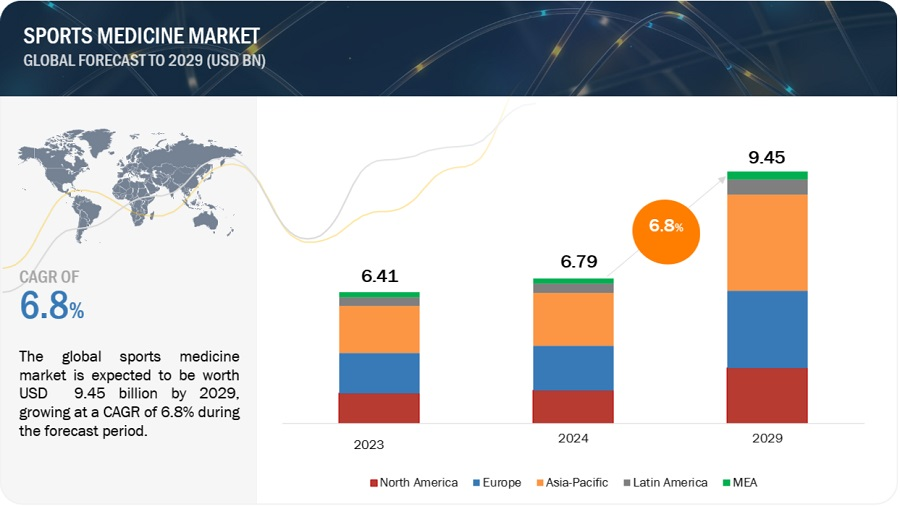

Sports medicine market is expected to grow from $6.79 billion in 2024 to $9.45 billion by 2029, driven by a 6.8% CAGR. Factors such as the rise in sports injuries, more sports participation, and increased R&D expenditure are key drivers. Despite challenges like high product costs and stringent regulations, advancements in health technologies and improving healthcare infrastructure in developing countries present lucrative opportunities.

Drivers of Growth

The sports medicine market is primarily driven by the rising demand for body reconstruction products, which accounted for the largest share of the market. High-impact activities and physical contact in sports often lead to fractures and ligament injuries, creating a growing need for effective recovery solutions. Advanced technologies such as suture anchors, screws, plates, and internal fixation devices are becoming essential for faster recovery and stability in injured areas. Furthermore, the increasing adoption of implants, arthroscopy devices, orthobiologics, and prosthetics contributes to the growth of this market, as these products play a pivotal role in athlete recovery and performance enhancement.

Product Segmentation

In terms of product segmentation, body reconstruction products dominate the sports medicine market, with subcategories including fracture and ligament repair products, implants, arthroscopy devices, orthobiologics, and prosthetics. Fracture and ligament repair products, such as suture anchors and plates, enable faster recovery for athletes. Implants assist in the correct alignment of broken bones, while arthroscopy devices are critical for accurate joint diagnosis and treatment. Orthobiologics are gaining popularity due to their ability to reduce inflammation and accelerate healing. Prosthetics help athletes regain motion and recover from severe injuries, further driving market growth.

Injury-Specific Insights

By injury type, knee injuries are expected to hold the largest market share in 2024. The knee’s complex structure, which includes bones, ligaments, tendons, and cartilage, makes it vulnerable to a wide range of injuries, such as meniscus tears, patellar tendinitis, and ligament tears (ACL, MCL). The demand for effective therapeutic solutions to treat knee injuries has surged, as these injuries are common in athletes participating in various sports. This segment’s growth is further fueled by the need for innovative treatments to address the rising number of knee-related injuries.

End-User Analysis

Hospitals are projected to capture the largest share of the sports medicine market in 2024. The ability of hospitals to provide comprehensive services, including diagnosis, surgery, rehabilitation, and support, positions them as the top choice for athletes seeking treatment. Hospitals’ access to advanced technologies, such as surgical theaters and physiotherapy equipment, significantly improves patient outcomes and accelerates recovery times, making them the preferred end-user segment.

Regional Insights

North America is expected to dominate the global sports medicine market in 2024, driven by the growing popularity of sports among youth, a well-established healthcare system, and increasing awareness regarding sports injury treatments. The region benefits from substantial investments in sports medicine and the introduction of advanced treatment options. For instance, in July 2024, the Stem Cell Network (SCN) initiated a funding event focused on regenerative medicine, further bolstering research and development in the sports medicine field. Government support and ongoing innovations in sports injury care are expected to propel the North American market forward.

Market Structure

The sports medicine market is characterized by a moderate level of competition, with prominent players maintaining significant market presence. The competition has intensified due to increased healthcare spending on athletes, the establishment of sports centers, and a rise in sports events and conferences. Additionally, innovative technologies developed by key players’ R&D efforts contribute to the market’s competitive dynamics. Notable companies in the sports medicine market include Smith & Nephew PLC (UK), DePuy Synthes (US), Stryker Corporation (US), Breg, Inc. (US), and Arthrex, Inc. (US), among others.

Key Player: Stryker (US)

Stryker is a leading medical technology company, known for providing advanced products aimed at improving patient outcomes. With a focus on orthopedics, Stryker produces sports medicine products such as fracture and ligament repair products, implants, arthroscopy devices, and orthobiologics. In 2024, Stryker launched the Gamma 4 Hip Fracture Nailing System, enhancing their portfolio for treating hip and femur fractures. Additionally, the company’s strategic acquisitions, including SERF SAS (Europe), have expanded its presence in the orthopedic segment and strengthened its position in Europe.

Key Player: Arthrex (US)

Arthrex is a global leader in medical devices and orthopedic education, particularly in arthroscopy. The company introduces over 1,000 innovative treatments and devices annually, contributing to its strong market position. Arthrex offers a wide range of products covering shoulder, knee, elbow, hand and wrist, foot and ankle, and hip injuries. In 2024, Arthrex launched “TheNanoexpression.com” to promote nano arthroscopy treatments, demonstrating its ongoing innovation in the field of sports medicine.

Key Player: DePuy Synthes (US)

DePuy Synthes is advancing orthopedic surgery with its minimally invasive and non-surgical sports medicine products, including fracture and ligament repair products, implants, and orthobiologics. The company continues to expand its orthopedic segment through strategic acquisitions, such as CrossRoads Extremity Systems in 2022. In 2024, DePuy Synthes introduced the TriAltis Spine System, further showcasing its commitment to offering advanced solutions for complex conditions, including those related to sports injuries.

Market Structure

The sports medicine market is characterized by a moderate level of competition, with prominent players maintaining significant market presence. The competition has intensified due to increased healthcare spending on athletes, the establishment of sports centers, and a rise in sports events and conferences. Additionally, innovative technologies developed by key players’ R&D efforts contribute to the market’s competitive dynamics. Notable companies in the sports medicine market include Smith & Nephew PLC (UK), DePuy Synthes (US), Stryker Corporation (US), Breg, Inc. (US), and Arthrex, Inc. (US), among others.

Key Player: Stryker (US)

Stryker is a leading medical technology company, known for providing advanced products aimed at improving patient outcomes. With a focus on orthopedics, Stryker produces sports medicine products such as fracture and ligament repair products, implants, arthroscopy devices, and orthobiologics. In 2024, Stryker launched the Gamma 4 Hip Fracture Nailing System, enhancing their portfolio for treating hip and femur fractures. Additionally, the company’s strategic acquisitions, including SERF SAS (Europe), have expanded its presence in the orthopedic segment and strengthened its position in Europe.

Key Player: Arthrex (US)

Arthrex is a global leader in medical devices and orthopedic education, particularly in arthroscopy. The company introduces over 1,000 innovative treatments and devices annually, contributing to its strong market position. Arthrex offers a wide range of products covering shoulder, knee, elbow, hand and wrist, foot and ankle, and hip injuries. In 2024, Arthrex launched “TheNanoexpression.com” to promote nano arthroscopy treatments, demonstrating its ongoing innovation in the field of sports medicine.

Key Player: DePuy Synthes (US)

DePuy Synthes is advancing orthopedic surgery with its minimally invasive and non-surgical sports medicine products, including fracture and ligament repair products, implants, and orthobiologics. The company continues to expand its orthopedic segment through strategic acquisitions, such as CrossRoads Extremity Systems in 2022. In 2024, DePuy Synthes introduced the TriAltis Spine System, further showcasing its commitment to offering advanced solutions for complex conditions, including those related to sports injuries.

Market Structure

The sports medicine market is characterized by a moderate level of competition, with prominent players maintaining significant market presence. The competition has intensified due to increased healthcare spending on athletes, the establishment of sports centers, and a rise in sports events and conferences. Additionally, innovative technologies developed by key players’ R&D efforts contribute to the market’s competitive dynamics. Notable companies in the sports medicine market include Smith & Nephew PLC (UK), DePuy Synthes (US), Stryker Corporation (US), Breg, Inc. (US), and Arthrex, Inc. (US), among others.

Key Player: Stryker (US)

Stryker is a leading medical technology company, known for providing advanced products aimed at improving patient outcomes. With a focus on orthopedics, Stryker produces sports medicine products such as fracture and ligament repair products, implants, arthroscopy devices, and orthobiologics. In 2024, Stryker launched the Gamma 4 Hip Fracture Nailing System, enhancing their portfolio for treating hip and femur fractures. Additionally, the company’s strategic acquisitions, including SERF SAS (Europe), have expanded its presence in the orthopedic segment and strengthened its position in Europe.

Key Player: Arthrex (US)

Arthrex is a global leader in medical devices and orthopedic education, particularly in arthroscopy. The company introduces over 1,000 innovative treatments and devices annually, contributing to its strong market position. Arthrex offers a wide range of products covering shoulder, knee, elbow, hand and wrist, foot and ankle, and hip injuries. In 2024, Arthrex launched “TheNanoexpression.com” to promote nano arthroscopy treatments, demonstrating its ongoing innovation in the field of sports medicine.

Key Player: DePuy Synthes (US)

DePuy Synthes is advancing orthopedic surgery with its minimally invasive and non-surgical sports medicine products, including fracture and ligament repair products, implants, and orthobiologics. The company continues to expand its orthopedic segment through strategic acquisitions, such as CrossRoads Extremity Systems in 2022. In 2024, DePuy Synthes introduced the TriAltis Spine System, further showcasing its commitment to offering advanced solutions for complex conditions, including those related to sports injuries.

Content Source:

https://www.marketsandmarkets.com/Market-Reports/sports-medicine-devices-market-751.html

https://www.marketsandmarkets.com/PressReleases/sports-medicine-devices.asp