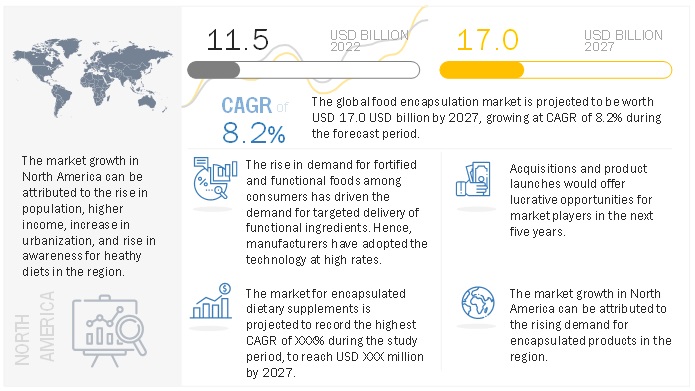

The food encapsulation market size was valued at USD 11.5 billion in 2022 and is projected to reach USD 17.0 billion by 2027, growing at a CAGR of 8.2% during the study period. The market for encapsulation is growing globally at a significant pace due to its numerous applications and multiple advantages over other technologies. Some of the major advantages of encapsulation are that it helps provide enhanced stability and bioavailability to the bioactive ingredients, increases the shelf life of food products, and maintains the taste and flavor for a longer period of time. Encapsulation is increasingly used in various industrial areas, such as nutraceuticals and food & beverages.

The high growth opportunities in emerging regions are attributed to growing economies and technological advancements. North America accounts for the largest share of the food encapsulation market, with the US being the largest contributor. This is because of the presence of most of the major players in the market and the availability of advanced technologies. Asia Pacific is projected to grow at the highest rate due to the increase in industrial activities and health consciousness among consumers.

Key Features in the Food Encapsulation Industry

The food encapsulation industry is a dynamic and innovative field, focusing on encapsulating bioactive compounds, flavors, and nutrients to enhance food products. Here are some key features driving the industry:

- Technological Advancements

Microencapsulation: This technique involves encapsulating small particles or droplets, enhancing stability and controlled release of core materials such as vitamins, minerals, and probiotics.

Nanoencapsulation: Utilizes nanotechnology to create even smaller particles, improving bioavailability and allowing for targeted delivery in the digestive system.

Spray Drying and Spray Chilling: Popular methods for encapsulating flavors, essential oils, and active ingredients, ensuring they are protected and released at the right moment during consumption. - Functional and Health Benefits

Nutrient Fortification: Encapsulation helps in the stable incorporation of vitamins, minerals, and other nutrients, enhancing the nutritional profile of food products.

Probiotic Stability: Encapsulating probiotics ensures they remain viable throughout the product’s shelf life and can survive passage through the stomach to reach the intestines. - Flavor and Sensory Enhancement

Flavor Masking: Encapsulation can mask unpleasant tastes or odors of certain nutrients and ingredients, improving the sensory experience of the final product.

Flavor Release: Controlled release mechanisms ensure that flavors are delivered at optimal moments during consumption, enhancing the overall taste experience. - Improved Shelf Life and Stability

Protection from Environmental Factors: Encapsulation protects sensitive ingredients from light, oxygen, and moisture, extending the shelf life of food products.

Stability of Bioactives: This ensures that bioactive compounds remain effective throughout the product’s lifecycle, providing consistent health benefits. - Innovative Delivery Systems

Time-Release Capsules: Designed to release ingredients at specific times, improving the efficacy of functional ingredients like caffeine, vitamins, or dietary supplements.

Multi-Component Systems: Enables the encapsulation of multiple ingredients in a single particle, allowing for complex formulations that can address various consumer needs in one product. - Sustainability and Natural Ingredients

Biodegradable and Edible Materials: The use of natural, biodegradable, and edible encapsulating materials aligns with the growing demand for sustainable and clean-label products.

Reduction of Additives: Encapsulation can reduce the need for additional preservatives and artificial ingredients, supporting cleaner and more natural product formulations. - Regulatory and Safety Aspects

Compliance with Food Regulations: Ensuring encapsulated products meet regulatory standards for safety and efficacy is crucial. Ongoing research and development focus on materials and methods that are safe and approved by food safety authorities.

Transparency and Traceability: Consumers demand transparency about the ingredients and processes used in food production. The industry is focusing on clear labeling and traceability of encapsulated components. - Market Trends and Consumer Demand

1. Personalized Nutrition: Encapsulation technology supports the development of personalized nutrition solutions, catering to individual health needs and preferences.

Convenience Foods: There’s a growing market for functional foods and beverages that are convenient, nutritious, and tailored to modern lifestyles, driving innovation in encapsulation techniques.

Food Encapsulation Market Opportunities: Reducing capsule size and increasing bioavailability

According to IUUPAC, nanocapsule size ranges from 1−100 nm. These nanocapsules are the perfect size for enclosing highly potent bioactive while ensuring targeted delivery. For dietary supplements, the best-suited size is sizes 1, 0, through 00. These capsules can hold between 290 and 850 mg of the core material. They are ideally suited for powdered and granulated substances. These small capsule sizes are best suited for minerals, water- and fat-soluble vitamins and antioxidants. Hence, it is necessary to focus on reducing the size of the capsule to increase its utility and bioavailability.

- Cargill, Incorporated (US)

- BASF SE (Germany)

- Kerry (Ireland)

- DSM (Netherlands)

- Ingredion (US)

- Symrise(Germany)

- Sensient (Germany)

- Balchem (US)

- International Flavors & Fragrances INC. IFF (US)

- Firmenich SA (Switzerland)

- FrieslandCampina (Netherlands)

Key Questions Addressed by the Food Encapsulation Market Report:

- Which region is projected to account for the largest share in the food encapsulation market?

- What is the current size of the global food encapsulation market?

- Which are the key players in the market?

- What are the most used core phase materials for food encapsulation?

- What are the most used food encapsulation technologies?