Synchronous Generator Industry Report 2023: Size, Share, Trends, Growth Drivers, Forecast to 2028

The Synchronous Generator Industry has experienced robust growth in recent years, expanding from $4.7 billion in 2023 to $5.9 billion in 2028 at a compound annual growth rate (CAGR) of 4.6%. A synchronous generator, also called an AC generator or alternator, is an electromechanical energy conversion device that converts mechanical energy from sources such as engines and turbines into electrical energy in the form of alternating current (AC). It is called an alternator as it produces alternating current electricity, and a synchronous generator because it is necessarily driven at synchronous speed to generate electricity at the desired frequency.

Strong Future Growth Anticipated

The Synchronous Generator Industry is projected to continue its strong growth, reaching $5.9 billion in 2028 at a compound annual growth rate (CAGR) of 4.6%. Synchronous generators are essential in power plants for generating electricity on a large scale as they provide grid stability, high efficiency, voltage regulations and synchronization with the grid.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=183822134

The new technological advancements in synchronous generators is virtual synchronous generators (VSGs). Virtual synchronous generators (VSGs) are software-based models of synchronous generators that can be used in power systems to provide inertia and stabilize grid frequency. VSGs use advanced control algorithms to emulate the behavior of traditional synchronous generators, which have been used for decades to provide these grid-stabilizing services. However, VSGs are not physical machines and do not require physical components like rotors or stators. Instead, they can be implemented in power converters connected to renewable energy sources, such as wind turbines and solar panels, enabling these sources to contribute to grid stability in a way that was previously only possible with traditional synchronous generators

Growth Driver Of The Synchronous Generator Industry

The renewable energy segment by end user is expected to be the fastest growing segment of the synchronous generator market. Synchronous generators are widely used in hydroelectric power plants. Water turbines, driven by the force of flowing water or falling water, are coupled to synchronous generators to produce electricity. This setup is commonly used in large-scale hydroelectric projects. They are also frequently employed in wind turbines to convert the mechanical energy from the wind into electrical energy. Synchronous generators offer advantages in renewable power generation, such as stable frequency output, grid synchronization capability, and the ability to provide reactive power for grid stability.

The gas turbine segment by prime mover is projected to be the fastest growing segment of the synchronous generator industry. Gas turbine synchronous generators are known for their high efficiency in converting fuel energy into electricity. They can achieve higher thermal efficiencies compared to other types of generators, such as steam turbines. Gas turbine generators have relatively lower emissions compared to conventional coal-fired power plants. Modern gas turbines employ advanced combustion technologies, such as lean-burn and dry low NOx (DLN) systems, which significantly reduce nitrogen oxide (NOx) emissions.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=183822134

The 1,500 RPM segment by speed is projected to be the fastest growing segment of the synchronous generators market. Synchronous generators operating at 1,500 rpm are well-suited for low-speed prime movers such as slow-speed diesel engines or certain types of industrial turbines. These generators can be directly coupled with such prime movers without the need for additional gearing or speed control mechanisms, simplifying the system design and reducing maintenance requirements. Their smaller size and reduced weight result in lower material and manufacturing costs. Additionally, the use of low-speed prime movers, which are often more cost-effective than high-speed engines or turbines, contributes to overall cost savings.

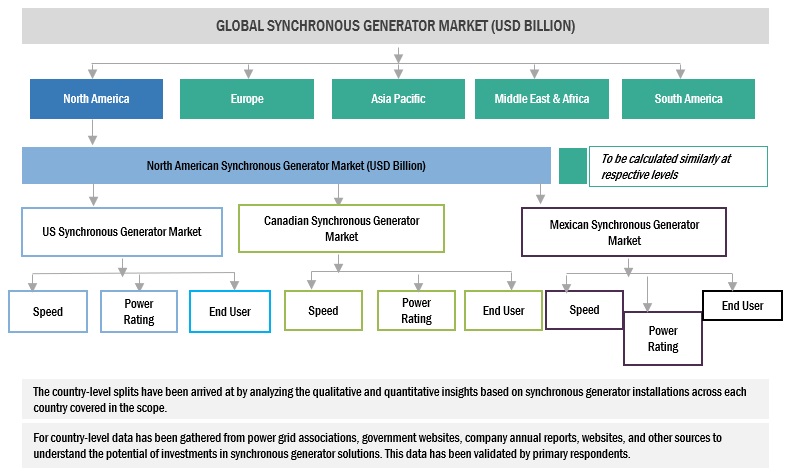

In 2022, the Asia Pacific dominated the global synchronous generator industry, followed by North America & Europe. The region, by country, has been segmented into the China, India, Japan, Australia, South Korea, and Rest of Asia Pacific. China has been actively investing in wind farms and hydroelectric projects, which require synchronous generators for power generation. Additionally, China’s continuous industrialization and urbanization have increased electricity demand, driving the need for synchronous generators in various industries. India has a rapidly growing economy and a rising population, leading to increased energy demand. The country requires reliable and efficient power generation technologies, including steam and gas turbines, to meet this demand. India has been promoting the use of natural gas as a cleaner alternative to coal. This has led to the construction of gas-based power plants, where gas turbines synchronous generators play a crucial role. Japan has a diversified energy mix that includes both conventional and renewable sources. While the country aims to increase its share of renewable energy, it still heavily relies on thermal power generation, where steam and gas turbines are essential.

Request Sample Pages of the Report: https://www.marketsandmarkets.com/requestsampleNew.asp?id=183822134

Major players operating in the synchronous generator industry include ABB (Switzerland), WEG (Brazil), Siemens Energy (Germany), Meidensha Corporation (Japan), and Andritz (Austria). These companies have reliable manufacturing facilities as well as strong distribution networks across key regions, such as North America, Europe, and Asia Pacific. They have an established portfolio of reputable products and services, a robust market presence, and strong business strategies. Furthermore, these companies have a significant market share, products with wider applications, broader geographical use cases, and a larger product footprint