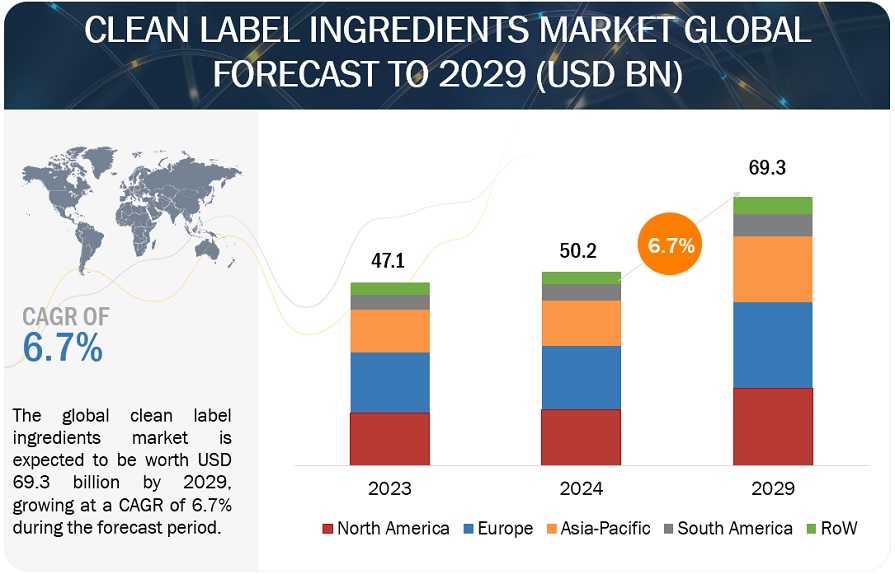

The clean label ingredients market size is estimated to be USD 50.2 billion in 2024 and poised to achieve a 6.7% CAGR, reaching USD 69.3 billion by 2029. The increasing consumer awareness and demand for healthier and more transparent food and beverage options have spurred the demand for clean label products. Consumers are now more mindful of the ingredients in their food and are actively seeking products with simpler, recognizable ingredients lists.

Moreover, growing concerns regarding food safety and sustainability have also propelled the clean label movement. Consumers are increasingly prioritizing products that are free from artificial additives, preservatives, and genetically modified organisms (GMOs), aligning with their values of health and environmental consciousness.

Clean Label Ingredients Market Trends

Here are some of the clean label ingredients market trends are –

- Health and Wellness Emphasis: Consumers are increasingly prioritizing health and wellness, driving a surge in demand for clean label products. These products are free from artificial additives, preservatives, and synthetic chemicals. Items that promote health benefits such as boosting immunity, managing blood sugar, and offering other functional health claims are especially popular.

- Preference for Natural and Organic Ingredients: There is a strong consumer preference for natural and organic ingredients over synthetic ones. This trend is reflected in the growing use of natural colorants, flavors, and sweeteners. For instance, companies are developing organic additives and vegan alternatives to meet the demand for clean label products.

- Impact of Regulations: Legislative actions, such as the California Food Safety Act, are propelling the clean label movement by enforcing stricter labeling requirements. This regulatory environment encourages manufacturers to adopt cleaner labels and reformulate products to exclude harmful synthetic ingredients.

- Technological Advancements: The integration of AI and data analytics is becoming more prevalent in the clean label market. These technologies help brands understand consumer preferences, optimize ingredient sourcing, and enhance marketing strategies to effectively promote clean label attributes.

Clean Label Ingredients Market Opportunities: Development of natural ingredients with functional benefits

Nowadays, consumers are not only seeking products with clean labels but also demanding added health benefits and functional properties. This presents a promising opportunity for ingredient suppliers and manufacturers to collaborate in the creation of natural ingredients that not only meet clean label criteria but also offer enhanced nutritional value and functional advantages. For instance, there is increasing interest in ingredients such as plant-based, fiber-rich additives, and natural ingredients that can contribute to improved health outcomes and cater to specific dietary preferences.

The convergence of food science and technology has enabled the development of novel extraction and processing techniques that preserve the nutritional integrity of natural ingredients while unlocking their full functional potential. From enhancing texture and stability to fortifying products with vitamins and minerals, the possibilities for innovation in clean label ingredient development are vast.

By capitalizing on these opportunities, companies can differentiate their products in the market, appeal to health-conscious consumers, and stay ahead of evolving regulatory requirements. The development of natural ingredients with functional benefits not only aligns with consumer preferences but also contributes to the overall advancement of the clean label ingredients market.

Dry Form Accounted For A Higher Market Share Among Form Segment in 2023.

The convenience factor plays a crucial role. Powdered or dry products offer ease of storage, transportation, and handling compared to other forms like liquid or solid. For instance, dry supplements and food additives are lightweight and compact, making them convenient for both manufacturers and consumers. This convenience translates into cost savings throughout the supply chain, from production to distribution.

Moreover, the versatility of dry form allows for a wide range of applications across industries. Brands can cater to diverse consumer preferences by offering a variety of formulations in dry form, enhancing their market appeal.

Top Clean Label Ingredients Companies

The key players in this market include Cargill, Incorporated (US), ADM (US), DSM (Netherlands), International Flavors & Fragrances Inc. (US), Kerry Group plc (Ireland), BASF SE (Germany), Ingredion (US), Sensient Technologies Corporation (US), Corbion (Netherlands), Symrise (Germany), Chr. Hansen A/S (Denmark), Puratos (Belgium), Ajinomoto Co., Inc. (Japan), Tate & Lyle (UK), and Givaudan (Switzerland)