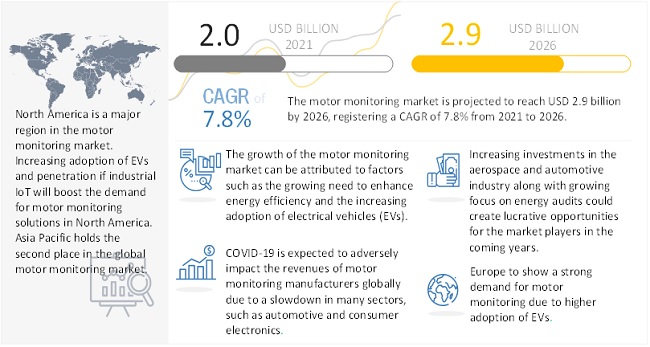

The report “Motor Monitoring Market by Offering (Hardware, Software, Services), Monitoring Process (Online, Portable), End-User Industry (Oil & Gas, Power Generation, Metals & Mining, Chemicals, Automotive), Deployment and Region – Global Forecast to 2026″, size will grow to USD 2.9 billion by 2026 from USD 2.0 billion in 2021, at a CAGR of 7.8% during the forecast period.

The growing demand for predictive maintenance and analytics is one of the driving factors for the motor monitoring market, globally. Predictive maintenance is gaining recognition as one of the more easily exploited applications of digitalization. Predictive maintenance (PdM) is a strategy for predicting when equipment will break and replacing the component before it fails. This aids in the reduction of downtime and the extension of component life. Predictive maintenance entails measuring the motors functioning parameters under full load, as well as the effective temperature and wetness conditions, while it is in use. For the maintenance of electric motors, there are 2 widely used methods of analysis, i.e., vibration analysis and infrared imaging. Vibration analysis is primarily employed in the case of rotating machinery while the technician can use infrared imaging to determine the temperature of the electric motor. Vibration analysis can detect any imbalance, misalignment, looseness, or bearing problems in the motor. Infrared imaging aids in the detection of problems such as bearing failure, airflow, insulation failure, unbalanced voltage, and shaft misalignment.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=142439618

The hardware segment is expected to dominate the motor monitoring market, by offering, during the forecast period.

The hardware segment is estimated to account for the largest market share of 69.2% of the motor monitoring market in 2021. This segment is expected to maintain its high market share during the forecast period, as various industries require sensors and other hardware components for motor monitoring. Moreover, with increasing penetration of IoT in end-user industries, various hardware components will be required to establish network connection; this will fuel the demand for hardware in the motor monitoring market.

The Oil & Gas segment is expected to be the largest motor monitoring market, by end-user industry, during the forecast period.

The Oil & Gas segment is expected to account for the largest share of the motor monitoring market during 2021-2026. This trend is expected to continue during the forecast period. The oil & gas industry is one of the biggest end users of motors and deploys many motors that are very critical for operations and face harsh environmental situations. Thus, motor monitoring plays an important role in the oil & gas sector. Apart from that, the increasing focus on safety in drilling activities will also provide more opportunities to the motor monitoring market.

North America likely to emerge as the largest motor monitoring market

In this report, the motor monitoring market has been analyzed for five regions, namely, North America, South America, Europe, Asia Pacific, and Middle East & Africa. North America is expected to dominate the global motor monitoring market between 2021–2026. North America is at the forefront in deploying asset performance management and condition monitoring solutions, which are efficient in providing early warning notification with predictive analytics and diagnosis of equipment issues days, weeks, or months before failure. In recent years, the development of various software and deployment of automation solutions in various industries have improved business operations and consequently fueled the growth of the motor monitoring market in North America.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=142439618

To enable an in-depth understanding of the competitive landscape, the report includes the profiles of some of the top players in the motor monitoring market.

Some of the key players are General Electric (US), Siemens (Germany), ABB (Switzerland), Honeywell (US), and Schneider Electric (France). The leading players are adopting various strategies to increase their share in the motor monitoring market.