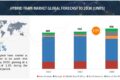

The Global Hybrid Train Market size is projected to reach 8,389 units by 2030, from an estimated 4,904 units in 2020, at a CAGR of 5.5%.

Factors such as high gasoline prices, traffic congestion, and greenhouse gas emissions have compelled railway OEMs to explore beyond the use of conventional propulsion systems in trains. In this pursuit, OEMs are working toward developing hybrid trains that use or combine alternative fuel sources, such as hydrogen fuel cells, electric batteries, CNG, LNG, and solar energy, to meet the required efficiency and emission standards.

The hybrid train market is dominated by established players such as CRRC (China), Bombardier (Canada), Alstom (France), Siemens (Germany), Wabtec Corporation (US), Hyundai Rotem (South Korea), Toshiba (Japan), and Stadler (Switzerland).

The hybrid train market has promising growth potential due to several factors, including the improving railway infrastructure, supporting legislation, increasing demand for efficient trains in freight as well as passenger segment, and rising trend of alternative fuel-powered propulsion systems. The rapidly growing sales volume of diesel-electric trains in China and India has propelled the growth of the hybrid train market in Asia Oceania.

Request FREE Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=238438631

In the hybrid train market, by propulsion type, the DSRC segment is projected to dominate the market during the forecast period. The electro-diesel segment is projected to be the largest during the forecast period. These trains are the most popular, and OEMs have been offering hybrid propulsion technologies incorporated with these diesel trains for a while now. This type of propulsion is more efficient than diesel locomotives as electro-diesel propulsion is efficient and 40% less polluting than conventional ones.

Europe presents a significant growth opportunity for hybrid trains as it is expected to be the second-largest market during the forecast period. The region’s vibrant R&D landscape and technological excellence justify the region’s dominance in the field of innovative hybrid train technologies. Additionally, the region was one of the first in the world to have commercialized hydrogen-powered passenger trains back in 2018. Many of the top train manufacturers from the region, such as Alstom, Siemens, Hitachi Rail STS, and CAF, have incorporated hybrid technology in their trains. For instance, Alstom was one of the pioneers in developing hydrogen fuel cell-powered trains and deploying it for commercial use. Countries such as the UK and Germany are planning to complete the electrification of railway lines to control or reduce emissions through diesel-operated trains, which will present a big opportunity for all hybrid train manufacturers, resulting in the growth of overall European hybrid train market.

Asia Oceania is projected to account for the largest share of the hybrid train market during the forecast period as it is home to renowned hybrid train manufacturers such as CRRC, Hyundai Rotem, and Toshiba, which offer advanced solutions in the region as well as all over the world. One of the key factors driving the market in Asia Oceania is the large sales volume of trains due to the high demand for trains in China and India. With the increased production of hybrid trains and expansion of hybrid train networks, Asia Oceania is estimated to be the largest hybrid train market and accounts for a market share of 55.6% in 2020, by volume.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=238438631

Hybrid trains offer the benefit of cost-effective and efficient transportation of passengers as well as freight. Several cities are implementing new rail infrastructure projects to reduce road congestion and provide an affordable means of transportation at an intercity as well as intracity level. Increasing urbanization and the growing demand for increased connectivity, comfort, reliability, and safety will boost the demand for hybrid trains. As of 2020, most of the hybrid train projects or operations are related to the passenger segment, as freight transportation requires powerful trains and hybrid train technologies are still in their initial stage to be able to cater to the freight transport demand. For instance, two passenger trains powered by hydrogen fuel cells have successfully been running in Germany since 2018, which makes it quite evident that hybrid trains, especially hydrogen trains, can run commercially.

Recent Developments:

- In July 2020, Hitachi Rail and Hyperdrive Innovation signed an exclusive agreement to develop battery packs to power zero-emission trains and create a battery hub in the North East of the UK.

- In July 2020, Cummins Inc. announced an agreement to form a joint venture with NPROXX, a leader in hydrogen storage and transportation, for hydrogen storage tanks. The joint venture will continue under the name NPROXX. The joint venture will provide customers with hydrogen and compressed natural gas storage products for both on-highway and rail applications..

- In March 2020, Siemens Mobility received the first order for battery-powered trains. SFBW ordered 20 Mireo Plus B trains from Siemens Mobility. The two-car electric trainsets with 120 seats can operate on rail routes with or without overhead power lines thanks to their battery hybrid drive and are scheduled to operate in Network 8 of the Ortenau regional system.

- In September 2019, Cummins Inc. (NYSE: CMI) closed on the previously announced acquisition of fuel cell and hydrogen production technologies provider, Hydrogenics Corporation.

- In June 2019, Hyundai Rotem teamed up with Hyundai Motor Company to develop hydrogen-electric trains by the end of 2020.

- In February 2019, Wabtec Corporation announced a successful merger with GE Transportation.

- In December 2018, Hitachi Rail Europe (HRE) worked with the University of Birmingham to test hydrogen trains on known rail routes.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst