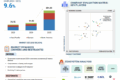

The automotive industry size, encompassing PV, LCV, and MHCV, size is projected to grow from 88 million units in 2024 and is projected to hit 104 million units by 2030, at a CAGR of 2.4%.

Numerous factors, including the adoption of electric vehicles, the development and production of long-range batteries and the installation of fast and ultra-fast charging stations, the introduction of autonomous vehicles, the rollout of 5G connectivity, and trends pertaining to shared mobility, all have an impact on the growth of the automotive industry.

Because of their expanding urban populations and economies, nations like China, Brazil, South Korea, and India have expanded their investments in the growth of the automotive industry. The demand for the automotive market will increase during the forecast period as a result of this investment.

“It is projected that autonomous vehicles will experience substantial expansion.”

Trends in the automobile industry are changing as a result of the advent of driverless vehicles with improved safety features and increased automation. Several automakers, such as Nissan (Japan), Honda (Japan), Audi (Germany), BMW (Germany), and Mercedes-Benz (Germany), are launching Level 2 (L2) and Level 3 (L3) autonomous vehicles. In Germany and the US, OEMs including Mercedes and BMW have been approved for L3 autonomous vehicles, respectively. Additionally, BMW has been given permission to test its L3 cars in Shanghai, China. As these OEMs begin releasing their L3 models, we anticipate that sales of L3 vehicles will increase in 2024. In addition to testing the vehicles on public roads, a number of IT behemoths and original equipment manufacturers have implemented acquisition tactics to acquire smaller businesses involved in the development of autonomous or driverless technology. From 2023 to 2030, the number of Level 3 (L3) autonomous vehicles is expected to increase at a compound annual growth rate (CAGR) of 86.5%. Only a few markets are anticipated to see significant commercial growth in the Level 4 (L4) autonomous car sector.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=142125279

“During the forecast period, Asia Pacific is anticipated to be the largest market.”

The largest proportion of PV and CV combined sales volume is held by the Asia-Pacific region. The primary cause of this is China’s extensive automobile production and exports. In terms of both car production and sales, the Chinese market is the biggest in the world. Over 25 million passenger cars were sold in China in 2023, accounting for about 50% of global sales. When it comes to raw material supply, manufacture, and sales, China is the country that dominates the automotive industry. The most robust EV battery supply chain is found in China. China is where more than half of the EV batteries are made. Furthermore, China produces about 75% of the parts used in EV batteries. These Chinese producers are trying to increase their global market share and service offerings. In 2022 and 2023, the production of automobiles increased in the Asia-Pacific area. Over the course of the projection period, the Asia-Pacific region will continue to dominate the market.

Key Players

The top automobile OEMs in the market are Toyota Motors Corporation (Japan), Tesla (USA), Volkswagen AG (Germany), Ford (USA) , BYD (China), Hyundai Motor Corporation (South Korea) and so on. The other companies that support the automobile industry with technology development are ABB, Siemens, Nvidia, Waymo, Bosch and others. These companies adopted new product launches, acquisitions, partnerships, collaborations, and other key strategies to gain traction in the automotive market.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=142125279