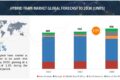

the global hybrid train market size is projected to grow from 470 units in 2022 to reach 745 units by 2030, at a CAGR of 5.9%. Europe is estimated to be the largest hybrid train market in 2022, followed by Asia Oceania. With the development of infrastructure and increasing adoption of hybrid trains in several countries, the global hybrid train market is anticipated to witness exponential growth in the coming years. During the last decade, many countries have initiated plans for the development of a hybrid train network to propel the growth of the transportation sector and reduce carbon emissions caused due to conventional trains.

100-200 km/h segment is estimated to be the largest during forecast period

The 100-200 km/h segment is estimated to be the largest segment in the hybrid train market due to majority of the hybrid trains running in the world can achieve speeds between 100–200 km/h. For instance, in February 2022, East Japan Railway (JR East) has unveiled a hydrogen-powered test train that features a fuel cell system and storage batteries with anticipated top speed of 110 km/h. Similarly, in February 2020, Alstom received its first supply contract of battery-electric regional trains that will be deployed on the Leipzig-Chemnitz line (yet to be deployed) in Germany. The contract includes three-car trains having a maximum speed of 99 mph (160 km/h) and can cover 75 miles. Considering these developments hybrid train market will grow in forecast period.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=238438631

Europe is expected to be the largest market during the forecast

Europe presents a big growth opportunity for hybrid trains as it is expected to be the largest market. Additionally, the region was one of the first in the world to have commercialized hydrogen-powered passenger trains back in 2018. Many of the top train manufacturers from the region, such as Alstom, Siemens, Hitachi Rail STS, and CAF, have incorporated hybrid technologies in their trains. For instance, in September 2021, Alstom presents its battery-powered multiple unit train in Saxony (Germany) in cooperation with the Technical University of Berlin. It will be the first battery-powered train to be approved for regular passenger service in Germany. Countries such as the UK and Germany are planning on complete the electrification of railway lines to control or reduce emissions through diesel trains, which will present a big opportunity for all hybrid train manufacturers, resulting in the growth of the overall European hybrid train market.

The electro-diesel segment is expected to be the largest propulsion segment in the forecast

Electro diesel is a train propulsion type used in hybrid trains, which consists of a combination of diesel and electric power. This type of propulsion has a diesel engine, a generator or alternator, traction motors with axles, and a control system, including some electronics and electric parts. This type of propulsion is more efficient than diesel locomotives. Electro diesel propulsion is efficient and 40% less polluting than conventional ones. The manufacturers have recognized the demand for more efficient propulsion in trains. Diesel trains are the most popular trains, and OEMs have been offering hybrid propulsion technologies incorporated with these diesel trains for a while now. For instance, November 2021, Hitachi Rail, in collaboration with Eversholt Rail, has proceeded to the advanced phases for designing and engineering an electric-diesel-battery (tri-mode) train. The intention is to undergo testing on a Great Western Railway (GWR) Class 802 by end of 2022.

Key Market Players:

The hybrid train market is dominated by established players such as CRRC (China), Alstom (France), Siemens (Germany), Wabtec Corporation (US), and Hyundai Rotem Company (South Korea).

Get Free Sample Now @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=238438631