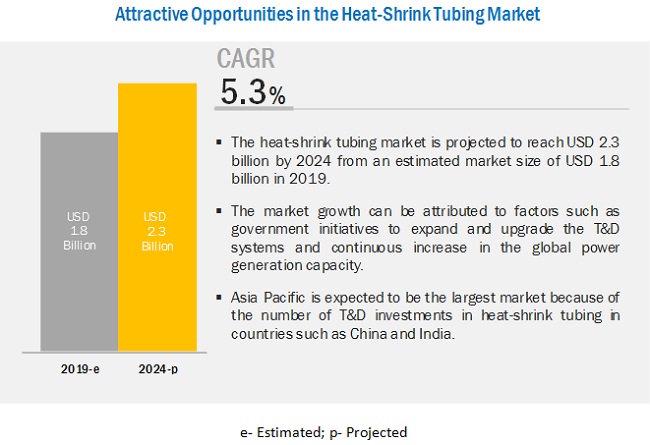

The heat-shrink tubing market is projected to reach USD 2.3 billion by 2024 from an estimated USD 1.8 billion in 2019, at a CAGR of 5.3% during the forecast period. This growth can be attributed to factors such as the growing usage of heat-shrink tubes in the automotive industry and the growing number of government initiatives and policies for grid infrastructure.

Asia Pacific is estimated to be the largest growing heat-shrink tubing market during the forecast period. The region has been segmented, by country, into China, India, Japan, Australia, and South Korea. The growth of this region is primarily driven by countries such as China and India. Government initiatives to expand and upgrade the T&D systems and continuous increase in the global power generation capacity would also boost the demand for the heat-shrink tubing market in this region.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=40363663

The heat-shrink tubing market, by voltage, is segmented into low voltage, medium voltage, and high voltage. The low voltage segment is projected to hold the largest market share by 2024. The usage of heat-shrink tubes for insulation purposes in terminations and joints is likely to fuel the market. The medium voltage segment of the heat-shrink tubing market is the second largest market during the forecast period.

The heat-shrink tubing market, by material, is segmented into Polyolefin, Polytetrafluoroethylene (PTFE), Fluorinated Ethylene Propylene (FEP), Perfluoroalkoxy Alkane (PFA), Ethylene Tetrafluoroethylene (ETFE), and others. The polyolefin segment constitutes a higher share of the heat-shrink tubing market. It finds a wide application in packaging and electrical insulation industries for mechanical and environmental protection. It forms a dense network of high molecular weight, which improves impact strength, Environmental Stress Crack Resistance (ESCR), and creep and abrasion resistance. Polytetrafluoroethylene (PTFE) segment is the second largest heat-shrink tubing market during the forecast period.

The heat-shrink tubing market, on the basis of end-users, has been categorized into utilities, automotive, food & beverage, chemical, and others (healthcare and military & aerospace industries). The protection for wires & cables against the harmful environmental elements is likely to drive the utilities segment. The chemical segment is the second largest heat-shrink tubing market during the forecast period. Increasing demand for thin, highly abrasive, and chemically resilient tubing in the chemical industry is likely to boost the market.

North America is projected to be the second largest region with countries such as the US, Canada, and Mexico. Energy efficiency and optimization services in Canada, and an increasing number of policies to support energy infrastructure growth and rising demand for renewables in Mexico are likely to drive the heat-shrink tubing market.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=40363663

Key Market Players –

The major players in the heat-shrink tubing market are TE Connectivity (Switzerland), 3M (US), Sumitomo Electric (Japan), ABB (Switzerland), HellermannTyton (West Sussex), Alpha Wire (US), Woer (China), Qualtek (US), Panduit (US), Zeus (US), Guanghai Materials (China), Thermosleeve (US), Insultab (US), Dasheng Heat Shrinkable Material (China), and Changchun Heat Shrinkable Materials (China).

TE Connectivity (Switzerland) is a key player in this segment. It operates through 3 business segments, namely, transportation solutions, industrial solutions, and communications solutions. The company offers heat-shrink tubing through all the 3 business segments. The transportation solutions business segment caters to the end markets such as automotive, commercial transportation, and sensors. The industrial solutions business segment caters to aerospace, defense, oil & gas, and energy industries. The communications solutions business segment caters to the end markets such as data & devices and appliances. The company actively focuses on both organic and inorganic strategies to increase its global market share. For instance, in March 2019, TE Connectivity introduced its BATTU heat-shrink tubing for its applications in industrial and commercial vehicles, construction equipment, and generator sets. TE Connectivity caters to various end-users such as utilities, automotive, medical, and defense with different materials of heat-shrinkable tubes such as PTFE, FPE, PFA, ETFE, and PET, which is a differentiating factor to increase the company’s footprint in the heat-shrink tubing market.

Sample Copy @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=40363663

Key Questions Addressed by the Report –

- Which revolutionary technology trends are expected over the next 5 years?

- Which heat-shrink tubing market elements are likely to lead by 2024?

- Which voltage segment is expected to get the maximum growth opportunity during the forecast period?

- Which region is expected to lead in terms of the highest market share by 2024?

- How are companies using heat-shrinkable tubes in different applications?