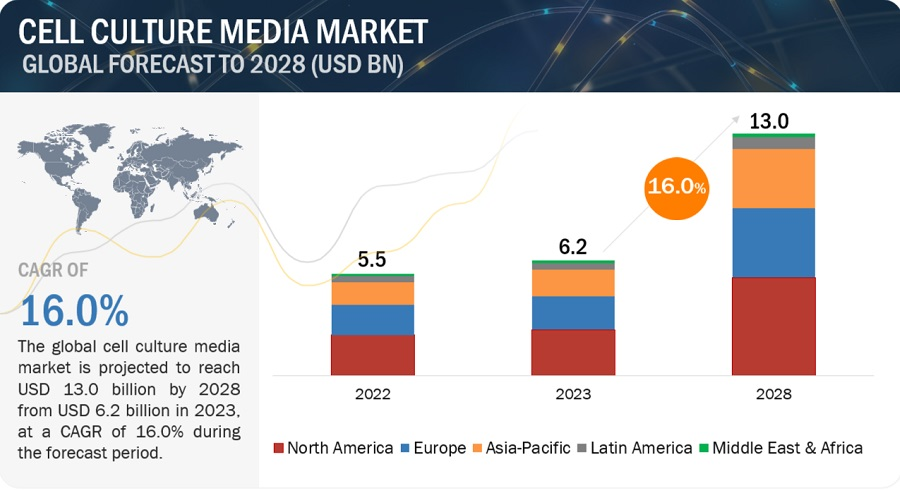

In 2023, the Cell Culture Media Market was estimated to be worth $6.2 billion, with expectations to reach $13.0 billion by 2028, reflecting a CAGR of 16.0%. This extensive research study focuses on industry trends, pricing analysis, and patent reviews, along with materials from conferences and webinars. It delves into the roles of key stakeholders and consumer buying behaviors in shaping the market. The growth of the cell culture media industry is driven by increasing interest in personalized medicine, augmented investment in stem cell research, and a heightened demand for serum and animal component-free media, including monoclonal antibodies and biosimilars.

Download an Illustrative overview

In 2022, the serum-free media segment accounted for the largest share of the type segment in the cell culture media market.

On the basis of type, the cell culture media market is divided into serum-free media, classical media & salts, stem cell culture media, specialty media, chemically defined media, and other cell culture media. In 2022, the serum-free media segment holds for the bigest share of the market. Factors responsible for the growth of this segment includes various advantages or benefits of serum-free media over other types of cell culture media.

In 2022, the biopharmaceutical production segment accounted for the largest share of the application segment in the cell culture media market.

On the basis of application, the cell culture media market is categorized into biopharmaceutical production, diagnostics, drug discovery & development, tissue engineering & regenerative medicine, and other applications. The biopharmaceutical production segment is estimated to grow at the highest growth rate during the forecast period. Factors responsible for the growth include, the growing production of cell culture-based vaccines, and expansion of pharmaceutical industry. The biopharmaceutical production applications of cell culture media include the manufacturing of biologic-based products such as vaccines, monoclonal antibodies, and other therapeutic proteins (such as anticoagulants, enzymes, blood factors, hormones, interferons, growth factors, interleukins, engineered proteins, and thrombolytics, among others).

In 2022, the Asia Pacific region is the fastest-growing region of the cell culture media market.

On the basis of the region, the global cell culture media market has been segmented into North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa. During the forecast period, the Asia Pacific market is estimated to register the highest CAGR during the forecast period. Increased focus of key market players on geographical expansion in emerging markets, favorable government policies and support for cell-based vaccines in the region and less manufacturing cost are some of the major factors anticipated to have positive impact on the market growth of Asia Pacific region.

Cell Culture Media Market Dynamics:

Drivers:

- Increasing demand for serum and animal component-free media

Restraints:

- Expensive cell biology research products

Opportunities:

- Increasing incidence of infectious diseases and outbreaks of pandemics

Challenges:

- Survival of small players and new entrants

Get 10% Free Customization on this Report

Key Market Players:

Key players in the cell culture media market include Thermo Fisher Scientific, Inc. (US), Merck KGaA (Germany), Danaher Corporation (US), Sartorius AG (Germany), Corning Incorporated (US), FUJIFILM Irvine Scientific, Inc. (Japan), Lonza Group AG (Switzerland), Becton, Dickinson and Company (US), Miltenyi Biotec (Germany), and among others.

Recent Developments:

- In June 2023, Thermo fisher launched Tumoroid Culture Medium to accelerate development of novel cancer therapies.

- In April 2023, FUJIFILM Irvine Scientific launched BalanCD CHO Media Platform Portfolio for Bioprocessing.

- In March 2022, FUJIFILM Irvine Scientific acquired Shenandoah Biotechnology. The deal would help the company to provide customers with a single point of access for their life science research, discovery, and cell and gene therapy needs.

- In January 2022, Cytiva and Nucleus Biologics LLC collaborated to enhance custom cell media development for cell and gene therapies.

Content Source:

https://www.marketsandmarkets.com/Market-Reports/cell-culture-media-market-97468536.html

https://www.marketsandmarkets.com/PressReleases/cell-culture-media.asp