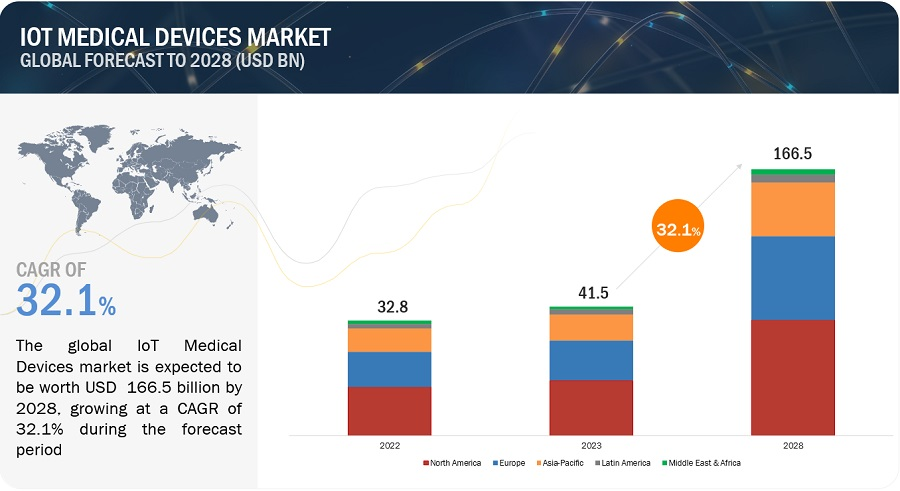

The report IoT Medical Devices Market by Product (Wearable (Vital Sign (BP, Glucose, ECG, Oximeter), Respiratory, Fetal), Implant (Neuro, Cardiac-Defib, Pacemakers) Pumps), Connectivity (Bluetooth, WiFi), End User (Hospital, Nursing Home) – Global Forecast to 2028 “, is projected to reach USD 166.5 billion by 2028 from USD 41.5 billion in 2023, at a high CAGR of 32.1% during the forecast period.

The market for IoT medical devices is driven by factors such as the increasing prevalence of chronic diseases, the need for efficient and cost-effective healthcare solutions, the rising adoption of telemedicine and remote patient monitoring, and advancements in sensor technology, connectivity, and data analytics. However, interoperability & transparency issues, the high setup and operational costs, and data privacy concerns in IoT medical devices market are expected to restrain market growth to a certain extent.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=15629287

Browse in-depth TOC on “IoT Medical Devices Market”

220– Tables

51– Figures

328– Pages

Key Market:

The key players functioning in the IoT medical devices market include Medtronic (Ireland), GE Healthcare (US), Koninklijke Philips N.V. (Netherlands), Abbott (US), Boston Scientific Corporation (US), OMRON Corporation (Japan), Baxter International Inc. (US), BIOTRONIK (Germany), Johnson & Johnson Private Limited (US), NIHON KOHDEN CORPORATION (Japan), Siemens Healthineers AG (Germany), Honeywell International Inc. (US), AliveCor, Inc. (US), Drägerwerk AG & Co. KGaA (Germany), Nonin (US), AMD Global Telemedicine (US), iHealth Labs Inc (US), Aerotel Medical Systems (1998) Ltd. (Israel), i-SENS, Inc. (Korea), Huntleigh Healthcare Limited (UK), ResMed (US), Masimo (US), Infinium Medical (US), ICU Medical, Inc. (US), and Hamilton Medical (Switzerland).

Driver: The advancement of high-speed networking technologies and the growing prevalence of mobile platforms in the healthcare industry

The healthcare industry has witnessed a multitude of new care options due to the availability of high-speed network connectivity. These options include remote consultation and monitoring, virtual health kiosks and portals, video conferencing for consultations, and electronic personal health records. With the help of small and powerful wireless solutions connected through IoT, it is now feasible to remotely monitor and provide advice to patients. Additionally, these solutions can securely capture patient health data from various sensors, apply complex algorithms for analysis, and transmit the information wirelessly to medical professionals. Wireless networking eliminates the limitations of traditional wired solutions and enables devices to connect via popular wireless standards such as BLE for personal area networks (PAN) and Wi-Fi & BLE for local area networks (LAN) in clinics or hospitals. IoT medical devices can be controlled and accessed through cellular networks (3G/4G/5G), Bluetooth, ZigBee, and other protocols.

The adoption of 3G, 4G, and 5G networks has significantly facilitated uninterrupted healthcare services. China leads in terms of 5G penetration, while South Korea and Japan have the highest penetration of 4G, according to Statista. Global 5G mobile subscriptions are projected to exceed 2.7 billion by 2025, with Northeast Asia, North America, and Western Europe having the largest subscriber base. Furthermore, 4G network traffic witnessed a growth of 39% in 2021, as reported by CLSA. India's 4G subscriber base also grew from 645 million in 2020 to 710-720 million in 2021 and is anticipated to surpass 800 million by March 2022, according to Crisil. The widespread and expanding presence of high-speed telecommunication networks in both developed and developing countries has played a pivotal role in driving the adoption of connected medical devices.

Opportunity: Increased reliance on self-operated eHealth platforms due to low doctor-to-patient ratio

Many countries worldwide suffer from a low doctor-to-patient ratio. The World Health Statistics report of 2020 reveals that approximately 40% of countries have less than one physician per 1,000 people, along with less than 18 hospital beds per 10,000 people. Additionally, there is a significant disparity between healthcare access in developed and developing markets. For example, developing countries in the APAC and Africa regions exhibit considerably lower densities of hospital beds, physicians, nurses, and midwives per 10,000 people compared to developed countries in North America and Europe.

The World Health Organization (WHO) sets the global standard doctor-to-patient ratio at 1:1,000. However, numerous countries fall below this standard, resulting in patients experiencing difficulties in accessing adequate medical care due to a shortage of skilled doctors.

Challenge: Concerns regarding data management and interoperability

The healthcare industry operates in an information-intensive environment where a substantial amount of data is generated continuously from numerous connected medical devices used in various healthcare facilities and remote patient monitoring. However, the key lies in generating reliable information by effectively integrating this vast volume of data to create comprehensive and accurate patient records. Given the use of diverse medical devices and diagnostic tools within healthcare systems, there is a growing need to integrate these systems to ensure healthcare professionals can respond promptly at different points of care delivery.

Request Free Sample Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=15629287

This research study involved the extensive use of both primary and secondary sources. It involved the analysis of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study extensively utilized secondary sources, including directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, as well as white papers, annual reports, and companies’ house documents. The aim of the secondary research was to gather and analyze information for a comprehensive and commercially focused study of the IoT medical devices market, encompassing technical aspects and market dynamics. It also facilitated the identification of key players, market classification, industry trends, geographical markets, and significant market-related developments. Additionally, a database of prominent industry leaders was compiled through secondary research.

Primary Research

In the primary research process, various supply-side and demand-side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the IoT medical devices market. Primary sources from the demand side included personnel from pharmaceutical & biotechnology companies, research institutes and hospitals (small, medium-sized, and large hospitals).

Request 10% Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=15629287

Recent Developments of IoT Medical Devices Industry

- In May 2023, Medtronic (Ireland) acquired EOFlow Co. Ltd. (South Korea) to expand the company’s ability to treat patients with diabetes.

- In April 2023, Koninklijke Philips N.V. (Netherlands) and Northwell Health (US) partnered to assist the health system in standardizing patient monitoring, improving patient care, and improving patient outcomes while promoting interoperability and data innovation.

- In April 2023, Abbott (US) acquired Cardiovascular Systems, Inc. (CSI) (US) to gains a complementary treatment option for vascular illness. The most advanced atherectomy technology from CSI prepares vessels for angioplasty or stenting to restore blood flow.

- In March 2023, Advantus Health Partners (US) and GE HealthCare (US) partnered to sign multi-year contract to expand access to Healthcare Technology Management Services.

- In February 2022, Boston Scientific Corporation (US) acquired Baylis Medical Company Inc. (Canada), a provider of innovative transseptal access solutions as well as guidewires, sheaths, and dilators used in catheter-based left-heart surgeries.