The direct-fed microbials market is projected to grow at a CAGR of 6.96% to reach USD 1,399.6 Million by 2022. The market is driven by factors such as increase in awareness about feed quality and safety, rising demand for manufactured animal feed, growth in demand for animal protein, changes in farming practices and technology, and replacing antibiotic growth promoters (AGPs) with direct-fed microbials. The continuous rise in the population has also resulted in an increase in the demand for food and the necessity for direct-fed microbials, to increase meat and milk production in a sustainable manner.

The consumption of direct-fed microbials is increasing significantly with various government regulations being adopted to improve animal health. The ban on the use of antibiotics as growth promoters in the European Union has created massive demand for direct-fed microbials. On the basis of type, the lactic acid bacteria segment is expected to be the fastest-growing, as these direct-fed microbials are highly effective.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=91112718

On the basis of livestock type, the direct-fed microbials (DFM) market has been segmented into swine, poultry, ruminants, aquatic animals, and others, which include equine and pets. The poultry segment is projected to be the fastest-growing, because direct-fed microbials provide poultry birds with protein and this increases their growth rate. With the high demand for poultry meat across the world due to their high nutrient value, the demand for direct-fed microbials is also expected to increase.

Direct-fed microbials are available in dry and liquid forms. The dry form has a longer shelf life compared to the liquid form, which varies according to the type of direct-fed microbials used in animal feed. Dry microbials have more advantages and are used in various animal feed additive products. Liquid microbials are preferred by farmers as they are easily mixable and do not affect the texture of the feed.

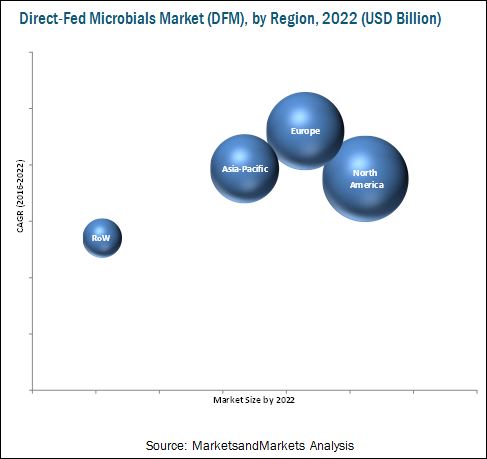

In 2015, North America accounted for the largest share in the direct-fed microbials (DFM) market, followed by Europe, and the Asian-Pacific region. France and Germany constituted the largest country-level markets in the European region in 2015. Increase in awareness about the benefits of direct-fed microbials, among livestock producers and a rise in population is leading to the growth of the market in this region. The direct-fed microbials market in the Asia-Pacific region is projected to grow with investments from several multinational manufacturers. The market is also projected to grow due to the increase in advanced agricultural technologies and export of key products in animal feed. Extensive R&D initiatives are also being undertaken to explore new varieties of direct-fed microbials to be used in animal feed.

Speak to Analyst: https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=91112718

Stringent international quality standards and government regulations for direct-fed microbial products act as a restraint for the market. The key players identified in this market include Archer Daniels Midland Company (U.S.), E. I. du Pont de Nemours and Company (U.S.), Koninklijke DSM N. V. (Netherlands), Novozymes (Denmark), Chr. Hansen A/S (Denmark), Kemin Industries (U.S.), BIOMIN Holding GmbH (Austria), Lallemand Inc. (Canada), Novus International, Inc. (U.S.), and Bio-vet (U.S.) also attained strong position in the global direct-fed microbials (DFM) market.

Most key participants have been exploring new markets through new product launches, expansions, and investments across the globe. Since 2011, the direct-fed microbials (DFM) market has witnessed an increase in demand, especially in countries such as the U.S., Germany, France, Brazil, India, and China.

Target Audience:

- Direct-fed microbial manufacturers

- Feed manufacturers

- Animal pharmaceutical companies

- Direct-fed microbial raw material suppliers

- Direct-fed microbial product exporters & importers

- Educational institutions

- Regulatory authorities

- Consulting firms