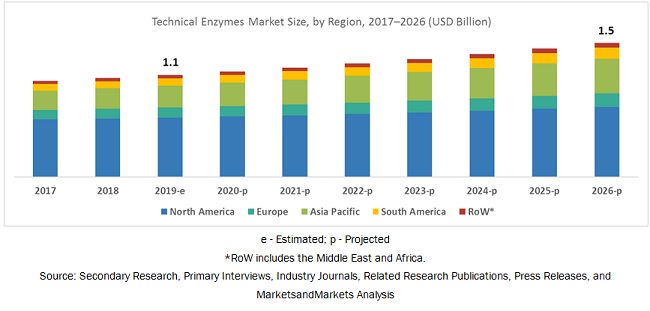

The report “Technical Enzymes Market by Type (Amylases, Cellulases, Proteases, and Lipases), Industry (Biofuel, Starch, Textiles & Leather, and Paper & Pulp), Source (Microorganism, Plant, and Animal), Form (Liquid and Dry), and Region – Global Forecast to 2026″, is projected to grow from USD 1.1 billion in 2019 to USD 1.5 billion by 2026, recording a compound annual growth rate (CAGR) of 4.0% during the forecast period. The major factors driving the growth of the technical enzymes market include an increase in demand for biofuel in developing countries and advancements in R&D activities for technical enzymes.

The biofuel industry is estimated to account for the largest share in 2019 in the technical enzymes market.

The biofuel industry is estimated to dominate the technical enzymes market, on the basis of industry, in terms of value, in 2019. Consumer inclination toward an alternative to gasoline for the reduction in harmful auto & industrial emissions has augmented the usage of biofuels in many developed countries. Enzymes have been used for the conversion of biomass into biofuels, as they overcome many drawbacks associated with the use of traditional chemicals as catalysts for biofuel generation. Enzymes are safer substitutes for MTBE (methyl tert-butyl ether), as MTBE is a blending component to oxygenate gasoline and is hazardous to human health.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=72989187

The starch industry is projected to account for the second-largest share during the forecast period.

The usage of enzymes in starch processing helps them to specifically react with carbohydrate components present in starch to retain moisture more efficiently and increase shelf life. Furthermore, enzymes are able to quickly reduce the viscosity of starch slurries to facilitate further handling and processing. They also play a role in halving the amount of pH chemicals (acidifiers) that are usually used in starch processing, as they help mitigate the pH; this helps in breaking down the large starch molecules into smaller molecules needed for liquefaction of starch.

The Asia Pacific region is projected to be the fastest-growing market for technical enzymes during the forecast period.

The Asia Pacific region projected to grow at the highest CAGR between 2019 and 2026. The increasing demand for technical enzymes in starch and textile & leather industries is projected to create lucrative growth opportunities for manufacturers in the market in the Asia Pacific region. This dominance is majorly due to the change in technological innovations in machinery, synthetic fibers, logistics, and globalization of business. Furthermore, the shift of industrial operations such as textile & leather production from developed nations in North America and Western Europe into the Asia Pacific region over the past decade has boosted the market for technical enzymes.

Request for Customization: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=72989187

Key vendors in the global technical enzymes market include BASF (Germany), DuPont (US), Associated British Foods (UK), Novozymes (Denmark), DSM (Netherlands), Dyadic International (US), Advanced Enzymes Technologies (India), Maps Enzymes (India), Epygen Labs (India), Megazyme (Ireland), Aumgene Biosciences (India), Enzymatic Deinking Technologies (US), Tex Biosciences (India), Denykem (UK), MetGen (Finland), and Creative Enzymes (US). These players have broad industry coverage and high operational and financial strength.

Key questions addressed by the report:

- Who are the major market players in the technical enzymes market?

- What are the regional growth trends and the largest revenue-generating regions for the technical enzymes market?

- What are the key regions and industries that are projected to witness significant growth in the technical enzymes market?

- What are the major industries of technical enzymes that are projected to account for a major revenue share during the forecast period?

- In which major forms are technical enzymes majorly used, and which form is projected to dominate during the forecast period?

- What are the major sources of technical enzymes that are projected to account for a major revenue share during the forecast period?