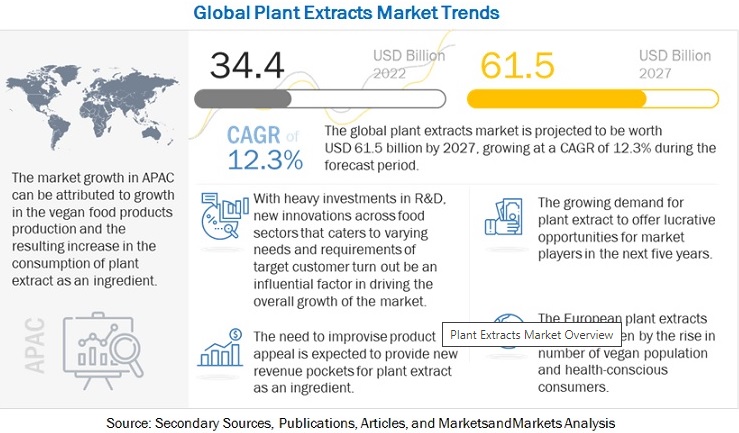

The global plant extract market size is estimated to be valued at USD 34.4 billion in 2022 and is projected to reach USD 61.5 billion by 2027, recording a CAGR of 12.3% in terms of value. With the surge in demand for natural ingredients and natural products due to the rise in awareness related to better dietary choices, the growth of the aging population, the increase in the trend of a healthy lifestyle, and the growth in incidences of chronic diseases, resulted in many manufacturers investing in R&D and producing various innovative extracts, which contribute to the nutritional health of consumers. However, consumer skepticism associated with the adoption of several plant extracts in different applications and inadequate supply of raw materials, and price fluctuation could hinder the market growth to a certain extent during the forecast period.

Download PDF brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=942

Drivers and Restraints:

Demand for essential oil within cosmetic industry

Essential oils are widely used in cosmetics, perfumery, food and beverages, cleaning products, and home fragrances, for their relaxing, stimulating, antiseptic, bactericidal, decongestant, soothing, antispasmodic, and anti-inflammatory properties. Besides being used for fragrance, essential oils like lemon and orange possess antiseptic properties, garnering attention as promising cosmetic active ingredients. Essential oils are also being used in skincare with anti-acne, anti-aging, skin lightening, and sun protection characteristics. Skincare is the most important product category, in which a wide range of products use natural ingredients. Essential oils are mainly used as fragrances, while various other plant-based extracts are also used for their active properties. Essential oils are also used in soaps, color cosmetics, and deodorants. Companies within the ecosystem are focusing on further expanding the market for essential oils within cosmetics. Primavera Life, a producer of natural cosmetics and essential oils, uses a wide range of essential oils in its products, including lemongrass from Bhutan and Nepal, cajeput from Cambodia and lemon verbena and myrtle from Peru.

Higher-priced essential oils are usually used in the perfumery and personal care sector. According to the European Federation of Essential Oils (E.F.E.O), fragrances, cosmetics and aromatherapy generate about one third of the demand for essential oils. There is an expected increase in demand from the cosmetics sector, because many natural and conventional cosmetics companies are using essential oils as fragrances. Some of the highly valued essential oils used as fragrances include eucalyptus, citrus, floral oils, tea tree and lavender. Geraniol, citral, linalool, limonene and citronellol are some of the other notable fragrances popular among the masses.

Price fluctuation and inadequacy of raw materials

The Botanical Survey of India estimates that there are over 8,000 different species of medicinal plants in India. Some plant species are no longer available due to forest degradation and species extinction. Additionally, because these medicinal plants are only grown in a few countries, the supply is constrained. Additionally, because these plants only produce once a year and have a limited supply, there is an imbalance in supply and demand. It also has an impact on the cost of raw materials, and the added expense of storage makes it expensive. It becomes challenging to standardize the final product’s price because of these wide price differences.Supply bottlenecks, and an increased demand in the countries of origin and weather unpredictability cause distress at times.

Lack of harvest workers, slowdown in production, and lockdown impacted port closures have caused crop failures and shortages. Extreme weather conditions such as heavy rain in Southern Europe or enormous drought and forest fires in Eastern Europe exacerbate these failures. Spice industry in Europe and adjacent regions have high dependency on imports. Distortions in freight and logistics have a direct impact on the spice trade. The consequences, such as the lack of availability of shipping containers, are omnipresent and lead to drastic cost increases. As the demand outstrips supply, the annual demand stands risky despite seasonal harvests and disrupting continuity of supply restraining the market.

Segments:

Increased use in pharmaceutical & dietary supplements could help propel the market for dry extracts

Powder extracts are standardized and tested to ensure a certain percentage of ’active’ ingredient content. The standardised extract is spray dried to form a consistent powder after being extracted with ethanol and water. Spray dried powders are stable and do not require any special storage conditions. A cool, dry location away from heat, sunlight, and moisture is adequate. Aside from the storage condition dry extracts have numerous advantages, including less storage space, stability, and ease of standardization for plant active ingredients. These dry extracts are used in a variety of applications, like in food and beverage industries use these extracts to improve the functionality of their products and as additives, flavoring, and coloring agents. Because of the growing popularity of clean label, chemical-free products, the use has increased dramatically in recent years, particularly in developed countries.

Dry extract is also used in the manufacturing of pharmaceuticals and dietary supplements. For thousands of years, medicinal plants have provided therapeutic agents and continue to be a great source of novel pharmaceutical products. Furthermore, because of an aging population, increasing interest of consumers in natural ingredients and increased consumer awareness about general health, demand for medicinal plant products is increasing in both developing and developed countries. Yerba mate, catuaba, and muirapuama are some of the popular choices in the medicinal plant category. Despite this, there is widespread concern about the safety, efficacy, and quality of herbal medicines. Dietary supplements with additional health benefits remain popular in developed countries and increased disposable income, active lifestyle, and increased globalization is expected to drive the market in developing countries.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=942

Regional Insights:

Asia Pacific dominated the market in 2021 and is projected to continue its dominance during the forecast period. The market for plant extracts in the region is thriving due to strong local and international demand. The region has several small and medium-sized manufacturers of plant extracts that are well-versed with the processing of plant extracts and aware of the benefits offered by them such as, Alchemy Chemicals, Vital Herbs, Sydler, Plantnat. Manufacturers in Indonesia, India, and Thailand are continuously investing in the market and focusing on innovation to expand their product range. This is due to the rise in the trade of plant extracts between Asia and international manufacturers of spices and essential oils.

List of Key Players Mentioned in the Report:

• International Flavors & Fragrances Inc. (US)

• Givaudan (Switzerland)

• Symrise (Germany)

• Kerry Group Plc (Ireland)

• ADM (US)

• Synthite Industries Ltd (India)

• Kalsec Inc. (US)

• Kangcare bioindustry co. ltd. (China)