The global current sensor market is projected to reach 5.41 billion by 2030 from USD 3.24 billion in 2025, at a CAGR of 10.8% during the forecast period in terms of value. Some factors driving the market for current sensors include growing use of battery-powered systems and increasing focus on renewable energy, high adoption of hall-effect current sensors and, increasing demand from consumer electronics industry. Increasing number of networked devices and significant growth in manufacturing of hybrid and electric cars to provide potential growth opportunities to players in the current sensor market during the forecast period.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=26656433

Magnetic sensing technology and the use of TMR (Tunnel Magnetoresistance) sensors are creating opportunities in current sensor market. TMR sensors are more sensitive, consume less power, and provide improved temperature stability than conventional Hall-effect sensors, making them particularly suitable for the automotive and industrial markets. Integrated current sensors with embedded signal processing functions are growing, which are improving accuracy and streamlining system design. Moreover, the introduction of optical current sensors in high-voltage applications offers greater isolation and noise immunity, opening up increased usage in renewable energy and smart grids. Miniaturization of sensors with greater accuracy and lesser power consumption is also fueling demand in consumer electronics and wearables. All these advancements are making better performance, lower costs, and broader applicability across industries possible.

The Asia Pacific held the largest market for current sensors in 2024 because of its robust manufacturing sector, robust EV demand, and rapid expansion in renewable energy projects. China, Japan, South Korea, and India are the world’s leading EV manufacturing nations where current sensors are essential parts in battery management systems, charging stations, and motor controllers. Its booming consumer electronics sector, which is a result of the high-volume production of smartphones, wearables, and home automation products, has also escalated demand for accurate current sensing solutions. The growth in industrial automation, facilitated by government policies encouraging smart manufacturing and Industry 4.0, has also accelerated the use of current sensors in robotics, motor drives, and power monitoring. The increasing adoption of smart grids and renewable energy sources, especially in China and India, has also contributed to market growth, as these industries need high-efficiency current measurement solutions for grid stability and energy storage. With dominant presence of leading sensor manufacturers, cost-effective production facilities, and rising investments in advanced semiconductor technologies, Asia Pacific remains the leader in the global current sensor market.

Automotive sector holds the largest share in the Asia Pacific current sensor market owing to the high growth rate of electric vehicles (EVs) and hybrid electric vehicles (HEVs) in the region. China, Japan, and South Korea are the leading countries in the world for EV production and adoption supported by robust government policies, infrastructure development, and clean energy vehicle incentives. Current sensors are heavily utilized in EVs and HEVs in charging systems, BMS, as well as in motor control for efficient power handling and fault avoidance to ensure no safety risks due to overheating. The push toward autonomous automobiles and ADAS also further elevates the necessity of current sensors to monitor electric load and allow system stability. In addition, more usage of high-performance infotainment systems, climate control, and power steering systems in automobiles requires very precise current sensing for maximum usage of energy and efficiency. The Asia Pacific also boasts a good automotive production base with industry giants such as Toyota, Hyundai, and BYD heavily investing in EV technology and ramping up their production capacities. The increasing focus on cutting carbon emissions and improving vehicle efficiency has prompted vehicle manufacturers to embrace advanced current sensing technologies such as Hall-effect and TMR sensors, driving the growth of the current sensor market in the region.

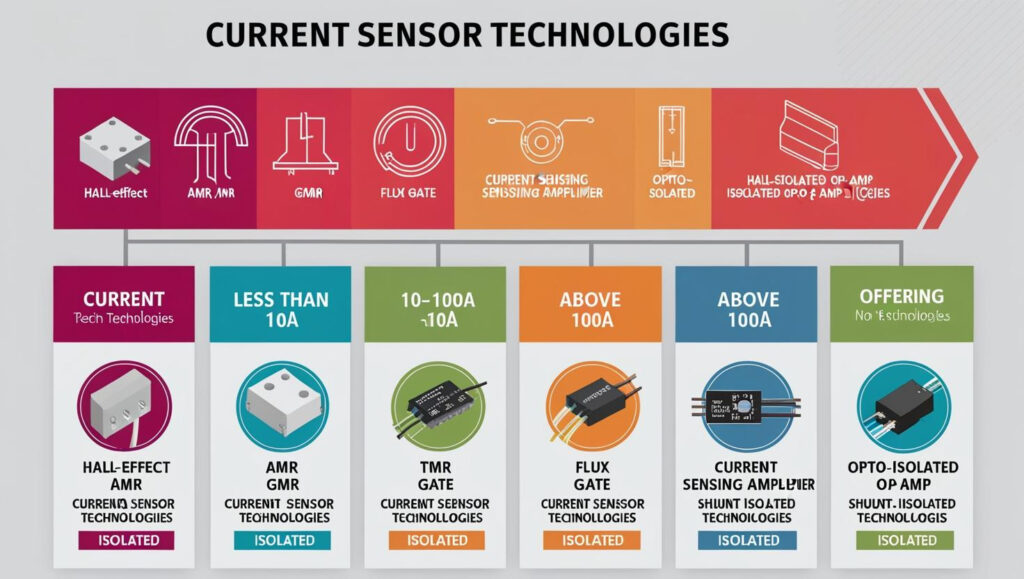

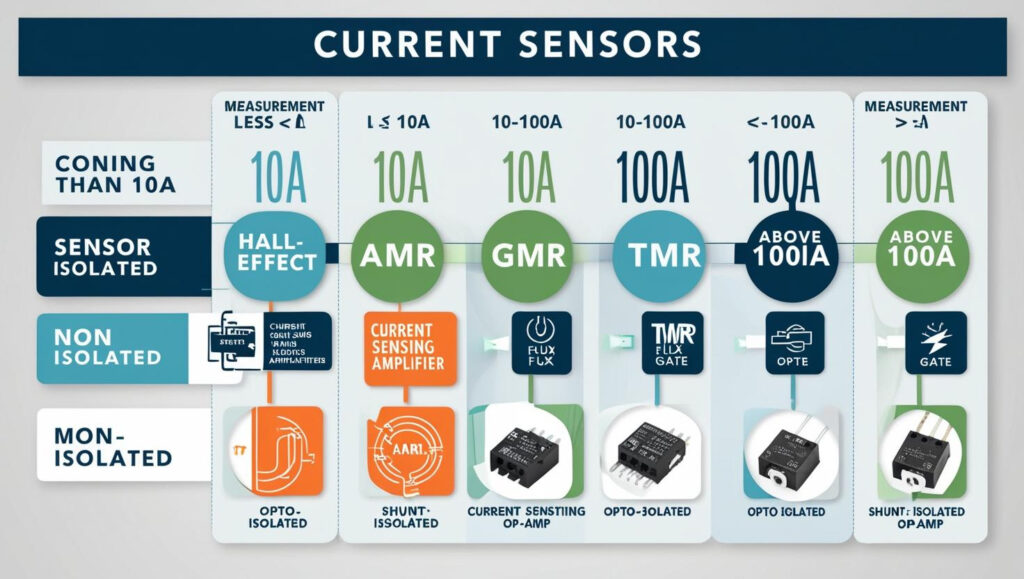

Magnetic current sensors dominated the current sensor market in 2024 due to their extensive use in automotive, industrial, and renewable energy applications. Hall-effect, AMR, GMR, TMR, and flux gate technologies are a few of the sensors that offer precise, non-contact current measurement, making them highly reliable and efficient for various power monitoring applications. Their support for high accuracy, rapid response rate, and galvanic isolation without introducing resistive losses makes them the tool of choice in electric vehicles (EVs), motor control, and smart grid applications. Increasing emphasis on electrification, especially in EV powertrain and battery management systems, has further accelerated demand for magnetic sensors because of their safety capability to conduct high-current measurements. Moreover, automation and industrial IoT (IIoT) industries highly depend on magnetic current sensors in real-time monitoring of power consumption and predictive maintenance to optimize working efficiency. Because of their high scalability and use in hostile operating conditions, with the improvements that have been brought about in the miniaturization and digital interfaces integration, it has made magnetic current sensors stand out as the top current sense technology in 2024.

The automotive industry had the highest market share of the current sensor market in 2024. The increasing shift towards vehicle electrification and mounting applications of advanced driver assistance systems (ADAS). The current sensors are used in battery management systems (BMS), motor control, and charging stations in cars. Furthermore, the rising trend toward electric vehicles (EVs) and hybrid electric vehicles (HEVs) is fueling demand for high-precision current sensors. These sensors carry out the critical activities of observing power flow, optimal energy efficiency, and ensuring high-voltage electric system security on new cars. In addition, traditional ICE vehicles continue to add additional and additional electronic components, i.e., power steering, infotainment, and comfort climate control, all which need efficient current sensing for optimum performance. Autonomous and connected vehicle expansion has additionally enhanced the use of current sensors in power distribution units (PDUs), inverters, and sensor-fusion technology that supports vehicle smartness and energy management. As car makers focus on lightweight, compact, and dependable electronic components, the uses of innovative current sensing technologies, especially magnetic and shunt-type sensors, grew substantially, reaffirming the automotive industry’s dominant role in 2024.

Market for current sensors is growing rapidly, driven by high demand across different industries like automotive, energy, and industrial automation. Increasing adoption of electric vehicles (EVs), renewable installations, and battery management systems have fueled demand for precise current monitoring devices with technologies like Hall-effect, TMR, and optical sensors. Moreover, investment in smart grids, self-driving cars, and IoT-enabled devices is also propelling this growth. Advances in sensor miniaturization, increased accuracy, and power efficiency are opening up new avenues for growth. Potential is there to build high-precision, low-power sensors for EVs, smart home appliances, and renewable energy installations. To capitalize on these trends, firms can focus on breakthrough product innovation, forging closer relationships with OEMs, and deepening their presence in high-growth geographies like Asia Pacific, where demand is increasing robustly. By fulfilling emerging needs and developing product competency, market players can acquire a competitive edge in this evolving environment.