Feed packaging market is projected to grow from USD 13.8 billion in 2018 to USD 17.8 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 5.2% during the forecast period. The study involved four major activities in estimating the current market size for the market. Exhaustive secondary research was done to collect information on the market as well as the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Report Objectives:

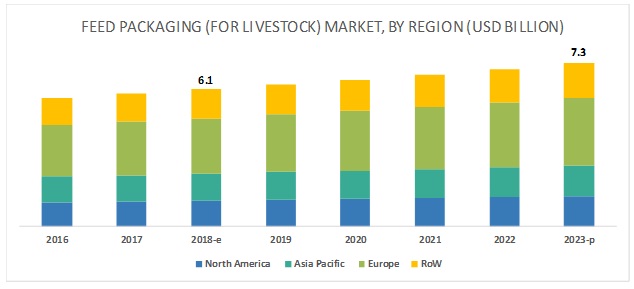

- Determining and projecting the size of the feed packaging market with respect to livestock, pet, type, material, feed type, and regional markets, over a five-year period ranging from 2018 to 2023

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro-markets with respect to individual growth trends, future prospects, and their contribution to the total market

- Identifying and profiling key market players in the livestock feed and pet food packaging markets

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=187589113

By livestock type, the poultry segment is projected to be the largest contributor to the feed packaging market (for livestock) during the forecast period.

The estimated largest market share of poultry feed is attributed to the large-scale production of poultry feed. The large-scale production of poultry feed is a result of its large-scale consumption, as, unlike beef and pork, it is devoid of religious concerns. Thus, the production of poultry for meat is projected to dominate and account for more than half the growth of all the additional meat produced by 2025. Such rapid growth in poultry meat production is expected to further fuel the demand for superior-quality feed and feed additives, thereby propelling the market for livestock feed packaging.

The dry feed type segment is projected to account for a larger market share during the forecast period.

Feed packaging (for livestock) is widely used for dry feed type. Dry feed is available in the form of pellets, powder, crumbles, cubes, and cakes. It is a largely produced and consumed, globally. Most feed manufacturers in the market offer their products in the dry form due to its ease of usage, storage, and transportation. Moreover, dry feed is widely used in animal diets, as it is affordable in comparison with wet feed. Due to these factors, the segment is estimated to acquire a larger market share in 2018. On the other hand, feed packaging market (for pets), by feed type, is estimated to be dominated by the dry segment, in 2018, due to factors such as economical prices and product durability of dry pet feed as compared to other pet feed type.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=187589113

North America is projected to hold the largest market share in the feed packaging (for pets) market during the forecast period.

North America is estimated to account for the largest share of the market in 2018. The region is considered the most advanced, in terms of pet adoption and packaging technology. The market for feed packaging (for pets) in this region is mainly driven by high pet ownership, premiumization, the proliferation of innovations, and the introduction of a variety of packaging types for pet food. Increasing demand for premium pet food with high nutritional value, along with pet food safety concerns among pet owners, has helped to improve the quality standards of packaging and labeling in the region, thereby propelling the market growth for pet food packaging.

Major vendors in the feed packaging market include LC Packaging (the Netherlands), El Dorado Packaging, Inc. (US), NPP Group Limited (Ireland), Plasteuropa Group (UK), NYP Corp. (US), ABC Packaging Direct (US), Shenzhen Longma Industrial Co., Limited (China), Amcor Limited (Australia), Mondi Group (Austria), ProAmpac (US), Sonoco Products Company (US), Winpak Ltd., (Canada), NNZ Group (the Netherlands), Constantia Flexible Group (Austria), and Huhtamäki Oyj (Finland).