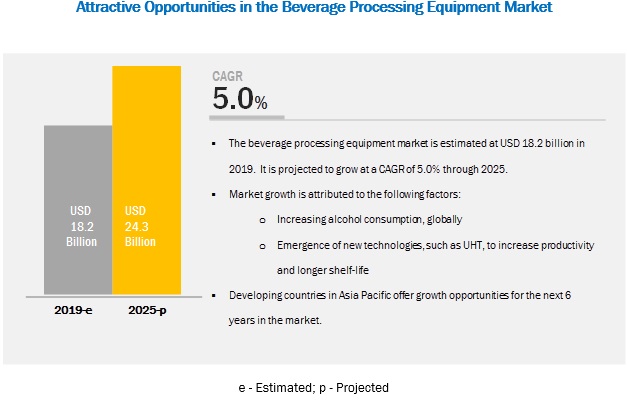

The global beverage processing equipment market is estimated to be valued at USD 18.2 billion in 2019 and is projected to reach USD 24.3 billion by 2025, recording a CAGR of 5.0% from 2019 to 2025. The global market is projected to grow in parallel to the growth of the beverage industry. The increased consumption of alcohol, rising need for pasteurized milk to combat raw milk outbreaks, continuous upgradation in the equipment and machinery are factors driving the demand for beverage processing equipment.

By type, the brewery equipment segment is projected to account for the largest share in the beverage processing equipment market. Brewery equipment is used in the production of beer, and its demand remains high as the consumption of beer in regions such as North America, Europe, and the Asia Pacific is high. In addition, rising income levels of consumers have reflected positively on the growth of the beer industry.

By beverage type, the alcoholic beverages segment holds the largest market share in the global market due to the increasing demand in emerging markets such as the Asia Pacific and South America. The market in regions such as North America and Europe has reached its maturity and are witnessing a shift in the demand for beer, from high-calorie beer to low-calorie beer.

The Asia Pacific accounts for the largest market share in the beverage processing equipment market. The market for beverage processing equipment in the Asia Pacific region is driven by the growing demand for beverages such as carbonated beverages, fruit juices, and alcoholic beverages. The Asia Pacific has a very large market for beverages; the improved standard of living of the people due to the rise in income levels is one of the major factors that is driving the beverage market in this region.

The key players are Tetra Laval (Switzerland), GEA Group (Germany), Alfa Laval (Sweden), Krones Group (Germany), Bucher Industries (Switzerland), SPX Flow (US), JBT Corporation(US), KHS GmbH (Germany), Pentair(US), and Praj Industries (India).