Similar to peas, rice, and canola, potato proteins are vegetable sourced proteins with significantly smaller market size. The small market size of potato protein can be mainly attributed to the introductory stage of its lifecycle. However, it is increasingly becoming a subject of R&D in the protein industry among both food and feed manufacturers. The consumption of potato protein is currently the largest in the feed industry, especially in cattle and swine feed, whereas in the food industry, it is used in limited applications such as confectionery, bakery, processed meat, and to some extent in dairy products. However, it is extensively researched as potato protein isolated by thermal coagulation is highly unstable and insoluble, resulting in the loss of their functionality in food applications. Furthermore, due to its solubility issues, potato protein concentrate is considered as a by-product of low value despite the high nutritional value of the indentured protein.

According to MarketsandMarkets, the global potato protein market is projected to grow from USD 72.2 million in 2017 to USD 88.2 million by 2022. The growth of the market is projected to be directly affected by the rising veganism trends and increased concerns toward the food allergen products. The global potato protein market is projected to grow at a CAGR of 4.1% from 2017 to 2022.

Download PDF brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=117255732

What is driving the growth of the potato protein market?

- Consumer concerns regarding food allergens in food products

Intolerance and allergenic reactions are common health concerns globally, particularly in regions such as North America and Europe. According to the Food Allergy Research & Education (FARE), in the US, nearly 200,000 people each year require emergency medical care due to allergic reactions to food, which cost about USD 25 billion annually. In the EU, according to The European Academy of Allergy and Clinical Immunology (EAACI), currently, around 150 million citizens suffer from chronic allergic diseases, and by 2025, it is estimated that more than 50% of all Europeans will suffer from allergies.

As a result of the growing concerns regarding allergies, an increasing emphasis is placed on accurate labeling of food products in order to help customers identify the presence of allergens. Manufacturers in the food industry have responded accordingly by introducing allergen-free products, labeling them as ‘gluten-free,’ ‘lactose-free,’ or by providing disclaimers on food products such as ‘this product is processed in a factory that also processes soy, wheat, peanuts, and eggs, among others’, in order to create product awareness and prevent allergen concerns among consumers through cross-contamination.

Therefore, consumers in the European and North American regions prefer allergen-free proteins such as potato proteins in food products. This has resulted in an increasing focus of food manufacturers on the identification of alternate sources of protein that are allergen-free, such as potato proteins. Consequently, this has resulted in increasing industrial investments in R&D for the use of potato protein in food applications.

- Untapped regional markets are creating opportunities for potato protein

The market for potato protein is currently at a nascent stage of its life cycle, and its production is largely concentrated in the European region, followed by the North American region. Moreover, the production of potation protein for use in both food and feed applications is significantly low in regions such as the Asia Pacific and South America. As a result, any industrial demand in these regions has to be met with imports from the European and North American regions, which significantly adds to the cost of procurement, and thereby production, translating into higher prices of the final products. This provides an opportunity for investments in potato protein production facilities in emerging economies that would enable easy procurement of potential potato protein for industrial users.

Speak to Analyst @ https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=117255732

The feed segment is projected to dominate the potato protein market by 2022. The feed segment dominated the potato protein market in 2016 and is projected to grow at the highest CAGR during the forecast period. Potato protein is widely used in feed applications. However, its usage in food & beverage applications is still at a nascent phase. Of the various feed applications, it is mainly used for piglets and broilers. The high usage of potato protein in the feed is due to its high digestibility, pure protein content, and good palatability. It is known to be of superior quality as compared to various animal protein sources and other plant protein as soy concentrates and pea protein.

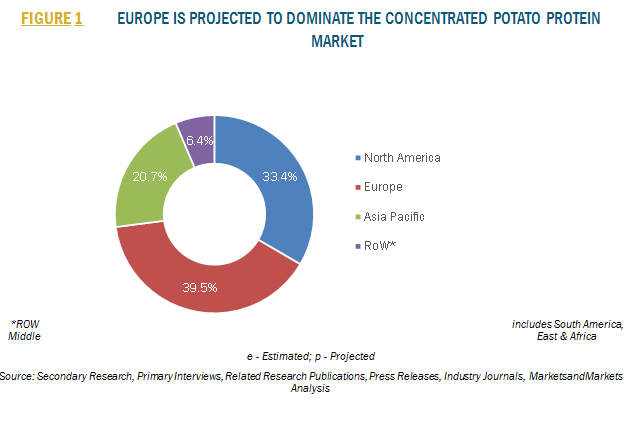

Based on region, the potato protein market is segmented into North America, Europe, Asia Pacific, and Rest of the World.

- The Asia Pacific accounted for the fastest growing market for potato protein in 2016. This market is projected to grow at the highest CAGR of 4.4% during the forecast period. The growth of this market is attributed to the increasing demand for potato protein, which is used in feed, due to Asia Pacific’s highest livestock population as well as feed consumption in the world.

- The large base of the vegan population in the Asia Pacific region is another major driver for the market. However, predominant preferences for soy protein in food applications, the lack of awareness about the benefits of potato protein, constrained supply issues, and drawbacks associated with potato protein inhibit its growth in the food industry.