Enzymes are biological molecules responsible for chemical inter-conversions in various food and beverage applications. These are selective catalysts stimulating the rate and specificity of metabolic reactions. The use of enzymes has become increasingly important in the brewing industry, as they can accelerate the chemical reaction without undergoing any changes at the end of the reaction.

Enzymes such as amylase, beta-glucanase, protease, xylanase, and others are widely used in the production of beers and wines. The production of beer majorly depends on enzymes. Adjusting the activity of the enzymes is crucial in the brewing process, and it widely depends on the availability of the raw material and the style of beer brewed. In this process, various external factors are taken into consideration to create the perfect beer. During this process, the temperature should be carefully controlled, along with ionic composition, time, and the material concentration, to ensure that the enzymes work properly.

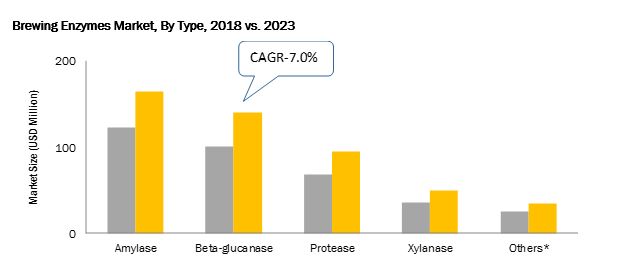

According to a recent study by MarketsandMarkets, the global Brewing Enzymes Market is projected to grow at a CAGR of 6.6% to reach USD 484.7 million by 2023 from USD 352.1 million in 2018.

In 2017, Asia Pacific led the global brewing enzymes market and the region is projected to be the fastest-growing in the global brewing enzymes market during the forecast period. The main countries contributing to the growth of the regional market include China, Japan, Vietnam, Australia, and New Zealand. In the Asia Pacific region, other sources of raw materials such as corn, sorghum, rice, and corn are widely used to produce beer, which requires more enzymes to increase capacity, shorten the production time, and to allow the use of raw materials other than malt. Thus, due to quality and supply constraints on malts and an increase in the prices of malt, the use of enzymes is increasing.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownload.asp?id=79318910

What’s Driving the Growth of the Brewing Enzymes Market?

- The global prices of cereals such as barley, corn, wheat, which are important raw materials for the brewing process, are expected to rise. The beer industry is the leading user of malting barley, an essential component of the brewing process. Apart from barley, cereals such as corn, wheat, rye, sorghum, and rice are another set of cereals used to produce beer. Estimates of the Food and Agriculture Organization (FAO) of the United Nations–in April 2018–showed a 1.1% rise in its food price index in March to 172.8 points. Prospects of wheat production in 2018 are more restrained, given less favorable weather conditions and lower prices. The latest forecast for global wheat production in 2018 stands at 750 million tonnes, down from seven MT from 2017. Despite favorable weather crop conditions in the EU, winter wheat production is forecasted to fall on account of reduction in sowings. Also, corn output is likely to fall in South America from a record high of 2017, with bad weather in Argentina and a shift away from its cultivation toward soybean in Brazil. The rising cereal prices are expected to reduce their volume of usage and increase the consumption of auxiliary enzymes that are used to supplement malt’s enzymes to guarantee smooth brewing operations at all stages.

- An overall decreasing trend is being observed in the beer industry, which is expected create a boom in the craft brewing industry. Companies such as DSM and Novozymes market their products—such as Brewer’s Clarex—to craft breweries as specialty ingredients. Craft breweries produce a variety of specialty beers which use enzymes. Big Beer often uses glucoamylase for light beer production, while some craft brewers prefer alpha and beta amylase supplementation. The use of proline endo-protease is an upcoming trend in craft breweries. The rising trend of craft brewing and the resulting demand is expected to drive growth in the brewing enzymes industry. More than 300 breweries were launched in the UK last year as a boom in craft beer sales encouraged start-ups with special offers ranging from gluten-free beer to ale made from leftover bread. According to UHY Hacker Young, an accountancy firm, the number of breweries rose by 18% in 2016 to 1,994 taking growth over the past five years to 64%. The trend continued in 2017, with the number of breweries rising to 2,000.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst