The Plant Growth Regulators Market was valued at USD 2.9 billion in 2022 and is projected to reach USD 4.5 billion by 2028, at a CAGR of 7.4% during the forecast period. Plant Growth Regulators are chemicals used to modify plant growth, such as increasing branching, suppressing shoot growth, increasing return bloom, removing excess fruit, or altering fruit maturity. Numerous factors affect PGR performance, including how well the plant absorbs the chemical, tree vigor and age, dose, timing, cultivar, and weather conditions before, during, and after application. Plant growth regulators can be grouped into six classes: compounds related to auxins, gibberellins, gibberellin biosynthesis inhibitors, cytokinins, abscisic acid, and compounds affecting the ethylene status.

The Asia Pacific is the largest and most densely populated region on Earth, making it a significant market for plant growth regulators. With 30% of the world’s land and 60% of its people in 2021, it is a region with untapped potential for major market players. Plant growth regulators have become increasingly important in the Asia Pacific due to the high demand for food in densely populated countries.

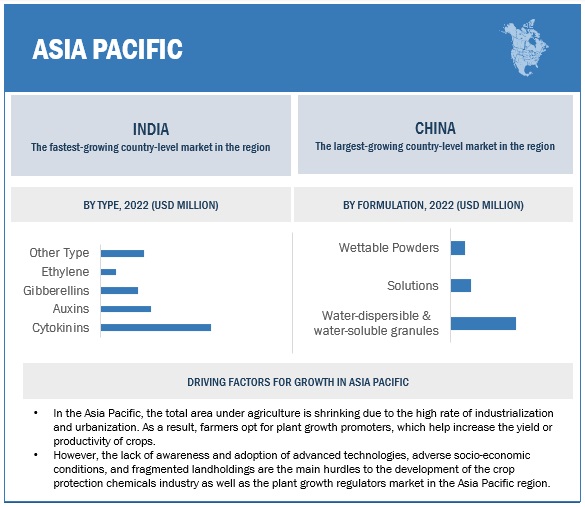

Agricultural land in the Asia Pacific is decreasing due to industrialization and urbanization, so farmers are turning to plant growth promoters to improve crop yields. However, the crop protection chemicals industry and the plant growth regulator market in the Asia Pacific face several obstacles, such as limited awareness and adoption of advanced technology, unfavorable socio-economic conditions, and small, fragmented landholdings.

In the last 20 years, plant growth regulator industries in many Asia Pacific countries have shifted focus from developing plant growth regulators to upgrading technology, management, and sustainability. As agricultural land continues to shrink, farmers must rely on methods that improve crop yields.

To expand their global reach and achieve exponential growth in the crop protection business, more global players are seeking to enter the Asia Pacific market through mergers, acquisitions, or partnerships. In 2020, Sumitomo Chemical Company acquired four South American subsidiaries in Brazil, Argentina, Chile, and Colombia, owned by group companies of Nufarm Limited, a leading Australian Chemical Company. This acquisition helped Sumitomo expand its global footprint. In 2019, Sumitomo Chemical merged two subsidiary companies, Sumitomo Chemical India Ltd and Excel Crop Care Limited, to become India’s second-largest company in the agrichemical market. This merger also helped the company diversify its portfolio and strengthen its position in the market.

The key players in this market include Sumitomo Chemicals Co., Ltd. (Japan), Xinyi Industrial Co., Ltd. (China), Sichuan Guoguang Agrochemical Co., Ltd. (China) Tata Chemicals Ltd. (India), and UPL (India).