With an increase in the number of consumers moving to a healthy diet and the adoption of “free-from “movement, gluten-free foods have been considered as one of the largely incorporated trends in the food industry. Certain food groups are naturally free from gluten. Some of them include fruits, vegetables, meat & poultry, seafood, dairy, beans, legumes, and nuts. Due to the increasing health trend, there are a lot of gluten-free substitutes, which are available in foods such as cereals, oats, soups, and beverages. Companies are now venturing into the fast-food business by adding products such as gluten-free pastas and burgers.

According to MarketsandMarkets analysis, the global gluten-free products market is projected to grow from USD 4.48 billion in 2018 to reach USD 6.47 billion by 2023, at a CAGR of 7.6%.

What is driving the growth of gluten-free products market?

- Increased diagnosis of celiac disease and other food allergies

Gluten intolerance also known as the celiac disease is an autoimmune disorder, which damages the small intestine lining and prevents the absorption of nutrients from consumed food items. This damage is majorly a reaction to eating foods with gluten, a type of wheat protein which is also found in barley, rye, and oats. A decade ago, the detection of the presence of celiac disease was unknown and was commonly mistaken for food indigestion. Avoiding the consumption of products containing gluten is the only way to treat celiac disease. Hence, there is a surge in demand for gluten-free products.

- Health benefits and adoption of special dietary lifestyles

The growing awareness among consumers about the benefits of adding nutritive foods in their everyday diet has led to an increased preference among consumers for gluten-free products processed from corn, soybean, millets, and pseudocereals. Even non-gluten intolerant consumers are adopting special diets that consist of gluten-free foods. There is an increasing desire among non-celiac consumers for grains that are naturally gluten-free such as quinoa, millet, teff, and amaranth to be incorporated in their food products. Certain gluten-free products are also used as substitutes to wheat, for instance, millet- and soybean-based products.

Gluten-free products, by type, are segmented into bakery products, snacks & RTE products, pizzas & pastas, condiments & dressings, and others. The bakery products segment is estimated to account for the largest market share in 2018. The constant innovations adopted by the top players in breads, pizza crusts, and doughs among other bakery products are driving the growth in this market. Moreover, the consumption of bakery products in the North American region is high. Countries in this region are also known to report maximum cases of celiac disease, which calls for the processed food industry giants to cater to those needs.

Gluten-free products, by distribution channel, is segmented into conventional stores, specialty stores, and drugstores & pharmacies. The conventional stores segment is estimated to account for a share of 71% of the total market, making it the largest segment in 2018. Convenience stores include grocery stores, mass merchandisers, warehouse clubs, and online retailers. These stores are ubiquitous, and customers find it more economical. Hence, it is a popular choice among consumers as opposed to specialty stores or drugstores & pharmacies.

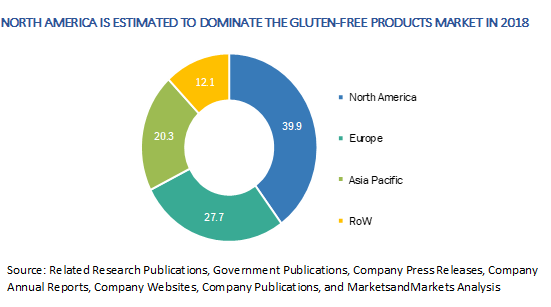

Based on region, the gluten-free products market is segmented into North America, Europe, Asia Pacific, and Rest of the World.

- North America dominated the market with a share of USD 2,146.7 million in 2017. According to the Celiac Disease Foundation, the incidence rate of celiac disease among Americans stands at 0.5% in 2018. About three million Americans have celiac disease and

- a further estimated 40 million suffer from gluten-intolerance or sensitivity. This is one of the major reasons why most Americans are shifting their focus toward gluten-free products.

- Companies such as General Mills (US), The Kraft Heinz Company (US), and The Kellogg Company (US) are introducing different variants of gluten-free products to tap into this dynamic food product category.