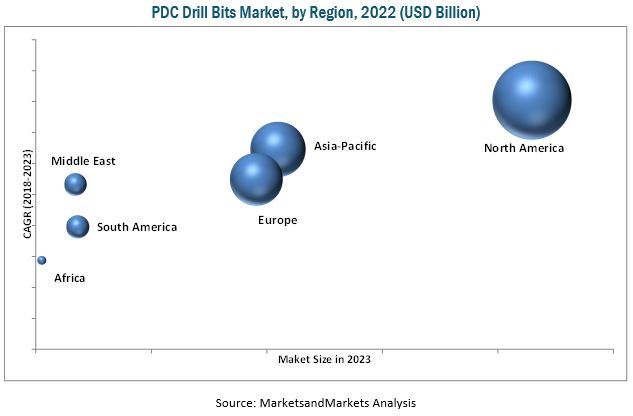

The PDC drill bits market is estimated to grow at a CAGR of 4.41% from 2018 to 2023, to reach a projected market size of USD 4.54 billion by 2023. This growth can be attributed to the increasing demand for production & exploration activities in the world, leading to an efficient oil & gas drilling.

The PDC drill bits market is dominated by a few major players that are established brand names with a wide regional presence. The leading players in the PDC drill bits market include Schlumberger (US), BHGE (US), Halliburton (US), NOV (US), and Varel (US). The North American region is projected to account for the largest market share during the forecast period because of a higher rate of drilling activities owing to shale gas exploration & production. The North American region is estimated to be the fastest-growing market as well during the forecast period. Vast hydrocarbon resources in the US shale basins and continuous offshore drilling in the Gulf of Mexico are driving the demand for the market.

Download PDF Brochure @https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=33536072

Schlumberger, a leading player in the PDC drill bits market for the oil & gas sector, offers different oil & gas upstream services and products. SHARC High-Abrasion-Resistance PDC Bit, Spear Shale-Optimized Steel-Body PDC Bit, Direct XCD Drillable Alloy Casing Bit, Quad-D Dual-Diameter Bits, Lyng PDC, Viking Drill Bits, and Staged Hole Opener (SHO) are some of the different kinds of PDC drill bits offered by Schlumberger.

Baker Hughes, a GE company (BHGE), is a renowned organization that provides reliable oil & gas services and products to increase the efficiency of oil production on rigs. Recently, Baker Hughes merged with GE’s oil & gas business to form the second-biggest oil field services group in the world. Baker Hughes has a strong product portfolio and has developed 11 types of PDC drill bits for different drilling applications

Target Audience:

The report’s target audience includes:

- PDC drill bits manufacturers and suppliers

- PDC drill bits operators

- Oil & gas drilling operators

- PDC drill bits research institutes

- Government and research organizations

- Institutional researchers and professors

- National and local government organizations

- Research organizations and consulting companies

- Technology providers

Speak to Analyst @https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=33536072

By type, the matrix body segment is estimated to grow at the highest CAGR during the forecast period. The global demand for matrix body PDC drill bits is driven by the need for an advanced technology with a higher ROP and less downtime in hard and medium-hard formation wells. It has the maximum demand in the North American region, followed by Asia Pacific.

The demand for 15–24 mm PDC drill bits is expected to increase swiftly in the next 5 years. This growth can be attributed to the high demand for drilling medium-hard formations in many regions. The 16 mm cutter size is the most commonly used cutter for different drilling applications, resulting in increasing the demand for the 15–24 mm segment.

By number of blades, the 6–10 segment is set to grow in the next 5 years. Research has proved that 6 is the optimum number of blades for drilling activities. Hence, the 6–10 number of blades segment has the largest and fastest-growing market for PDC drill bits.

Ask for sample pages of the report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=33536072

Recently after the oil & gas financial crisis, a majority of the companies started drilling again. The US and China have also extensively started their exploration & production of shale gas. The Middle East and Russia have planned for heavy investments in the upstream sector for another 5 years. These factors will drive the market of PDC drill bits.