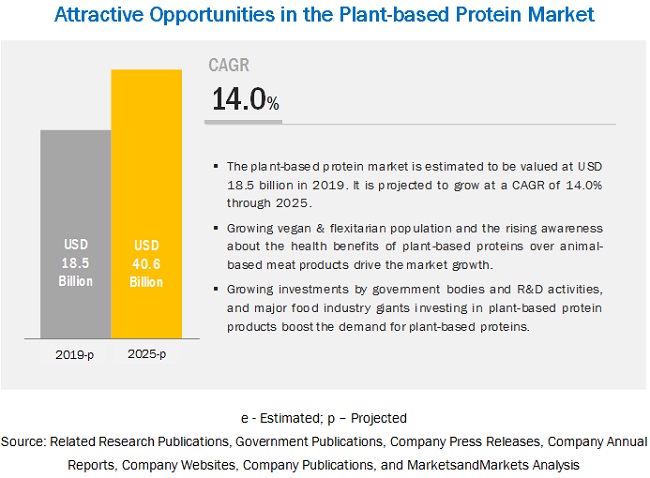

The plant-based protein market is estimated at USD 18.5billion in 2019 and is projected to reach USD 40.6billion by 2025, at a CAGR of 14.0% during the forecast period. Consumers are focused toward a better understanding of the provenance of their food and avoid products deemed unnatural or unhealthy. These “clean” eating trends, driven primarily by millennials, favor foods that are healthy, ethically and naturally sourced, and less processed. Increased plant-based protein product consumption is a direct consequence of this shift.

By source, the pea segment is projected to be the fastest-growing segment within the global plant-based protein industry during the forecast period. The pea segment is driven by the rising demand for plant-based meat and healthy food products. A significant increase in the usage of pea as a key ingredient is being noticed in the plant-based meat industry. It is gradually becoming the primary choice for plant-based meat consumers due to its high nutritional profile and rich protein content. Leading players in the global plant-based meat industry are now shifting their interest toward pea and have also started developing pea-based meat products such as patties, sausages, and slides, which are high in protein content.

Based on type, isolates accounted for the highest demand in 2018, followed by concentrates and protein flour. Protein isolates contain a larger amount of protein along with higher digestibility. Isolates are demanded widely in protein and nutrition-oriented applications such as sports nutrition, protein beverages, and nutrition supplements. In recent years, they have been required more from athletes, bodybuilders, vegetarians, and have gained wide application in various beverages and dairy products, due to their different functional properties. Market players such as ADM (US), DuPont Danisco (US), Ingredion Inc. (US), BurconNutraScience Corp. (Canada), Axiom Foods (US), and The Scoular Company (US) offer protein isolates for various food applications such as protein bars, meat alternatives, protein beverages, dairy alternatives, nutrition bars, and bakery products.

Request for Sample Report Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=14715651

On the basis of application, the demand for protein beverages was the highest in 2019; as a result, the protein beverages segment is estimated to account for the largest market share, followed by dairy alternatives, meat alternatives, protein bars, nutrition supplements, processed meat, poultry, and seafood, bakery products, sports nutrition, and convenience food. The perception of consumers about beverage products has changed as beverages are no longer just thirst-quenching drinks. Considering these requirements, beverage manufacturers across the world are actively developing and introducing plant-based beverage products. Moreover, in response to this trend, leading plant protein producers are introducing new and high-protein sources in the global market. For instance, DuPont Nutrition & Health expanded its plant-based protein product range with a new pea protein for beverages called TRUPRO 2000 Pea Protein in 2018.

North Americais the fastest-growing market for plant-based protein; it is projected to record the highest CAGR during the forecast period. The presence of leading plant-based protein companies in this region, along with the availability of a variety of plant-based protein products that are manufactured using different sources such as soy, wheat, pea, canola, and rice, is a key factor driving the North American plant-based protein market. Consumers in the region are incorporating plant-based protein products in their daily routine diets, owing to the health concerns related to the consumption of animal protein products.

Plant-based protein manufacturers are focusing on product launches to expand their consumer base in the market. Leading players operating in the plant-based protein market include Cargill Inc. (US), ADM (US), DuPont Danisco (US), Glanbia (Ireland), Kerry Group (Ireland), Tate & Lyle (UK), Ingredion Inc. (US), BurconNutraScience Corporation (Canada), Royal DSM N.V. (Netherlands), Sotexpro S.A (France), Axiom Foods (US), and The Scoular Company (US).