The report “Rapid Test Market (Services) by Technology (PCR, Immunoassay, HPLC, GC-MS, LC-MS/MS), Contaminant (Pathogens, Meat speciation, GMO, Allergens, Pesticides, Mycotoxin, Heavy Metals), Food Tested (Processed, Crops), and Region – Global Forecast to 2022″, The rapid test market, in terms of value, was valued at USD 10.14 Billion in 2016. It is projected to reach USD 15.71 Billion by 2022, at a CAGR of 7.7% from 2017. The market is driven by factors such as an increase in the requirement for a rapid test results to enhance productivity, increase in product recalls due to stringent regulations, growing incidences of foodborne illness, and globalization of food trade. Growing consumer awareness for food safety and increasing involvement of government & non-government bodies to deliver safe food products to consumers provides new growth opportunities for market players.

The objectives of the study are:

- To define, segment, and forecast the size of the rapid test market with respect to contaminant, technology, food tested, and region

- To analyze the market structure by identifying various subsegments of the rapid test market

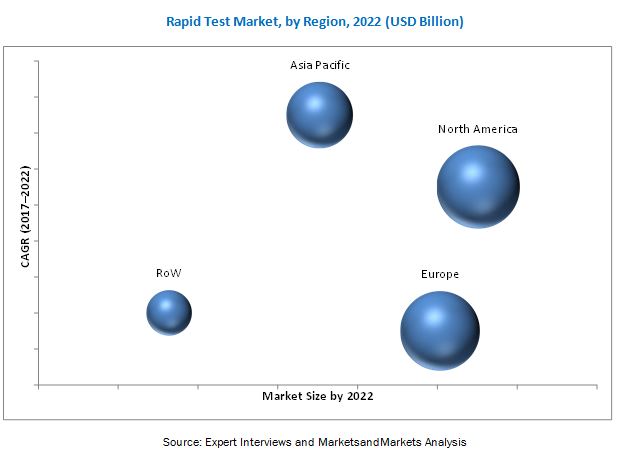

- To forecast the size of the market and its various submarkets with respect to four main regions, namely, North America, Asia Pacific, Europe, and the Rest of the World (RoW)

- To provide detailed information about crucial factors that are influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their market share and core competencies

- To analyze competitive developments such as expansions & investments, acquisitions, new product/service & technology launches, agreements, collaborations, and partnerships in the rapid test market

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=161522931

PCR-based segment projected to grow at the highest CAGR, by technology, from 2017 to 2022

PCR is the dominant rapid test technology applied in food testing; the market for the same is projected to grow at a significant rate in the next five years. The market for PCR-based technology in rapid test is growing due to the automated, faster, and accurate results with low level of detection.

Meat & seafood products segment projected to grow at the highest CAGR, by food tested, from 2017 to 2022

Meat & seafood products are tested by means of rapid test technologies for various contaminants. Meat speciation testing, in its different forms, is a routine practice conducted to safeguard consumer interest and health, especially against malpractices such as adulterations. This segment is expected to grow at a high rate primarily due to increasing stringency of regulations for meat products along with increasing cases of contaminated meat.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=161522931

Significant growth for rapid test is observed in the Asia-Pacific region

The requirement for rapid test has grown in the region in recent years, owing to an increase in consumer awareness in the Asia-Pacific region regarding the safety of food products. The growth in this market is fueled by the economic development in countries such as China and India. Food safety procedure compliance in Europe (a major importer) is severe, and in order to hold the food trade, Chinese food producers have to comply with the food standards and regulations. China is a potential market for rapid test due to various factors such as unhygienic food practices, human negligence, regulatory violations, and fraudulent practices growing incidences of foodborne illness due to contaminated food.

This report includes a study of marketing and development strategies, along with the product portfolios of leading companies. More than 240 developments were tracked for the 25 companies in the market. It includes the profiles of leading companies such as SGS (Switzerland), Bureau Veritas (France), Intertek (UK), Eurofins (Luxembourg), and TUV SUD (Germany).