The global marine engines market is projected to reach USD 13.3 billion by 2027 from an estimated USD 11.7 billion in 2022, at a CAGR of 2.6% during the forecast period. The global marine engines market is driven by the growth in international marine freight transport, aging fleet, and adoption of smart engines for performance and safety.

Key Market Players

The major players in the global marine engines market are Caterpillar (US), Wärtsilä (Finland), Volkswagen Group (MAN Energy Solutions) (Germany), Rolls-Royce Holdings (UK), Volvo Penta (Sweden), Mitsubishi Heavy Industries, Ltd. (Japan), Cummins (US), Hyundai Heavy Industries Co., Ltd. (South Korea), Daihatsu Diesel Mfg. Co., Ltd. (Japan), Deutz AG (Germany), WinGD (Switzerland), Siemens Energy (Germany), Fairbanks Morse (US), Wabtec (GE Transportation) (US), Yanmar (Japan), Isotta Fraschini Motori (Italy), CNPC Jichai Power Company Limited (China), Bergen Engines (Norway), Doosan Infracore (South Kore), Mahindra Powerol (India), IHI Power Systems (Japan), and others.

Download PDF Brochure – https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=261640121

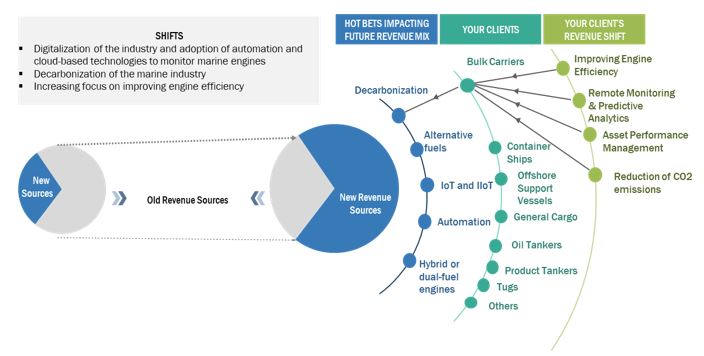

The marine engines market has promising growth potential due to the revitalization of maritime trade post the pandemic and the resultant increase in demand for new build ships which require new marine engines. Marine engines are primarily used to allow the movement or “propulsion” of a vessel through the water and to drive electrical generators, pumps, fans, and other equipment onboard. The stringent regulations put in force by the International Maritime Organization (IMO) from January 2020 limit the emission of sulfur from marine engines to below 0.5%. The prime focus, as a result, of the maritime industry will be on decarbonization, digitalization, alternative fuels, and the use of hybrid or dual-fuel engines. The shift toward decarbonization due to stringent regulations has resulted in an increased in demand for energy-efficient marine engines, which can operate on cleaner fuels. The demand for marine engines will also grow as shipowners scramble to replace their aging, less efficient fleet with new or retrofitted vessels with cleaner engines onboard. The option of hybrid engines or systems, which combine conventional internal combustion engines or turbines with battery storage are also being explored and deployed to reduce emissions and increase the overall efficiency of marine engines. The IMO Sulfur Cap may also lead to an increase in the deployment of LNG or dual-fuel marine engines, contributing to the growth of the marine engines market. The maritime industry, in line with Industry 4.0 and Shipping 4.0, has also started focusing on adopting remote monitoring, predictive analytics, asset performance management, IIoT, and automation to improve the performance of marine engines by reducing their downtime and increasing efficiency. Asia Pacific is the global shipbuilding hub and the resumption of maritime trade to its full scale and the aging of the global fleet has boosted the demand for new build ships, with shipyards in the region receiving a large number of orders for vessels like bulk carriers, oil tankers, offshore support vessels, and container ships. In addition, governments in the region are offering tax incentives to shipbuilders, which is further catalyzing the growth of the industry, and driving the marine engines market.

The marine engines market, by engine, is segmented into propulsion engine, and auxiliary engine. The propulsion engine segment held the largest share of the marine engines market. Propulsion engines are the main engines of ships, providing thrust and power to move and sail the oceans. Marine propulsion engines are a very important asset of ships as they are the prime mover of the ship. Thus, the demand for propulsion engines across various engine types is high and expected to increase further. Propulsion engines are further divided into gas turbines, diesel engines, steam turbines, and dual-fuel engines. Growth of maritime trade, and replacement of the aging commercial fleet are expected to drive the propulsion engine segment of the marine engines market during the forecast period.

Speak to Analyst – https://www.marketsandmarkets.com/speaktoanalystNew.asp?id=261640121

The report also segments the marine engines market, by power range, into up to 1,000 HP, 1,001–5,000 HP, 5,001–10,000 HP, 10,001–20,000 HP, and above 20,000 HP. The above 20,000 HP segment accounted for the largest market share. The marine engines of the above 20,000 HP power range segment have applications mainly for very large vessels, which include large bulk carriers, cargo vessels, containerships, defense vessels, LPG carriers, LNG carriers, and others. These engines are primarily used as main engines on such vessels. The requirement of more and more vessels to sustain the growing maritime trade, and the retrofitting of older vessels with cleaner engines to make them compliant with the stringent IMO regulations are expected to create a favorable environment for the growth of the above 20,000 HP segment during the forecast period.

The marine engines market, by vessel, is categorized into offshore support vessels, oil tankers, bulk carriers, general cargo, container ships, product tankers, tugs, and others. Others includes vessels like bunkering & fleet replenishment vessels, dredger, and landing crafts. The largest share of the marine engines market in 2021 was held by the bulk carriers segment. Bulk carriers are used for transporting raw ingredients including grain, iron ore, and coal, as well as products such as bauxite, cement, fertilizers, rice, sugar, and timber. Bulk carriers can also be used to transport manufactured goods such as steel coils. As the demand for raw materials, grains, and metals transportation increases, shipping companies will react with a surge of new orders for dry bulk carriers, as they are the most environmentally efficient way to move big volumes of dry freight over long distances. The recovery of world trade post 2020 also led to a surge in new orders to address severe fleet capacity constraints and the uptick in freight rates, which may drive the bulk carriers segment of the marine engines market during the forecast period.

Ask Sample Pages – https://www.marketsandmarkets.com/requestsampleNew.asp?id=261640121

Asia Pacific is estimated to be the largest and fastest-growing market for marine engines during the forecast period. The growth of the regional market is driven by the growth of the shipbuilding industry, development of efficient marine engine technologies, and an increase in maritime trade activities. The region is a global shipbuilding hub, dominated by countries such as China, South Korea, Japan, and the Philippines. Over the past few years, this region has witnessed rapid economic development as well as the growth of the manufacturing and energy sectors, thereby resulting in an increase in maritime trade. The rise in seaborne trade has subsequently led to an increase in demand for ships that are used to transport manufactured goods to various regions worldwide. The demand for marine engines in the defense sector is also projected to increase because of the ongoing territorial conflicts among countries in the region. The governments in the region are offering tax rebates to the shipbuilding industry as well. Hence, the region is witnessing a spike in investments in the shipbuilding industry, consequently leading to a rise in demand for marine engines.