The ongoing COVID-19 pandemic—and the worldwide reaction to it—has compelled companies to radically rethink their strategies and the way they operate. We salute the industry experts helping companies survive and sustain in this pandemic.

At MarketsandMarkets™, analysts are undertaking continuous efforts to provide analysis of the COVID-19 impact on the De-oiled Lecithin Market. We are working diligently to help companies take rapid decisions by studying:

- The impact of COVID-19 on the De-oiled Lecithin Market, including growth/decline in product type/use cases due to the cascaded impact of COVID-19 on the extended ecosystem of the market

- The rapid shifts in the strategies of the Top 50 companies in the De-oiled Lecithin Market

- The shifting short-term priorities of the top 50 companies’ clients and their client’s clients

You can request an in-depth analysis detailing the impact of COVID-19 on the De-oiled Lecithin Market: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=89222733

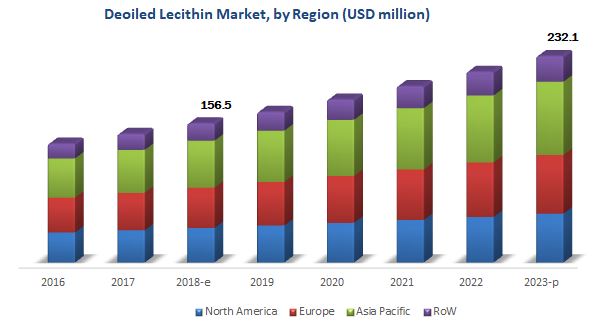

The global de-oiled lecithin marketis estimated to be valued at USD 156.5 million in 2018 and is projected to reach USD 232.1 million by 2023, at a CAGR of 8.2% during forecast period. The global market is driven by the increased demand of lecithin in feed and food applications and rise in the trend toward the consumption of natural ingredients such as de-oiled lecithin in the cosmetics & dietary supplements industry around the globe.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=89222733

Based on the source, the global market has been segmented into soy, sunflower, rapeseed, and egg. The soy segment is estimated to account for the largest share in the de-oiled lecithin market for 2018. It is widely preferred among manufacturers, owing to the sufficient availability of soybean and a cost-effective extraction process. De-oiled soy lecithin is growing in popularity in the feed application and is also being used as a replacement to cocoa butter in the chocolate industry, owing to rise in prices of cocoa butter. Further, increased demand for natural sources in the cosmetic and pharmaceutical industries has boosted the demand for soy-based de-oiled lecithin at a global level.

Based on application, the global market has been segmented into feed, food, and healthcare. The food segment is estimated to be the largest segment in 2018, in terms of value; however, the application in the healthcare industry is expected to grow at the highest CAGR through the forecast period, owing to factors such as adoption of natural ingredients by manufacturers in the pharmaceutical and healthcare industries are due to strict regulations and rising demand for herbal and natural nutritional products, which would drive the growth of healthcare applications incorporating de-oiled lecithin. Moreover, the healthcare expenditure is increasing in developing countries such as India, China, Japan, and Brazil, owing to rise in awareness of the benefits of healthy food consumption.

In 2018, Asia Pacific is estimated to account for the largest share of the de-oiled lecithin market. Factors such as availability of prominent sources such as soy within the region, increase in awareness toward the benefits of healthy food and feed, growth in demand for non-allergic and organic food, rise in meat consumption, growth of the aquaculture industry, and high investment growth in the pharma and personal care industry have boosted the demand for de-oiled lecithin market in the Asia Pacific region. Furthermore, the growing adoption of a premium lifestyle with quality food and increase in animal husbandry also fuel the de-oiled lecithin market growth in this region.

Speak to Analyst:

https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=89222733

This report includes a study of the marketing and development strategies, along with the product portfolios of the leading companies. It includes the profiles of leading companies such as DowDuPont (US), Cargill (US), Archer Daniels Midland (US), Bunge Limited (US) and Stern Wywiol Gruppe (Germany). Other players include Lecico GmBH (Germany), American Lecithin Company (US), Lecital (Austria), Lasenor Emul (Spain), GIIAVA (INDIA) PVT. LTD (India), Novastell Essential Ingredients (France), Rasoya Proteins Ltd. (India), Clarkson Grain Company, Inc. (US), Amitex Agro Product Pvt. Ltd. (India), and Austrade Inc. (US).

Target Audience:

- De-oiled lecithin producers, suppliers, distributors, importers, and exporters

- Manufacturers from industries such as confectionery, chocolate, bakery, nutrition & supplements, cosmetics, pharmaceuticals, paints, herbicides, and feed

- Government and research organizations

- Associations and industry bodies

- National Soybean Processors Association (NSPA)

- The United States Department of Agriculture (USDA)

- The Food and Drug Administration (FDA)

- The European Vegetable Oil and Protein meal Industry (FEDOIL)

- European Feed Manufacturers’ Federation (FEFAC)

- European Feed Safety Ingredients Certification (EFISC)

- The Soybean Processors Association of India, American Soybean Association (ASA)

- United Soybean Board (USB)

- National Aquaculture Association (NAA)

- Brazilian Association of Vegetable Oil Industries (ABIOVE)

- Canadian Oilseed Processors Association (COPA)

- Cosmetics Toiletries and Fragrance Association (CTFA)

- The International Soybean Growers Alliance (ISGA)

- The Australian Oilseeds Federation (AOF)

- The Paraguayan Chamber of Cereal and Oilseed Exporters (CAPECO)

- Ukrainian Association of producers and processors of soya, Cámara de la Industria Aceitera de la República Argentina (CIARA)

- National Oilseed Processors Association (NOPA)