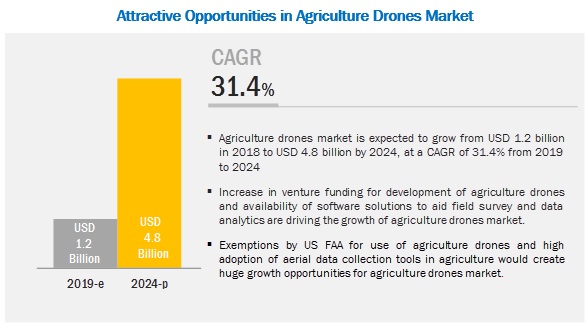

The agriculture drones market is expected to grow from USD 1.2 billion by 2019 to USD 4.8 billion by 2024 at a CAGR of 31.4%. A few key factors driving the growth of this market are pressure on global food supply due to growing world population, and availability of software solutions for field survey and data analytics.

Recently, the Federal Aviation Administration (FAA), the regulatory body for commercial drone operations in the US released the Small UAS Rule (Part 107). This has made a major impact on how drones can be and are being used across industries, including agriculture. Mostly, concerned toward the agricultural industry, the rules suggest the ways for the use of drones by farmers and ranchers, and define the requirements and provisions to conduct remote sensing operations over farms and ranches. For agriculture, in Part 107 rule, a waiver allowing operations beyond the visual line-of-sight (BVLOS) of the operator allows pilots to capture more area in a single deployment, compared to the area taken while flying a drone within line-of-sight.

Browse 62 market data Tables and 35 Figures spread through 157 Pages and in-depth TOC on “Agriculture Drones Market” – Get Sample Pages of Report: Click here

The agriculture drones market for software and services is expected to grow at a higher CAGR during the forecast period. This growth is attributed to high investments being done by the venture capitalists and investors in the start-up companies offering software and analytics to digitize the information collected by drones; the investments are mainly directed at mapping, imaging, and data analytics software.

The agriculture drones market for fixed wing drones is expected to grow at the highest CAGR during the forecast period. This growth is attributed to the ability of fixed wing drones to traverse long distances, map wider areas, and stay within proximity over points of interest. Fixed wing drones have more efficient aerodynamics, and better payload capacity and endurance than other drones, making them ideal for carrying multiple onboard sensors (multispectral camera, thermal imaging, and LIDAR, among others).

The agriculture drones market for navigation systems is expected to grow at the highest CAGR during the forecast period. A drone well equipped with a navigation system and an autopilot system, including a camera, gives plenty of aerial options. For aerial photogrammetry and 3D mapping, it is essential to deploy a drone with a navigation system, an autopilot flight system, and a camera.

The agriculture drones market for precision fish farming is expected to grow at the highest CAGR during the forecast period. The increasing demand for various hardware devices such as GPS/GNSS, and various sensors is contributing to the growth of the agriculture drones market for precision fish farming. Drones are used as a fisheries assessment tool by natural resource agencies in Texas and Nebraska in the US. These agencies have used fixed-wing drones to conduct in-channel habitat mapping in low waters in the Guadalupe (Texas) and Niobrara (Nebraska) rivers.

The agriculture drones market in APAC is expected to grow at the highest CAGR during the forecast period. The adoption of smart agriculture techniques is expected to grow at a high rate in APAC as this region consists of emerging countries such as India and China, and countries in Southeast Asia. The rapidly increasing population, availability of arable farms, and government support through subsidies are the major factors driving the adoption of agriculture drones in APAC.

The major opportunities for the growth of the market include rising demand for drones in APAC countries and high adoption of aerial data collection tools in agriculture. The demand for drones in APAC is expected to increase during the forecast period, driven by greater awareness of their use in agriculture. This growing demand for advanced agricultural technologies in Australia, New Zealand, China, Japan, and India is likely to present significant growth opportunities for the market in the near future. While many industries use drones, the adoption rate of tools required to collect aerial data is high in the construction, agriculture, and mining industries. For Instance, agriculture experts and insurance companies use DroneDeploy’s SkyClaim app to detect crop damage and determine loss estimates using computer vision and artificial intelligence (AI).