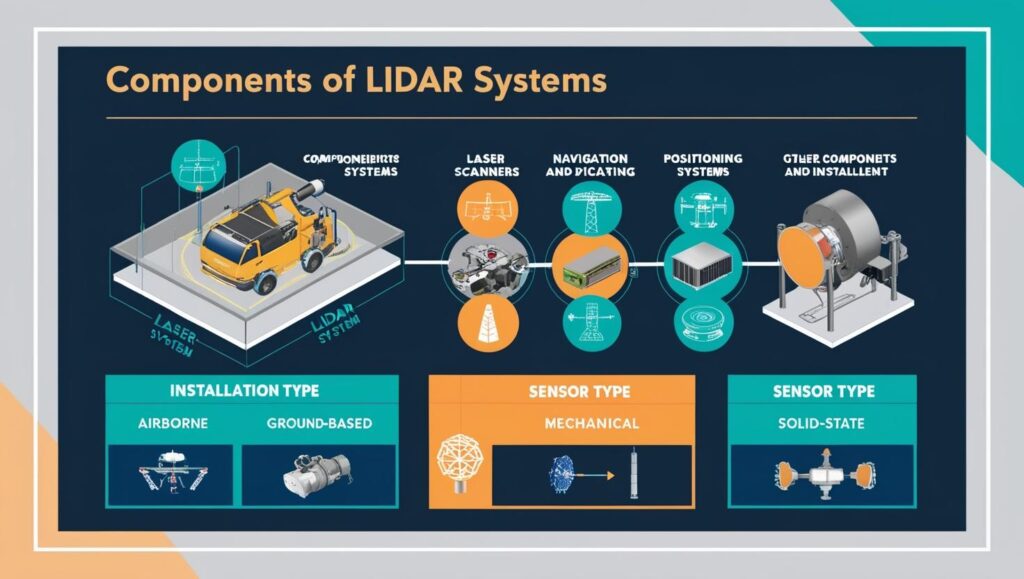

LiDAR technology uses laser pulses to measure distances with extreme precision, creating highly accurate 3D maps of physical environments. Compared to radar and cameras, LiDAR offers superior resolution, performance in varying light conditions, and detailed environmental awareness—key capabilities for autonomous navigation, terrain modeling, and infrastructure analysis.

What makes LiDAR particularly valuable is its versatility. From scanning building sites and utility corridors to enabling driverless cars and detecting forest density, LiDAR is becoming indispensable across a wide range of use cases. This multi-sector relevance enhances its attractiveness as an investment.

Key Market Drivers in North America

1. Autonomous Vehicles and Advanced Driver Assistance Systems (ADAS)

North America is a global leader in autonomous vehicle development, with companies like Waymo, Tesla, Cruise, and Aurora actively investing in LiDAR-based perception systems. LiDAR enhances safety and navigation, offering 360-degree awareness and centimeter-level accuracy.

The U.S. Department of Transportation is also supporting smart mobility initiatives, further bolstering the deployment of LiDAR in connected transportation networks.

Investor Insight: Startups producing low-cost, solid-state LiDAR sensors for automotive OEMs are prime acquisition and growth targets.

2. Smart Cities and Infrastructure Modernization

Cities across the U.S. and Canada are integrating LiDAR into urban planning, traffic management, and infrastructure monitoring. Whether it’s mapping flood zones, managing pedestrian traffic, or inspecting bridges, LiDAR delivers real-time spatial data that improves public safety and planning efficiency.

Federal initiatives, like the U.S. Bipartisan Infrastructure Law, are pumping billions into infrastructure renewal, much of which requires precision mapping and analysis—a sweet spot for LiDAR providers.

3. Geospatial and Environmental Applications

LiDAR has long been used for topographic mapping, but its use in environmental monitoring is expanding rapidly. From forestry management and coastal erosion tracking to disaster response and archaeology, LiDAR offers unparalleled data for government agencies and environmental firms.

Organizations like USGS, NASA, and NOAA are increasing their reliance on LiDAR datasets for national-scale projects.

Market Stat: The U.S. government remains one of the largest customers of aerial and satellite-based LiDAR services.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1261

4. Drone and UAV Integration

LiDAR sensors are now being miniaturized and mounted on unmanned aerial vehicles (UAVs). This is revolutionizing surveying, construction monitoring, mining, and agriculture by allowing rapid, cost-effective data collection over large or inaccessible areas.

Companies like DJI, Velodyne, and Quantum Spatial are developing drone-LiDAR packages, targeting both commercial and government clients.

5. Construction, Energy & Utilities

Utilities and energy companies are using LiDAR for powerline inspections, terrain mapping for pipelines, and wind farm siting. Construction firms leverage LiDAR for real-time site analysis, progress tracking, and BIM (Building Information Modeling) integration.

The push for energy grid modernization and increased renewable energy projects is creating a ripple effect of demand for spatial data and monitoring systems.

- Investment Landscape and M&A Activity

- Venture Capital Hotspot

North America is home to a robust startup ecosystem in LiDAR technology. Companies like Luminar Technologies, Aeva, Ouster, and Innoviz have drawn significant VC attention and have either gone public or partnered with major OEMs.

Private investment is also flowing into companies developing application-specific LiDAR software platforms, such as those specializing in forestry analytics, autonomous drones, or AR/VR environments.

- Mergers and Acquisitions

The competitive landscape is consolidating as larger firms acquire niche players to expand capabilities. Notable M&A moves include: - Velodyne and Ouster merger (2023) – A strategic play to pool R&D and scale production.

- Apple’s stealth acquisitions of LiDAR-related startups to fuel AR/VR and autonomous tech.

- Hexagon AB’s acquisitions in surveying and mapping to enhance 3D reality capture.

This activity signals investor confidence in long-term market potential and validates the value of well-positioned startups.

Private Equity Outlook

PE firms are showing increased interest in profitable mid-market LiDAR providers, especially those with SaaS-based analytics or recurring government contracts. There’s growing opportunity to build platform companies that consolidate LiDAR hardware, software, and services into scalable offerings.

Challenges & Considerations

- While the market is promising, investors should be aware of a few key challenges:

- High R&D costs and the race for miniaturization and cost-efficiency

- Market saturation in some verticals, particularly automotive

- Regulatory hurdles in autonomous systems and aerial mapping

- Standardization and interoperability issues across hardware and platforms

- Smart investors will prioritize companies with IP differentiation, a strong partner ecosystem, and demonstrated commercial viability.

Why North America? Strategic Advantages

Tech Hubs: Silicon Valley, Austin, Boston, and Toronto lead in sensor innovation.

Government Support: U.S. federal and state investments in geospatial and mobility tech.

OEM Presence: Strong automotive and aerospace ecosystems drive adoption.

Diverse Terrain: From mountains to coastlines, the continent offers rich environments for LiDAR development and testing.

Access to Capital: Abundant VC and public markets for early-stage and growth-stage funding.

The Future of LiDAR in North America

Looking ahead, several trends will define the next chapter of LiDAR in North America:

- Solid-state LiDAR will go mainstream, especially in automotive and consumer applications.

- Edge AI integration will make sensors smarter and reduce cloud dependency.

- New verticals like retail (for spatial analytics), AR/VR (for room scanning), and even insurance (property risk assessment) will expand the addressable market.

- LiDAR-as-a-Service models will emerge, enabling customers to access spatial insights without large CapEx.

Conclusion: A Prime Time to Invest

The North America LiDAR market is no longer an emerging opportunity—it’s a strategic growth engine across multiple high-impact industries. From smart cities and mobility to defense, agriculture, and construction, LiDAR is powering the next wave of spatial intelligence.

For investors seeking long-term, technology-driven value creation, LiDAR offers a rare combination of deep tech, cross-industry relevance, and high scalability.

With the right due diligence and strategic focus, now is the time to invest in the light-powered future of sensing.