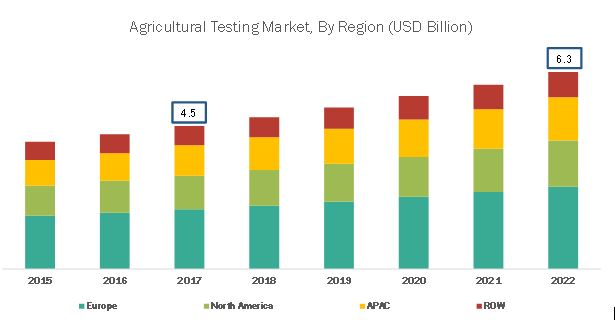

The agricultural testing market, is estimated to be valued at USD 4.56 billion in 2017, and is projected to reach USD 6.29 billion by 2022, at a CAGR of 6.64%. The market is driven by stringent safety and quality regulations for agricultural commodities, and rapid industrialization leading to the disposal of untreated industrial waste into the environment.

Driver: Stringent safety and quality regulations for agricultural commodities

Growing complexities in the supply chain, lack of adoption of good agricultural practices (GAP), and absence of proper hygiene & sanitation practices have resulted in increasing instances of contamination of food, feed, and agricultural products at the beginning of the supply chain, which are responsible for large-scale outbreaks of illnesses and poisoning in both humans and livestock. This has caused severe concerns among farmers, livestock producers, end consumers, regulatory authorities, and other industry stakeholders.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=203945812

Furthermore, in countries such as the US, Canada, Australia, and countries in the European Union, various mechanisms have been formed, and there is a strong emphasis in the framework regarding monitoring policies and their strict enforcement to attain higher transparency in the supply chain and ensure traceability. Such moves have ensured that contaminated food, feed, and agricultural products face border rejections and are quarantined. Moreover, violators are penalized with heavy fines and have their licenses revoked. Therefore, in order to comply with the safety and quality parameters set by various regulatory authorities, agricultural testing is increasingly being adopted as an essential pre-emptive measure.

Restrain: Testing of seeds, soil, water, and compost amongst other samples require proper enforcement measures, coordination between market stakeholders, and supporting infrastructure. However, many developing economies are lacking in these aspects, which act as a restraint for the growth of the agricultural testing industry.

Opportunity: The agricultural commodities market in developing countries is highly fragmented and is dominated by small farmers and growers who may not have necessarily adopted good agricultural practices, leading to a greater risk of contamination.

Spectrometry & chromatographic technologies contributed to the fastest growing rapid technology market in agriculture testing

The agricultural testing services market, by technology, has been segmented into conventional and rapid. The rapid technology segment is estimated to dominate the market in 2017, and is projected to grow at a higher CAGR by 2022. This can be attributed to low turnaround time, higher accuracy, sensitivity, and ability to test a wide range of bacteria in comparison to conventional technological methods.

The safety testing is projected to be the fastest growing market in application segment

The agricultural testing market, by application, has been segmented into safety testing and quality assurance. The global market, by application, was dominated by the quality assurance segment in 2016. The dominance of quality assurance in agricultural testing is attributable to the fact that it aids in proactively resolving major problems related to soil fertility, available water quality for irrigational facilities, and identifying required nutrients essential for a more robust growth and development of crops and other agricultural produce. The market for safety testing is projected to be the fastest-growing during the forecast period. Safety testing of agricultural samples is conducted to test samples for targets such as toxins, pathogens, heavy metals, pesticides, GMOs, and other organic contaminants. A growing importance given to safety laws for agricultural produce and food commodities is expected to boost the market for this segment during the forecast period.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=203945812

Key players in the agricultural testing market include SGS (Switzerland), Intertek (UK), Eurofins (Luxembourg), Bureau Veritas (France), ALS Limited (Australia), and TÜV NORD GROUP (Germany). Furthermore, Mérieux (US), AsureQuality (New Zealand), RJ Hill Laboratories (New Zealand), SCS Global (US), Agrifood Technology (Australia), and Apal Agricultural Laboratory (Australia) are the other players that hold a significant share in the agricultural testing market.

Critical questions the report answers:

- Where will all these developments take the industry in the long term?

- What are the upcoming trends for the Agricultural testing market?

- Which segment provides the most opportunity for growth?

- Who are the leading vendors operating in this market?

- What are the opportunities for new market entrants?