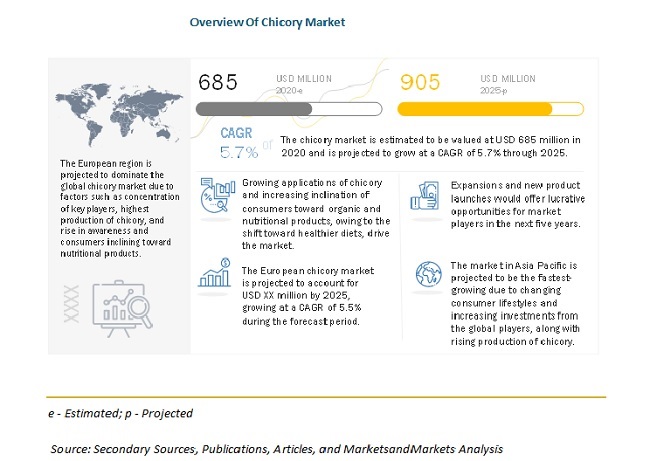

According to MarketsandMarkets, the global chicory market size is estimated to be valued at USD 685 million in 2020 and is projected to reach USD 905 million by 2025, recording a CAGR of 5.7%, in terms of value. Rising prices of coffee beans along with increasing consumption of coffee, is navigating the coffee and other food & beverage manufacturers to adopt to chicory ingredient, as a cheaper substitute to coffee. Also, high medicinal values and health benefits associated with the consumption of chicory, is expected to further propel the market. Furthermore, easy cultivation process of the crop and rising number of new entrants in the market, is substantially snowballing the growth prospects.

Report Objectives:

- To describe and forecast the chicory market, in terms of type, form, plant-part, application, and region

- To describe and forecast the chicory market, in terms of value, by region–North America, Europe, Asia Pacific, South America, and the Rest of the World—along with their respective countries

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall market

- To study the complete value chain of the chicory market

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=122013320

Drivers: Preference for chicory as a cheaper substitute for coffee

Chicory is currently ten times cheaper than coffee. Coffee is one of the premium food products. The prices of coffee powder have further increased due to an increase in global prices, making it impossible for companies to absorb the higher cost of raw material. Coffee companies are now blending in chicory to protect their margin. Large coffee companies that hold a couple of bestselling brands have increased their chicory content in their branded sachets to 49% from 30%. According to Mr. S Jagdeesh Gupta, the managing director of Jyothi Chicory, India’s leading chicory manufacturer that supplies to all the leading coffee companies, “Earlier most coffee producers were offering blends with up to 30% chicory. Now virtually all my customers have raised it to 47%–49%.” This has highly increased the cultivation of chicory roots and hence the production of instant chicory powder across major countries. Direct consumer products made from chicory, such as the roasted chicory powder that is an absolute coffee substitute, are also very cheap; therefore, people now prefer more chicory because of its lower price, accompanied by significant health benefits and also is caffeine-free.

The root segment, by plant-part in the global chicory market, is projected to grow at a faster rate during the forecast period.

The chicory market, on the basis of plant-part, was dominated by the root segment in 2019. Also, the same segment is projected to grow at a faster rate during the forecast period. The continuous developments and innovations introduce various uses of chicory root products. Chicory root is a completely natural food with many proven benefits and, after processing, is available in multiple forms. The chicory root plant-part of chicory is the most widely known, adopted, and offered in the market. Belgium, France, and the Netherlands are the largest chicory root producing countries in 2018. According to the data provided by FAOSTAT, Belgium had produced over 421,270 tonnes (464,370.68 tons) of chicory root in 2018.

On the basis of application, the food & beverage segment is expected to hold the majority share and grow at the fastest rate in the global chicory market.

The chicory plant is quite versatile, and it has found its application in many areas; it is best known for its association with coffee. Chicory is primarily an organic and all-natural ingredient and a cheaper substitute to an array of ingredients in the food & beverage industry. It is mainly consumed as blends or alternative in caffeine-containing beverages such as coffee, which is largely consumed across the globe. The young leaves can be used in salads, and the root can be boiled and eaten like a vegetable. Thus, finding its most important and wide application in the food & beverage industry, the market is expected to grow at a substantial rate during the forecast period.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=122013320

The Europe region dominated the chicory market with the largest share in 2019, whereas Asia Pacific is expected to witness the highest growth rate.

The European market accounted for the largest share in 2019. According to FAOSTAT, Europe contributed to over 95.5% of the global production of chicory roots. According to the same data, Belgium is the largest chicory roots producing county in Europe, followed by France, the Netherlands, and Poland. Consumers of chicory in Europe witness a high preference for clean-label products due to the increase in awareness pertaining to the consumption of natural and free-from products. This, in turn, is projected to drive the chicory market in this region. The region also witnesses the concentration of maximum global players engaged in the manufacturing and marketing chicory products in the global market. Thus, the European region was the largest contributor to the global chicory market in 2019.

Asia Pacific is projected to witness a higher growth rate during the forecast period. This is attributed to factors such as untapped potential, growing awareness among the population, rising investments from the global key players, and increasing economic developments, among others. The densely populated countries in the region with higher risks of chronic diseases such as obesity and heart-related issues are expected to bolster the growth in demand for chicory. The growing food & beverage industry, along with the rising cultivation and production of chicory, is further driving the demand and growth prospects for the chicory market in Asia Pacific.

This report includes a study on the marketing and development strategies, along with the product portfolios of leading companies. It consists of profiles of leading companies, such as Cosucra Groupe Warcoing (Belgium), Delecto Foods Pvt Ltd (India), BENEO GmbH (Germany), Sensus (Netherlands), Leroux (France), Cargill Incorporated (US), Reily Foods Company (US), Pioneer Chicory (India), PMV Nutrient Products Pvt Ltd (India), Farmvilla Food Industries Pvt Ltd (India), Murlikrishna Foods Pvt Ltd (India), Starwest Botanicals (US), STOKROS Company Ltd (Russia), Nature’s Gold Production (Netherlands), Organic Herb Trading Co (UK), Narasu’s Coffee Company (India), NP Nutra (US), Shaanxi Sciphar Natural Product Co Ltd. (China), Jamnagar Chicory Industries (India), and Herbs & Crops Overseas (India).

Recent Developments:

- In July 2020, BENEO GmbH announced a significant expansion for its chicory root fiber production facility in Chile by 2022, funded by an investment of more than EUR 50 million. This was done as a result of rising interest in chicory root fibers from food and drink manufacturers around the globe, creating a high market demand for BENEO’s inulin and oligofructose ingredients.

- In July 2020, Approval was granted exclusively to Sensus’ Frutafit inulin and Frutalose fructooligosaccharides made from chicory roots by the Thailand FDA. This development would allow the company to penetrate the Thailand local market and thereby expand the consumer base in the digestive health market.