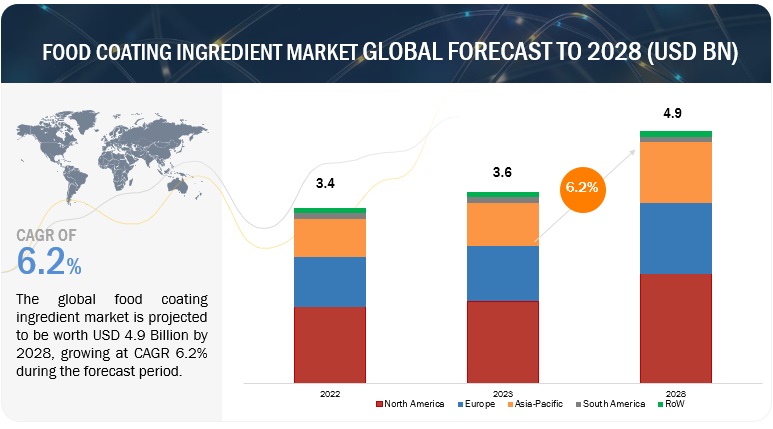

According to a research report “Food Coating Market by Ingredient Type (Batter, Flours), Application (Bakery, Snacks), Equipment Type (Coaters and Applicators, Enrobers), Form (Dry, Liquid), Mode of Operation (Automatic, Semiautomatic) and Region – Global Forecast to 2028″ published by MarketsandMarkets, the food coating ingredients market is estimated at USD 3.6 billion in 2023 and is projected to reach USD 4.9 billion by 2028, at a CAGR of 6.2% from 2023 to 2028.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=168532529

The food coating equipment market is estimated at USD 5.7 billion in 2023 and is projected to reach USD 7.7 billion by 2028, at a CAGR of 6.3% from 2023 to 2028.

Food coating refers to the process of adding a layer of coating or breading to food products, which can provide improved texture, taste, appearance, and preservation. The market for food coating is driven by several factors, including the growing demand for convenience and processed food products, increasing consumer preferences for crispy and crunchy food textures, and the need for extended shelf life of packaged food. The demand for convenience food products, such as frozen and ready-to-eat meals, has been on the rise. Food coatings are used to enhance the taste and texture of these products, thereby driving the market growth. The food coating equipment market is steadily increasing in North America and Europe and growing consistently due to established equipment manufacturers and the organized food industry.

The Cocoa & Chocolates in by ingredient type segment accounted for the largest share of the food coating market in 2023 in terms of value.

Chocolate and cocoa are crucial ingredients that are used to make a variety of products, including cereal, protein bars, dried fruits, and nuts. These components are frequently used to add a delightful chocolate flavor to bakery and confectionery items. Enrobing, panning, and dipping are the three main techniques for coating foods like caramel or almonds in chocolate. The centers that will be covered in chocolate are transported via a machine during the enrobing process. Chocolate is sprayed onto revolving centers that are put on pans during panning, and then the chocolate is solidified by air that has been cooled. The centers are dipped, then cooled after being submerged in molten chocolate.

Make an Inquiry: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=168532529

The liquid in by ingredient form segment accounted for the largest share of the food coating market in 2023 in terms of value.

Liquid coating materials include cocoa, chocolate, fats, oils, batter, sugar, and syrups. Liquid coatings are used in the manufacturing of bread goods, flavored spreads, ice cream coatings, granola bars, and confectioneries such as candy bars. These coatings are made up of fat-based formulations that are melted and applied on solid food products such as nuts, cakes, doughnuts, cookies, sugar wafers, ice cream bars, and fruit pieces. Manufacturers utilize liquid coatings to improve the flavor and texture of various food products, adding a layer of flavor and appeal to the finished product.

The North America region accounted for the largest share, in terms of value, of the global food coating ingredients market in 2023.

The food coating ingredient market in North America is witnessing substantial growth, primarily fueled by the thriving food processing industry. Furthermore, the region’s rising health concerns, including obesity and heart ailments, have led to a heightened emphasis on consuming healthy products such as low-sugar breakfast cereals. In response to this demand, food coating ingredient manufacturers have introduced products with reduced sugar content and allergen-free formulations. These factors have provided a significant boost to the North American food coating ingredient industry.

The North American food coating market is experiencing robust expansion, driven by various factors. One of the key drivers is the increasing demand for convenience foods, which arises from evolving lifestyles and busy schedules. Consumers are actively seeking quick and easy food options that align with their time constraints. Food coatings play a crucial role in enhancing the appeal of convenience foods by adding layers of flavor and texture. Additionally, these coatings aid in preserving the freshness and quality of products during transportation and storage, contributing to their popularity in the market.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=168532529

The Asia Pacific region accounted for the largest share, in terms of value, of the global food coating equipment market in 2023.

The Asia Pacific area is poised to become the largest market for food coating equipment. This expansion is being fueled largely by causes such as the region’s growing industrialization, rising demand from numerous applications, and government measures to assist food producers and processors in modernizing their technology and processes. Many multinational corporations are creating manufacturing facilities, distribution centers, and research & development centers to capitalize on the promise of these expanding markets. Due to favorable government backing and cheap labor costs, India is likely to enjoy tremendous development, drawing investments from global firms. Small and medium-sized equipment manufacturers in the Asia Pacific area mostly supply semi-automatic coating equipment, responding to the rising demand from diverse end-use applications in countries such as China, India, Indonesia, and other Asian nations, driving the expansion of the coating equipment market in the region.

Major key players operating in the food coating market Cargill Incorporated (US), Kerry Group plc. (Ireland), ADM (US), Ingredion (US), Newly weds Food (US), Associated British Foods PLC (UK), Tate & Lyle (UK), Solina (France), Idan Foods (US), POPLA International, Inc. (US).