Stringent emissions regulations have shifted the global focus on electric vehicles, which has resulted in an exponential growth of these vehicles in recent years. According to International Energy Agency (IEA) publication, though car sales dropped by ~16% during the pandemic, electric vehicle sales increased by 41%. According to IEA, the number of on-road electric cars across the globe by the end of 2021 was about 16.5 million, three times the number of EVs in 2018. According to the latest Global Electric Vehicle Outlook, electric vehicle sales, including battery electric & plug-in hybrids, doubled in 2021. Regardless of semiconductor shortages, the Russia-Ukraine war increased energy prices and policy rates, leading to a recession-type situation mainly in Europe and North America; overall EV sales had grown significantly in 2022.

Further, electric buses and trucks have also shown good demand in recent years. The electric bus sale crossed the 90,000 units mark in 2018, which according to MarketsandMarkets analysis, is estimated to reach ~110,000 units in 2022. The sale of electric buses is expected to cross ~790,000 units by 2030. Similarly, electric truck sales touched a mark of 2,000 units in 2018, which is expected to reach ~13,000 units in 2022 and then cross the 100,000 units mark by 2030.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=249749128

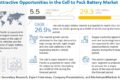

European countries have also witnessed a lower CAGR than expected growth, especially in the second quarter of 2022. The EV sales kept rising strongly in 2022, with 25.5 million units sold in the first three quarters of 2022. In China, electric car sales nearly tripled in 2021 to 3.3 million, accounting for about half of the global total. Alternatively, demand for electric trucks is mainly concentrated in the Chinese market due to strong government support. However, other countries have also announced to development and support of heavy trucks; presently, more than 170 new electric truck models were available outside the Chinese market in 2021, according to IEA. Supply chain stakeholders are investing in new innovations and technologies that comply with the ever-changing regulatory landscape to find more affordable and sustainable options. Below is the graph showing electric vehicle sales across the globe.

Figure 1 electric vehicle sales, by region, 2018-2021 (‘000 Units)

1.2 Growth of electric vehicles and infrastructure

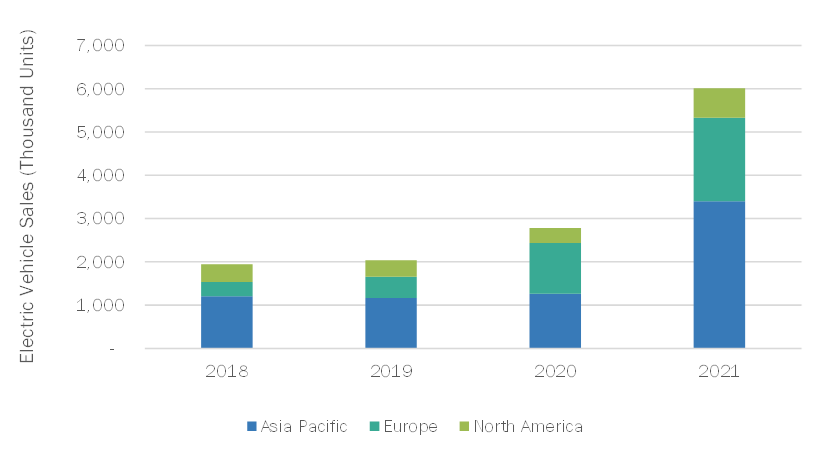

The net zero emissions target says – to keep global warming to not more than 1.5°C – as called for in the Paris Agreement – emissions need to be reduced by 45% by 2030 and reach net zero by 2050. The transport sector contributes to ~16% of global emissions, and an increase in production & sales of EVs would help countries achieve Net Zero Emissions by 2050. To achieve this, EV sales should be 60% of the total car sales by 2030, which means the EV sales share should increase by ~6% per year.

Further, significant investments by automakers are expected to cater to the rising demand for EVs and play a significant role in encouraging EV adoption. Tesla, Volkswagen, Ford, Nissan, BMW, and General Motors have significant R&D budgets for developing EVs. For instance, in October 2021, GM announced plans to invest USD 35 billion to develop and achieve more than one million EV sales and other technology by 2025. The company plans to go all-electric by 2035. As of November 2021, six major automotive OEMs – General Motors, Ford, Volvo, Jaguar Land Rover, and Mercedes-Benz signed a pledge at the 2021 United Nations Climate Change Conference (COP26) to phase out the internal combustion engine and only produce zero-emission vehicles by 2040.

Apart from government initiatives and incentives, the EV battery ecosystem is witnessing several innovations and improvements in charging infrastructure globally. According to IEA, 1.8 million public charging stations were available globally in 2021. Nearly 5 lakh chargers will be installed in 2021, more than the total number of public chargers available in 2017. The development rate of charging stations in China is faster than in other countries, with more than 1,050 thousand public chargers available in the country, including slow and fast chargers. Europe is another front-runner in developing many charging stations within the region. In October 2022, Germany planned to invest USD 6.17 million in the next three years to reach 1 million public charging stations by 2030. As per The European Association for Electromobility (AVERE), France will be needed to have at least 330,000 – 480,000 public charging points available by 2030 for light vehicles. According to the European Automobile Manufacturers’ Association (ACEA), in 2021, 25.4% of total charging points in the European Union were located in the Netherlands. Several government initiatives to increase the number of publicly accessible charging stations, including fast chargers, will compel automotive OEMs to develop and manufacture more electric vehicles and encourage consumers to buy them.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=249749128

FIGURE 1 ELECTRIFICATION TARGETS BY COUNTRIES

1.3 ROLE OF CELL TO PACK BATTERIES IN THE EV ECOSYSTEM

With the launch of top-line electric vehicles across passenger and commercial vehicle segments in the global market, the need and advent of improved EV batteries have become a key focus among electric vehicle OEMs and battery suppliers. The demand for highly efficient, fast charging, longer life cycle, and low-cost maintenance batteries has created an opportunity for EV manufacturers.

Major EV battery manufacturers like CATL, LG Energy Solution, BYD Company Ltd, and Sunwoda Electronic Co., Ltd. are investing in developing new battery technologies. The recent innovation of cell-to-pack (CTP) technology, which eliminates the need for modules to house cells in the battery pack, is gaining traction as it reduces the pack’s dead weight and improves the battery’s energy density. Cell-to-pack battery packs also offer advantages like weight reduction, cost reduction, higher energy density, fast charging solution, improved battery thermal management system, and less manufacturing complexity. The Cell to pack battery packs can lead to a 20-30% increase in volume utilization of battery packs and achieve a 10-15% cost reduction with 50% production efficiency.

Battery Electric Vehicles (BEV) are the primary choice of the electric vehicle variant for the installation of cell-to-pack batteries. Pure electric vehicles are installed with larger batteries with limited drive range. With technological advancements and reduced raw material costs, the demand for lightweight, cost-efficient, and high-energy density batteries in BEVs has created an opportunity for the cell to pack batteries.

These companies are early birds in developing the cell to pack battery packs. In June 2022, CATL unveiled its Qilin Battery, the third-generation CTP (cell-to-pack) technology. It delivers a range of 1,000 km and has an energy density of up to 255 Wh/kg. The Qilin Battery is expected to be mass-produced in 2023. In January 2022, C4V launched the LiSER Battery Technology, a form of cell-to-pack battery type. The LiSER is a cobalt and nickel-free lithium-ion cell technology with 40-50% higher energy density. It provides VCTP (volumetric cell to pack) of 82% and GCTP (gravimetric cell to pack) of 83% capacity. In March 2020, BYD Company Ltd patented its cell-to-pack battery technology named Blade Battery Technology. In addition, LG Energy Solution intends the mass production of these module-less battery packs by 2025.

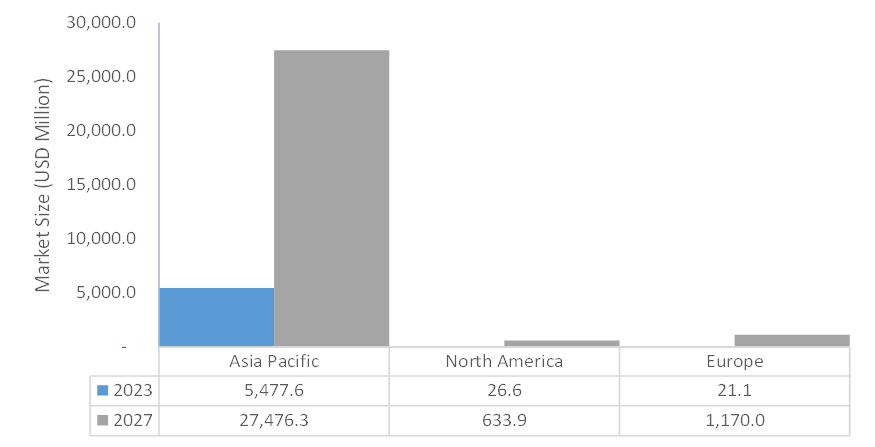

FIGURE 2 CELL-TO-PACK BATTERY MARKET, BY REGION, 2022 VS. 2030 (USD MILLION)

So far, Asia Pacific is the largest market for cell-to-pack batteries in the present scenario, with a dominance of the Chinese market, which contributes >90% of the passenger car segment. The country is home to major battery suppliers such as Contemporary Amperex Technology Co., Limited (CATL), Sunwoda Electric Co. Ltd. who are suppliers to key OEMs such as Tesla (Model 3), BYD Company Ltd (Atto3, e6 MPV, Han EV), Xpeng (P7), and Nio (ET7) among others in the country. The positive responses in the local market for these models would encourage other OEMs to adopt cell-to-pack batteries in upcoming models.

Cell-to-pack batteries are yet to be fully commercialized and waiting to be introduced in the global market. However, considering the recent developments in the industry, battery technology would be widely accepted globally. For instance, in October 2022, Maruti and Toyota announced using Blade batteries from BYD in their upcoming EV models in India by 2025. Other Asia Pacific countries, such as Japan and South Korea, have yet to have any commercial EV model with cell-to-pack batteries; however, recent developments may propel the demand for cell-to-pack batteries in the respective countries. For instance, in November 2022, CATL entered a strategic agreement with Daihatsu to promote e-mobility in Japan. As a part of the agreement, both companies would focus on developing advanced battery technologies like cell-to-pack batteries and implementing them in their EV models. Further, in October 2021, Hyundai MOBIS entered into a partnership with CATL, wherein CATL would supply the cell-to-pack battery technology to Hyundai MOBIS. This will likely bring some EV models to South Korea during 2023-2024.

TABLE 1 KEY OEMS AND MODELS EQUIPPED WITH CELL-TO-PACK BATTERIES

| Country | OEM | Models Equipped with Cell to Pack Batteries | Planned Launch Year |

| India | BYD | e6, Atto3 | 2023-2024 |

| BYD-Maruti | Not disclosed | 2025 | |

| BYD-Toyota | Not disclosed | 2025 | |

| Japan | BYD | Atto 3, Dolphin, and Seal | 2023-2024 |

| Norway | BYD | Tang | Launched |

| US | BYD | Han | Launched |

| Global | Tesla | Model 3 | Launched |

| Tesla | Model Y | Planned |

Further, few partnerships occurred in recent years for the electric bus segment. BYD also mentioned providing the blade battery in its pure electric bus platforms. It introduced the ‘eBus Blade Platform’ in IAA Transportation 2022, held in Hanover, Germany. This eBus platform is installed with a blade battery based on cell-to-pack technology, offering a longer drive range and reduced chassis weight. CATL has entered a supply agreement with Solaris Bus & Coach sp. z o.o to supply cell-to-pack batteries for purely electric buses. In April 2020, VDL Bus & Coach B.V. (Netherlands) partnered with CATL, in which CATL would supply LFP batteries based on the CTP platform. So far, no prototype or commercial plug-in hybrid vehicle is offered with cell-to-pack batteries; however, according to industry experts’ comments, the demand in this segment will depend on the cell-to-pack battery success in the pure electric vehicle segment.

1.4 WHAT’S NEXT

The evolution of the battery packs did not stop with eliminating the battery modules. Manufacturers have started adding features to their products on the production line to keep up with customer demands. With new advancements in the field of electric vehicle battery platforms, automakers and manufacturers have gone a step ahead with battery cell packs to be directly mounted in the vehicle body/chassis.

Cell to chassis refers to the technology that integrates a car battery, chassis, and lower body to simplify product design and production processes. Compared with cell-to-pack (CTP) technology, cell-to-chassis battery technology can further reduce the number of parts, simplify production steps, and improve battery capacity and cruising range while reducing costs.

In September 2022, Leapmotors (China) launched the C01 electric sedan vehicle, which used the cell to chassis battery technology that offers a weight reduction of 15kg, a 20% reduction in the number of components, and an over 14% increase in battery density. Also, in October 2022, Contemporary Amperex Technology Limited (CATL) (China) officials stated that the company plans to have its cell-to-chassis solution ready by 2025. Besides this, BYD launched its Seal model, fitted with the cell to chassis battery technology. Thus, introducing new technology for improving electric vehicle performance would act as catalytic factors for more technological advancements in batteries.

View Detail TOC @ https://www.marketsandmarkets.com/Market-Reports/cell-to-pack-battery-market-249749128.html