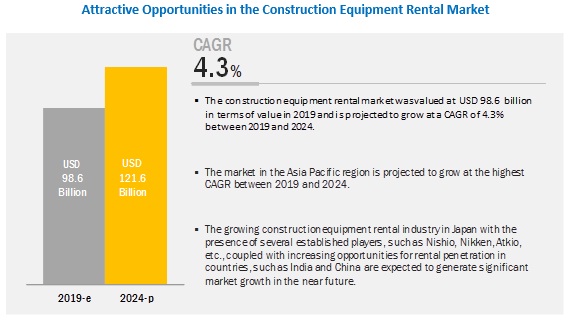

The construction equipment rental market is projected to grow from USD 98.6 billion in 2019 to reach USD 121.6 billion by 2024, at a CAGR of 4.3% from 2019 to 2024. The major drivers for the market include the increasing demand for rental equipment due to various benefits, shift in trend towards rental, increasing infrastructure activities in emerging nations, and cost-benefits associated with the use of construction equipment on a rental basis rather than purchasing it.

Download PDF brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=225391699

North America projected to be the largest construction equipment rental market during the forecast period

North America accounted for the largest share of the market in 2018, and is expected to continue in the trend during the forecast period due to the recent boom in non-residential construction in the region, coupled with supporting investments from domestic and foreign investors and favorable policies. The growth and financial health of North American construction equipment rental market is driven by factors, such as non-residential construction activity, capital investments in the industrial sector, repair, maintenance, and overhaul services, government spending and demand for construction equipment rental for remediation and rebuilding efforts. The market in the Asia Pacific is projected to grow at the highest CAGR during the forecast period. This growth is attributed to the increasing building & construction activities, especially in China, Japan, and India, coupled with increasing investments from domestic & foreign investors in public & private sectors.

Recent Developments

- In August 2019, Ahern Rentals started its operational facility in Argentina. Located in Buenos Aires, Ahern Argentina is the eighth Ahern International business to open, joining Ahern Australia, Ahern Canada, Ahern Chile, Ahern Deutschland, Ahern Ibérica, Ahern Ireland, and Ahern Japan, and is the second Ahern International entity in Latin America. Focused on supporting the Argentinian market, the company specializes in sales, service, and spare parts for Xtreme Manufacturing telehandlers, Snorkel aerial work platforms, and Ruthmann Bluelift tracked spider lifts.

- Equipment rental company, Boels Rentals is adding the Barreto 30SGB stump grinder to its rental product range, based on positive feedback relating to Vanguard’s V-Twin engine. Boels Rentals will introduce the new stump grinder units which feature the Vanguard V-Twin engine across its European network as part of its strategic collaboration with engine manufacturers, Briggs and Stratton.

Key Market Players

Companies such as United Rentals Inc. (US) (Belgium), United Rentals Inc. (US), Ashtead Group Plc (UK), Loxam (Paris), Herc Holdings Inc. (US), Aktio Corporation (Japan), Nishio Rent All Co. Ltd. (Japan), Kanamoto Co. Ltd. (Japan), Nishio Rent All Co. Ltd (Japan), Nikken Corporation (Japan), and Ahern Rentals (US), among others, are the major players in the construction equipment rental market. These players focus on strategies, such as contracts, product launches, acquisitions, partnerships, expansions, joint ventures, and investments that have helped them to expand their businesses in untapped and potential markets.

The diversified product portfolios and multiple uses are factors responsible for strengthening the positions of these companies in the construction equipment rental market. They have adopted various organic and inorganic growth strategies, such as new product launches, acquisitions, and contracts, to enhance their current positions in the construction equipment rental market.