The report “Animal Disinfectants Market by Type (Iodine, Lactic Acid, Hydrogen peroxide, Phenolic Acid), Application (Dairy Cleaning, Swine, Poultry, Equine, Dairy and Ruminants, Aquaculture), Form (Liquid, Dry), and Region – Global Forecast to 2025″, The animal disinfectants market is projected to reach USD 4.4 billion by 2025 and was estimated at USD 2.9 billion in 2019, recording a CAGR of 6.9% from 2019. The major factors driving the animal disinfectants market include the increasing incidences of diseases in livestock. In addition, increasing introduction of regulations pertaining to animal hygiene across the globe reflects positively on the market growth.

Download PDF Brochure:

https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=38718363

By form, the liquid segment is projected to hold the largest market share during the forecast period.

The liquid segment is projected to dominate the market as the liquid disinfectants are highly effective against different types of virulent compounds. Additionally, liquid disinfectants include a wide range of applications including footbaths, foot dips, foam-based sprays, aerial disinfection, and water-system disinfection procedures.

The dairy cleaning segment in the animal disinfectants market is projected to be the fastest-growing segment during the forecast period.

The dairy cleaning segment is projected to be the fastest-growing segment in the animal disinfectants market during the forecast period. This is attributed to dairy cleaning, which involves the removal of equipment and bedding before cleaning. The nature of the surfaces also influences the disinfection process. For instance, rough and porous surfaces are difficult to disinfect, in comparison to smooth surfaces. Both, the milking parlors and milking machines also need to be cleaned on a daily basis, due to which the segment is projected to account for the largest share in this market.

Request for Customization:

https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=38718363

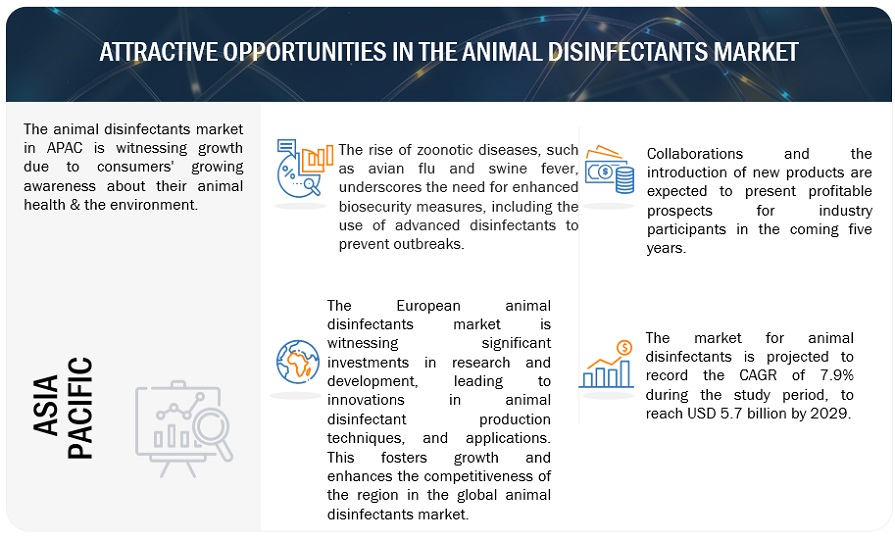

Europe is projected to account for the largest share in the animal disinfectants market during the forecast period.

The European market accounted for the largest share in 2019; this market is majorly driven by France, which is a major market for animal disinfectants. France is among the leading producers of livestock in the European Union. According to the French Ministry of Agriculture, pasture lands account for 25% of the country’s land use and comprise 198,000 cattle farms and 250,000 livestock farms. France is a leading poultry and cattle producer in the EU and is the third-largest producer of swine and sheep in the region. These animals are distributed all over the country based on their conducive links to the diversity of French geographical, soil, and climate contexts, which differ between different parts of the country, making it one of the largest users of animal disinfectants.

Major vendors in the global animal disinfectants market are Neogen Corporation (US), GEA Group (Germany), Zoetis Inc. (US), Lanxees AG (Germany), Kersia Group (France), Virox Animal Health (US), CID Lines (Belgium), Theseo Group (France), Evans Vanodine (UK), Krka (Slovenia), Diversey Inc. (US), Evonik Industries (Germany), Fink-Tec GmbH (Germany), Laboratoire M2 (Canada), and DeLaval Inc. (Sweden).

Recent Developments:

- In May 2019, Lanxees gained approval for its products, VIRKON S and VIRKON LSP, from the Centre for Animal Health Research (CISA) in Madrid, Spain, by the EN 14675 test method, which was modified to enable testing against the ASF virus.

- Diversey achieved full BPR (Biocidal Product Regulation) approval for its Deosan line of iodine disinfectants across all the European Union members.

- Neogen’s Viroxide Super disinfectant gained DEFRA approval for Diseases of Poultry (DoP) orders; the classification under the UK’s general orders policy also meets with the requirements for the British Lion Quality mark for egg production and assured chicken production scheme for broiler flocks.

- In February 2019, the Kersia group launched a new chlorine-free wash system, which is designed to deliver optimum efficiency without the need for a chemical formulation.