The ongoing COVID-19 pandemic—and the worldwide reaction to it—has compelled companies to radically rethink their strategies and the way they operate. We salute the industry experts helping companies survive and sustain in this pandemic.

At MarketsandMarkets™, analysts are undertaking continuous efforts to provide analysis of the COVID-19 impact on the Brewing Enzymes Market. We are working diligently to help companies take rapid decisions by studying:

- The impact of COVID-19 on the Brewing Enzymes Market, including growth/decline in product type/use cases due to the cascaded impact of COVID-19 on the extended ecosystem of the market

- The rapid shifts in the strategies of the Top 50 companies in the Brewing Enzymes Market

- The shifting short-term priorities of the top 50 companies’ clients and their client’s clients

You can request an in-depth analysis detailing the impact of COVID-19 on the Brewing Enzymes Market: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=79318910

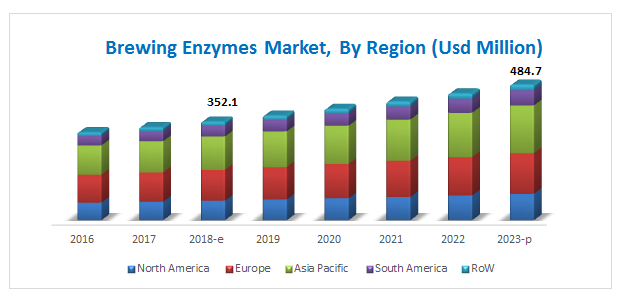

The brewing enzymes market is estimated at USD 352.1 million in 2018. It is projected to reach USD 484.7 million by 2023, at a CAGR of 6.6% from 2018, in terms of value. The use of enzymes has become increasingly important in the brewing industry, as they accelerate the chemical reaction without a change in their own structure. To enhance the brewing process, commercial exogenous enzymes are used in various steps to make the brewing faster, easier, and more consistent. The demand for brewing enzymes in the beer segment is expected to witness significant growth in the near future, due to the rising popularity of beer consumption among young consumers, rise in technological innovations, and growth in the craft beer segment and number of microbreweries.

Objectives of the Report:

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Analyzing demand-side factors based on the impact of macroeconomic factors such as GDP, population size, per capita income, the beer & wine industry, and microeconomic factors such as technological advancements, growing innovations, and the cost/price of enzymes used in the market

- Identifying and profiling key players in the brewing enzymes market

- Providing a comparative analysis of the market leaders on the basis of the following:

- Product offerings

- Business strategies

- SWOT (strengths, weaknesses, opportunities, threats)

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across key regions

- Analyzing the market dynamics and competitive situations & trends across regions and their impact on prominent market players

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=79318910

The amylase segment is projected to dominate the brewing enzymes market through the forecast period. The growth of this market is proportionally dependent on the production of beer globally. Amylases are mainly used in industries because of their cost-effectiveness, less-time-consuming processes, and less space; it is also easy to modify and optimize the processes involving them. The consumption of amylase is significant in the Asia Pacific and African regions, due to lower access to malt in these regions which will lead to higher demand for amylase.

The microbial source is estimated to dominate the global market, as they are easy to handle, can be produced in huge tanks without light, and have a high growth rate. The ideal microorganism grows quickly and produces a significant amount of the desired enzyme at mild temperatures while consuming inexpensive nutrients. Microbial sources are also more cost-effective sources than plant sources, which has fueled the growth of this segment.

The liquid form of brewing enzymes is projected to grow at a higher CAGR between 2018 and 2023. It is preferred in the brewing process as it saves energy, reduces water usage, reduces wastage of beer, and simplifies the filtering process.

The Asia Pacific region is projected to be the fastest-growing market for brewing enzymes over the next five years, owing to an increase in overall economic growth, with diversity in income levels, technology, and demand from end consumers leading to enhanced scope for future growth. The main countries contributing significantly toward the growth of the market in this region are China, Japan, and Vietnam. The malt that is produced in China for beer production is facing a deficit in barley; hence, manufacturers are focusing on building malt production units due to the ongoing increase in domestic demand. Due to barley deficit in this region, commercial enzymes are added to improve the quality of the beer and to fulfill the domestic demand for beer, which drives the usage of enzymes in the brewing process.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=79318910

In this region, countries such as China and Japan are expected to account for a major share of the market. Vietnam is projected to be one of the fastest-growing markets for brewing enzymes in the Asia Pacific region.

This report studies the marketing and development strategies, along with the product portfolios of leading companies such as Novozymes (Denmark), DSM (Netherlands), DowDuPont (US), Amano Enzyme (Japan), Chr. Hansen (Denmark), Associated British Foods (UK), Kerry Group (Ireland), Brenntag (Germany), Enzyme Development Corporation (US), Aumgene Biosciences (India), Biocatalysts (UK), and Enzyme Innovation (US).

Target Audience

- Government and research organizations

- Associations and industrial bodies

- Raw material suppliers and distributors

- Beer and wine producers/processors

- Commercial research & development (R&D) institutions