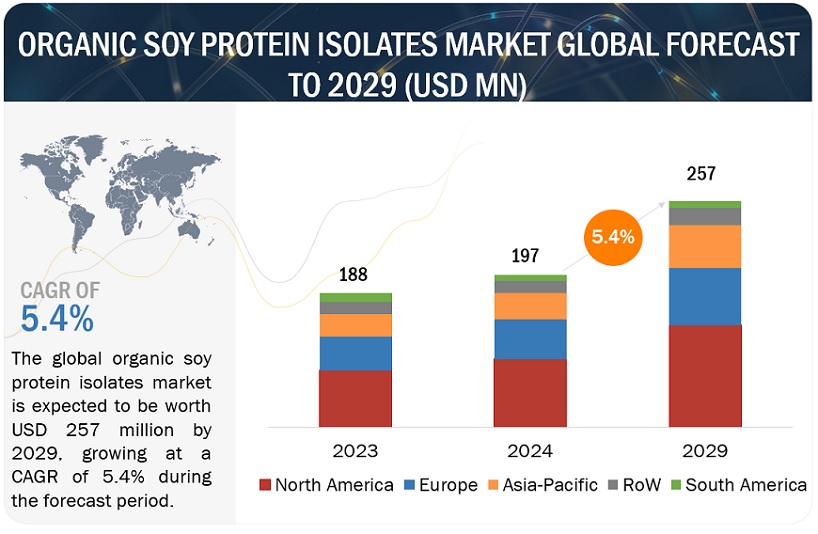

The global organic soy protein isolates market, valued at USD 197 million in 2024, showcases a remarkable growth projection, anticipated to escalate to USD 257 million by 2029, indicating a robust compound annual growth rate (CAGR) of 5.4% during the forecast period. One of the key applications of organic soy protein isolates is in the food and beverage industry, where they are utilized as ingredients in meat alternatives, bakery products, performance nutrition. These soy protein isolates offer a rapid and efficient source of amino acids, facilitating quicker muscle recovery and promoting overall health. The market’s versatility and diverse applications underscore the manifold benefits of organic soy protein isolates, making them a sought-after ingredient in various sectors and contributing to the industry’s sustained expansion.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=11767112

Growth in demand for clean label and sustainable feed products propelling the market for organic soy protein isolates at the highest CAGR.

The demand for organic soy protein isolates in the feed industry continues to grow as the demand for meat products in developed countries increases. The North American and Asia Pacific regions are among the key regions for meat production and are predominant consumers of feed products. While plant-based sources have routinely been utilized in the feed industry, they have been processed and used in a crude protein format. The development of soy protein-based feeds, including isolates, represents the increase in the shift toward high-grade premixes.

FAOSTAT estimates that about 1,000 million tons of animal feed are produced globally every year; this includes 600 million tons of compound feed. More than 80% of this feed is produced by 3,800 feed mills, and 60% of the global total is from 10 countries: the US, China, Brazil, Japan, France, Canada, Mexico, Germany, Spain, and the Netherlands. The importance of nutritional diets for animals is increasing, owing to the demand for high-quality animal products, such as meat, dairy, and other animal byproducts.

The liquid segment within the organic soy protein isolates steering the market’s momentum due to its blendability.

Liquid soy protein isolates are gaining popularity due to their suitability for various applications, particularly in beverages and infant nutrition products. Unlike their powdered counterparts, which enjoy high demand, liquid soy protein isolates offer distinct advantages. Their inherent blendability makes them well-suited for incorporation into ready-to-drink (RTD) beverages, where they contribute to the desired nutritional profile and texture. While powdered soy protein ingredients typically dominate the market, the liquid form presents unique advantages, particularly in terms of ease of use and quick integration into formulations. Despite having a shorter shelf life compared to powdered alternatives, liquid soy protein isolates are preferred for their convenience and immediate availability, making them a preferred choice for manufacturers of RTD beverages and similar products.

An article published in Forbes in September 2022 highlighted the surging demand for RTD beverages, which has directly contributed to the increased interest in liquid soy protein ingredients. This trend underscores the importance of liquid soy protein isolates in meeting evolving consumer preferences and industry demands for convenient, nutritionally dense beverage options.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=11767112

In Europe, the organic soy protein isolates market witnesses significant advancement as government measures to increase production of plant-based protein.

The European market for organic soy protein isolates is divided into applications for both food and feed. The rise of product manufacturers and the acceptance of plant-based protein alternatives have spurred a surge in product introductions across the region.

Moreover, there has been a remarkable increase in veganism within the country, representing a substantial portion of the population. This shift is driven by escalating concerns about sustainability and a heightened emphasis on maintaining good health practices. The growing adoption of veganism and the move away from animal-derived meat offer significant business prospects for companies involved in the organic soy protein industry.

The French government has implemented various strategies to bolster and expand the production of plant-based protein, including organic soy, within the country. This involves collaborating with international counterparts and earmarking substantial funds to enhance domestic production capabilities of plant-based protein. In September 2020, the French government unveiled plans to invest USD 11.85 billion to enhance the country’s production of plant-based protein, specifically organic soy.

The key players in the market are ADM (US), The Scoular Group (US), Xinrui Group (China), Shandong Saigao Group Corporation (China), Taj Agro international (Taj Pharma Group) (India).