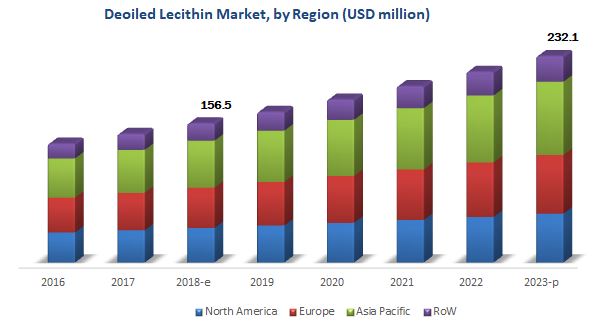

The report “De-oiled Lecithin Market by Source (Soy, Sunflower, Rapeseed, and Egg), Application (Food (Bakery Products, Confectionery Products, Convenience Foods, and Dairy & Frozen Desserts), Feed, and Healthcare), and Region – Global Forecast to 2023″, The de-oiled lecithin market is estimated to be valued at USD 156. 5 million in 2018 and is projected to reach USD 232.1 million by 2023, at a CAGR of 8.2% during the forecast period. The market is driven by factors such rise in clean label food, increase in demand of trans-fatty acid and healthy snacking, and the replacement of artificial and synthetic emulsifier with natural and eco-friendly emulsifiers such as de-oiled lecithin in various different regions.

Based on the source, the global market has been segmented into soy, sunflower, rapeseed, and egg. The soy segment is estimated to account for the largest share in the market for 2018. It is widely preferred among manufacturers, owing to the sufficient availability of soybean and a cost-effective extraction process. De-oiled soy lecithin is growing in popularity in the feed application and is also being used as a replacement to cocoa butter in the chocolate industry, owing to rise in prices of cocoa butter. Further, increased demand for natural sources in the cosmetic and pharmaceutical industries has boosted the demand for soy-based de-oiled lecithin at a global level.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=89222733

The key market players adopted various growth strategies such as new product launches, expansions, mergers, and acquisitions to cater to the increasing demand for de-oiled lecithin. These players are focusing on strategic new product launches to enhance their presence in the de-oiled lecithin market. For instance, in 2018, Cargill is focusing on expanding its product portfolio to strengthen its presence in the de-oiled lecithin market. Some key companies also adopted the merger & acquisition strategy to reach their wide consumer base in various regions. For instance, in 2017, DuPont and Dow Chemicals formed a merger agreement to form the new company, DowDuPont. Post-merger, the companies started operating into three independent divisions: agriculture, materials science, and specialty products. It helped the company to expand its presence in the ingredient (de-oiled lecithin) market. Furthermore, ADM acquired WILD Flavors GmbH and expanded its ingredients offering that includes lecithin products. The acquisition was valued at USD 2.50 billion.

Cargill, one of the global leaders in the de-oiled lecithin market, supplies and manufactures de-oiled lecithin across the globe. It offers de-oiled lecithin products that find applications in bakery, beverages (instant and powdered), confectionery, convenience foods (instant mixes, soups, and sauces), dairy, and meat & fish (ground meat products and fillings). In 2018, the company introduced a new range of de-oiled rapeseed lecithin products to complete its portfolio of GMO and non-GMO lecithin products in Europe. This new range offers great emulsification performance without compromising on taste or texture. Hence, it will allow the company to better serve the growing demand from consumers for label-friendly ingredients in bakery and snack applications.

Based on application, the global market has been segmented into feed, food, and healthcare. The food segment is estimated to be the largest segment in 2018, in terms of value; however, the application in the healthcare industry is expected to grow at the highest CAGR through the forecast period, owing to factors such as adoption of natural ingredients by manufacturers in the pharmaceutical and healthcare industries are due to strict regulations and rising demand for herbal and natural nutritional products, which would drive the growth of healthcare applications incorporating de-oiled lecithin. Moreover, the healthcare expenditure is increasing in developing countries such as India, China, Japan, and Brazil, owing to rise in awareness of the benefits of healthy food consumption, ultimately driving the demand for healthcare applications that incorporate de-oiled lecithin.

In 2018, Asia Pacific is estimated to occupy the largest share of the global de-oiled lecithin market, in terms of value and volume. Export opportunities of non-GMO lecithin from countries such as India to the European market are expected to drive the market for de-oiled lecithin in the region. Sonic Biochem Extractions and Shankar Soya Concepts are some of the key players based in India offering non-GMO de-oiled lecithin to the European market. Apart from this, the booming aquaculture industry in China is expected to boost the demand for de-oiled lecithin in the feed segment. On the other hand, the increased demand for personal care products and cosmetics in countries such as Japan and South Korea are expected to the market in the region.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=89222733

The key players in the de-oiled lecithin market include DowDuPont (US), Cargill (US), Archer Daniels Midland (US), Bunge Limited (US), and Stern Wywiol Gruppe (Germany). Other players include Lecico GmBH (Germany), American Lecithin Company (US), Lecital (Austria), Lasenor Emul (Spain), GIIAVA (INDIA) PVT. LTD (India), Novastell Essential Ingredients (France), Rasoya Proteins Ltd. (India), Clarkson Grain Company, Inc. (US), Amitex Agro Product Pvt. Ltd. (India), and Austrade Inc. (US).

Target Audience:

- De-oiled lecithin producers, suppliers, distributors, importers, and exporters

- Manufacturers from industries such as confectionery, chocolate, bakery, nutrition & supplements, cosmetics, pharmaceuticals, paints, herbicides, and feed

- Government and research organizations

- Associations and industry bodies

- National Soybean Processors Association (NSPA)

- The United States Department of Agriculture (USDA)

- The Food and Drug Administration (FDA)

- The European Vegetable Oil and Protein meal Industry (FEDOIL)

- European Feed Manufacturers’ Federation (FEFAC)

- European Feed Safety Ingredients Certification (EFISC)

- The Soybean Processors Association of India, American Soybean Association (ASA)

- United Soybean Board (USB)

- National Aquaculture Association (NAA)

- Brazilian Association of Vegetable Oil Industries (ABIOVE)

- Canadian Oilseed Processors Association (COPA)

- Cosmetics Toiletries and Fragrance Association (CTFA)

- The International Soybean Growers Alliance (ISGA)

- The Australian Oilseeds Federation (AOF)

- The Paraguayan Chamber of Cereal and Oilseed Exporters (CAPECO)

- Ukrainian Association of producers and processors of soya, Cámara de la Industria Aceitera de la República Argentina (CIARA)

- National Oilseed Processors Association (NOPA)