New Revenue Pockets:

The global motor monitoring market is projected to reach USD 2.9 billion by 2026 from an estimated USD 2.0 billion in 2021, at a CAGR of 7.8% during the forecast period. The global motor monitoring market is driven by the adoption of industry 4.0 in the industrial sector and wireless technology and increased adoption of motor monitoring in Electric vehicles and transportation.

Key Market Players:

A few major players that have a wide regional presence dominate the well intervention market. The leading players in the well intervention market include General Electric (US), Siemens (Germany), ABB (Switzerland), Honeywell (US), and Schneider Electric (France).

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=142439618

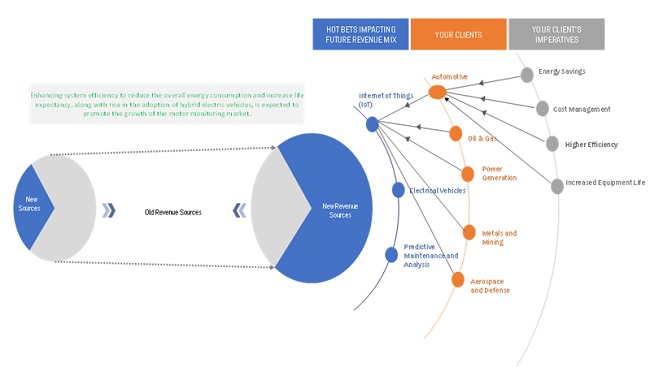

The motor monitoring market has promising growth potential due to the growing demand for energy audits and regulations and the advent of the intelligent transportation system. Predictive maintenance has become a worldwide accepted practice and is being implemented and finely tuned by nearly every industry. Locating, defining, and acting on potential problems before they become catastrophic is the main objective of a predictive maintenance program. The failing machinery is predicted by monitoring the vibration or temperature of the motor case or the bearings; it can also be detected by monitoring and analyzing the current in the motor. Routine monitoring is the most effective strategy for detecting potential problems, and it can prompt invaluable follow-up inspections. Motor monitoring methods play a significant role in reducing power consumption by measuring the quality of power as well as various parameters of power. Another vital role of motor monitoring solutions includes increasing the lifespan of the motors, thus saving money and preventing the failure of machines.

The motor monitoring market, by offering, is segmented into hardware and software. The hardware segment held the largest share of the motor monitoring market and are of different type such as Vibration sensor, Infrared sensors, Corrosion probes, Ultrasound detectors, Spectrum analyzers, and others. The vibration sensors segment led the motor monitoring hardware market in 2020, in terms of size. Vibration monitoring of motors is a key aspect of any successful predictive maintenance program. Different applications have their specific vibration levels; this makes it one of the most critical parameters to evaluate the health of motors and the entire plant.

The report segments the motor monitoring market, by deployment type, into could and on-premise. The cloud segment of the motor monitoring market is expected to grow at the fastest rate during the forecast period, as cloud-based solutions offer various advantages, such as scalability, adaptability, cost-effectiveness, and low energy consumption, due to which their adoption rate is increasing at a significant rate across organizations.

The motor monitoring market, by end user, is categorized into metals & minings, oil & gas, power generation, water & wastewater treatment, food & beverages, chemicals, automotive, aerospace & defense, and others. The oil & gas segment held the largest share of the motor monitoring market as oil & gas companies are looking for new ways to meet the rising energy needs as well as to cut down their operating costs and improve efficiency. As a motor is one of the key components of the machinery in oil & gas plants, there is a need for an exclusive monitoring solution that can be implemented. Moreover, as oil & gas companies are establishing their drilling operations in remote offshore locations, the implementation of proper monitoring solutions becomes necessary in this industry.

Ask Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=142439618

North America is expected to dominate the global motor monitoring market between 2021–2026. North America is at the forefront in deploying asset performance management and condition monitoring solutions, which are efficient in providing early warning notification with predictive analytics and diagnosis of equipment issues days, weeks, or months before failure. In recent years, the development of various software and deployment of automation solutions in various industries have improved business operations and consequently fueled the growth of the motor monitoring market in North America.