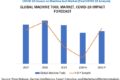

Post COVID-19, the “COVID-19 Impact on Global Machine Tool Market by Machine Type (Cutting and Forming), Automation Type (CNC and Conventional), Industry (Automotive, Sheet Metal, Capital Goods and Energy), Sales Channel (Direct Sales, Events & Exhibitions and Dealer & Distributor) and Region – Global Forecast to 2021″ size is projected to reach USD 68.9 billion by 2021 from an estimated USD 65.6 billion in 2020, at a CAGR of 5.0%. The projections were based on the ongoing automotive industry production drop, which is the biggest consumer of machine tools and, additionally, the supply chain disruptions caused by the COVID-19 pandemic in the manufacturing industry. Economies rely on machinery for production, and machine tools form the crux of it. Companies are expected to recover from the recession slowly by taking preventive measures to meet production needs. Chinese firms have also become creative and resourceful to recruit the workforce. Some firms negotiated with local governments for permission to send in charted buses and even airplanes to bring back the workforce from remote regions. Others have started to adopt automation to make up for labor shortages. Some are also applying technologies to do crash training for newly recruited manual labor workforce. In some firms, salaried workers are temporarily taking on the work of hourly labor workforce in certain critical production areas

“Asia Pacific is expected to recover at a faster growth than compared with other regions post COVID crisis during the forecast period.”

Even with COVID-19 originating from China, the country has been successfully implementing strategies to control the spread, where it has been successful when compared to Europe and North America. Recently, China has slowly started its production activities with the minimum workforce. With Asia being the largest automotive producer, the machine tool market is expected to rebound faster with investments in new technologies like Chipmaking equipment, which is expected to propel growth. The field likely will see an increase in demand amid advancement in technologies for 5G communication and artificial intelligence.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=151804864

“Supply chain disruptions during the COVID-19 have made machine tool manufacturers, and other end-use industries realize the over-reliance on China could be destructive.”

Problems in the supply of materials have affected machine tool manufacturers due to supply shortages from China, has most of the materials were imported from China and due to the lockdown or limited production, other countries were looked upon for the supply of material. Due to the demand, large suppliers of components that dominate the machine tool market prioritized big companies to SMEs at the time of recovery. Also, the recent disruptions in the supply chain have revealed that machine tool manufacturers over-rely on suppliers of key components and their weak negotiation power vis-à-vis suppliers of CNC, electronic components, casting, high precision components, and others.

“Manufacturing industries are strategically re-tooling their production systems to make totally different products within machine tool market.”

Some OEMs have strategically planned to re-tool their production systems to make totally different products. For example, when the automotive industry was down by more than 90% in China in February, automobile manufacturer like Shanghai-GM-Wuling (SGMW) quickly retooled its production system to produce medical face masks, which positively contributed to mitigating the COVID-19 spread and at the same time generated rewarding revenues and positive reputation for the company.

Key Market Players:

Some of the major players in the machine tool market are Doosan (South Korea), Amada (Japan), Makino (Japan), JTEKT (Japan), GF Machining Solutions (Switzerland), DMG Mori (Japan), Komatsu (Japan), OKUMA (Japan), Hyundai WIA (South Korea), Schuler (Germany), and Chiron Group (Germany), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst