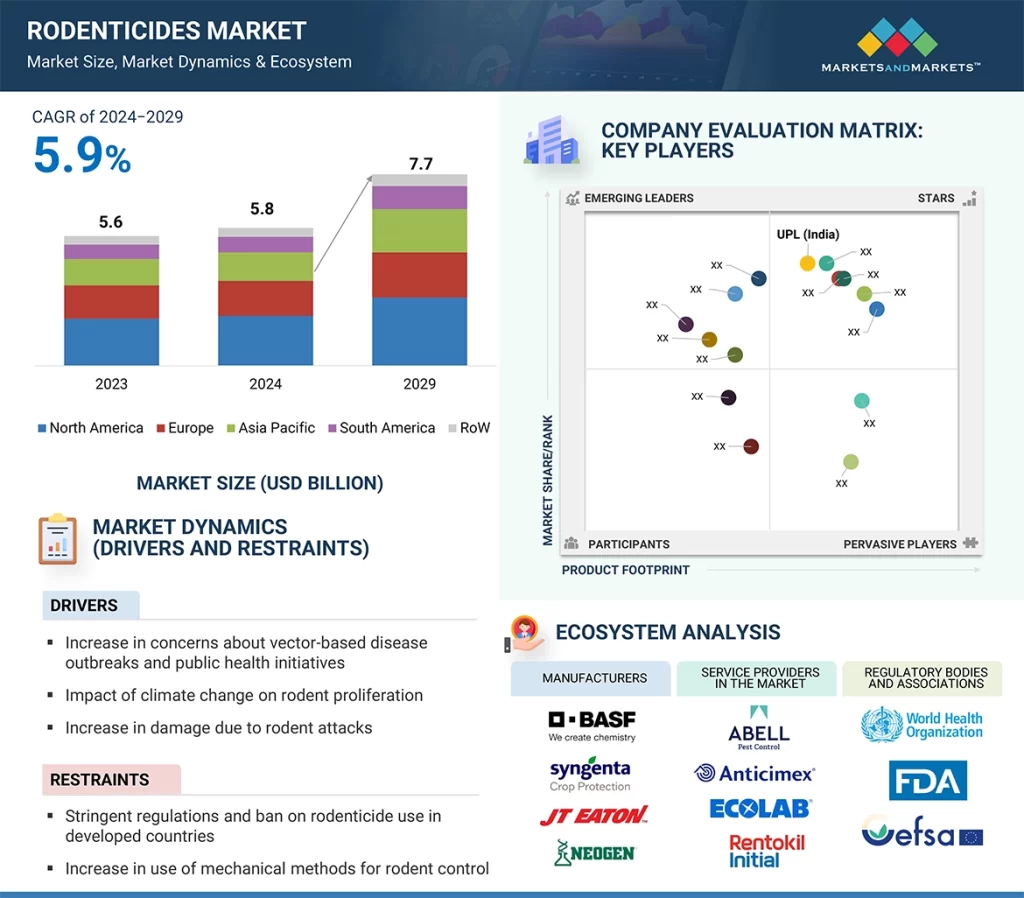

The global rodenticides market is valued at USD 5.8 billion in 2024 and is expected to grow to USD 7.7 billion by 2029, with a CAGR of 5.9% during this period. This growth is driven by several key factors, including urbanization and industrial expansion, which contribute to increased rodent populations due to greater waste generation and habitat disruption. Additionally, changing weather conditions—such as temperature variations, precipitation levels, and seasonal shifts—affect rodent breeding patterns and habitat choices. Extreme weather events can further amplify rodent activity, leading to a higher demand for rodenticides.

Rodenticides Market Growth Drivers

- Rising Rodent Infestation in Urban Areas: The rapid expansion of urban spaces and increasing waste generation have created a favorable environment for rodent populations. Cities with dense populations face significant challenges in controlling rodent infestations, leading to a higher demand for rodenticides.

- Growing Concerns Over Food Security: Rodents cause substantial damage to crops, leading to food wastage and economic losses. The agricultural sector heavily relies on rodenticides to minimize crop damage and improve food production efficiency.

- Stricter Regulations and Pest Control Standards: Governments worldwide are implementing stringent regulations regarding food safety and hygiene, encouraging the use of rodenticides in food storage facilities, restaurants, and homes.

- Advancements in Rodenticide Formulations: The development of eco-friendly and less toxic rodenticides has further fueled market growth. Manufacturers are focusing on biodegradable and target-specific formulations to minimize environmental impact.

Rodenticides Market Trends and Opportunities

- Development of Natural and Biological Rodenticides: Increasing research into natural rodenticides using botanical extracts and microbial-based products is expected to drive innovation in the industry.

- Integration of Smart Pest Control Solutions: The use of IoT-based rodent monitoring systems and AI-driven pest management solutions is gaining traction in urban pest control programs.

- Expansion in Emerging Economies: Rapid urbanization and agricultural growth in developing countries present lucrative opportunities for market expansion.

Spraying to Hold the Second-Largest Share in the Mode of Application Segment

The spray application method is anticipated to secure the second-largest share in the mode of application segment of the rodenticides market. Pesticide application through spraying can inadvertently affect rodent populations. When rodents consume plants or insects treated with pesticides, they may ingest toxic residues, leading to fatalities or weakened conditions. As a result, the demand for rodenticides may rise as an additional measure to manage rodent populations indirectly impacted by spraying.

Urban Centers to Dominate the End-Use Segment of the Rodenticides Market

Urban areas, with their dense human populations, provide abundant food sources and shelter for rodents. The close proximity of buildings, infrastructure, and waste management systems creates ideal conditions for infestations. Various urban structures, including buildings, sewers, and subway systems, serve as nesting sites for rodents. Structural vulnerabilities such as cracks and crevices further facilitate rodent entry, increasing the likelihood of infestations.

The North American Region Dominates the Rodenticide Market Share.

With over 400 rodent species, many of which have adapted to human environments, North America faces significant rodent-related challenges in urban, agricultural, and forestry settings.

Climate factors, such as mild winters and warm springs, have contributed to increased rodent reproduction and survival, leading to outbreaks like the surge of house mice populations in the United States.

Approximately 60% of the global rodent control service market is concentrated in North America, encompassing the United States, Canada, and Mexico. Leading companies, including Rollins, Inc., Rentokil Initial plc, and Ecolab, drive market growth, particularly in the US, where high urbanization rates and expanding pest control services fuel the demand for rodenticides.

Top 10 Companies in the Rodenticides Market

- BASF SE (Germany)

- Bayer AG (Germany)

- Syngenta AG (Switzerland)

- Anticimex (Sweden)

- Neogen Corporation (US)

- Ecolab (US)

- Rentokil Initial plc (UK)

- Senestech, Inc. (US)

- Rollins, Inc. (US)

- Liphatech, Inc. (US)